Global| Jun 13 2007

Global| Jun 13 2007Brazil's Q1 GDP Growth Eases, but Remains Surprisingly Buoyant; Fixed Investment Leads

Summary

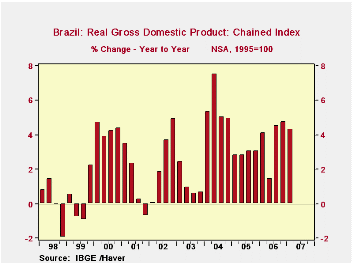

Q1 GDP in Brazil grew 3.1% from Q4 (seasonally adjusted) and 4.3% from the year earlier. This represents a modest slowing from recent performance, as the 3.1% follows 12 quarters that averaged 4.4%. Still, the Brazilian economy looks [...]

Q1 GDP in Brazil grew 3.1% from Q4 (seasonally adjusted) and 4.3% from the year earlier. This represents a modest slowing from recent performance, as the 3.1% follows 12 quarters that averaged 4.4%. Still, the Brazilian economy looks to be on a strong trend overall.

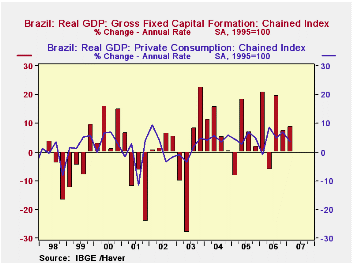

Fixed investment and exports were the main drivers of growth in Q1. Investment expanded at an 8.9% rate up from 7.5% in Q4. Exports swung from a decrease of 4.7% in Q4 to an increase of the same size in Q1. Exports are moderating from a period of rapid, but erratic, expansion that ran from late 2002 through Q3 2006. Possibly a strengthening currency is starting to be felt in export markets, or simply, after such strong growth, some consolidation is occurring. The strong currency argument has some force however in the trend of imports, which surged ahead at a 17.5% annual rate in Q1 and were almost 20% higher than the year-ago quarter.

Fixed investment and exports were the main drivers of growth in Q1. Investment expanded at an 8.9% rate up from 7.5% in Q4. Exports swung from a decrease of 4.7% in Q4 to an increase of the same size in Q1. Exports are moderating from a period of rapid, but erratic, expansion that ran from late 2002 through Q3 2006. Possibly a strengthening currency is starting to be felt in export markets, or simply, after such strong growth, some consolidation is occurring. The strong currency argument has some force however in the trend of imports, which surged ahead at a 17.5% annual rate in Q1 and were almost 20% higher than the year-ago quarter.

Consumer spending was up "only" 3.7% in Q1, but had risen considerably more in prior quarters, putting it up 6.0% over the past year.

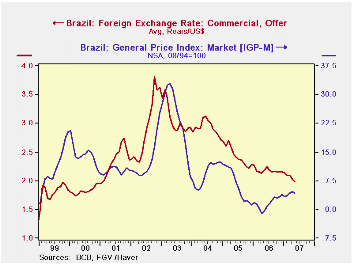

We'll admit some surprise at the strength in Brazil (although analysts who follow it closely had projected slightly faster Q1 growth, according to one press report) but several conditions are favorable. Inflation, although above its lows, has diminished significantly from spurts in 2002-3 and 2004-5. The currency, in turn, has strengthened, as seen in the last graph here, where it fell just below 2 reais per US dollar in May, the most favorable exchange rate since early 2001, to say nothing of the mid-1990s periods of revaluation. So the Brazilian economy is settling and stabilizing. Haver and NTC Economics recently added a PMI index for manufacturing and a number of clients were anxious to get a look at it, even though there are only 15 months of history -- the May value was just above 54%, suggesting moderately widespread growth of manufacturing activity. But the point is that there is widening interest in the Brazilian economy, a diverse place with mineral resources and 187 million people (all told; a labor force count says there are just over 40 million people in the major urban areas, comparable to Argentina's 35.3 million).

| BRAZIL | Q1 2007* | Q4 2006* | Year Ago* | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Real GDP (1995=100) | 134.81 | 133.80 | 129.38 | 132.12 | 126.47 | 122.86 |

| % Change | 3.1 | 4.3 | 4.3 | 3.7 | 2.9 | 5.7 |

| Private Consumption | 3.7 | 6.8 | 6.0 | 4.3 | 4.7 | 3.8 |

| Gross Fixed Investment | 8.9 | 7.5 | 7.2 | 8.7 | 3.6 | 9.1 |

| Exports | 4.7 | -4.7 | 5.9 | 4.6 | 10.1 | 15.3 |

| Imports | 17.5 | 16.1 | 19.9 | 18.1 | 9.3 | 14.4 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.