Global| Mar 21 2007

Global| Mar 21 2007Canada's Retail Trade Eases in January after Big December Gain; Western Provinces Show Strength While Ontario Is [...]

Summary

Retail trade in Canada eased 0.2% in January after surging 2.2% in December. The result year-on-year was up 4.9%, a bit slower than the overall gains during 2005 and 2006. However, the January decline was concentrated in the [...]

Retail trade in Canada eased 0.2% in January after surging 2.2% in December. The result year-on-year was up 4.9%, a bit slower than the overall gains during 2005 and 2006.

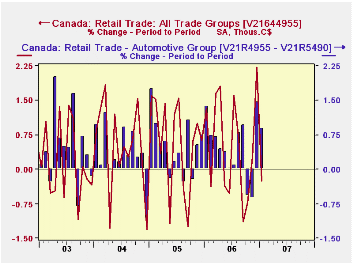

However, the January decline was concentrated in the automotive sector, and several other store groups had nice increases. New car dealers and used vehicle and parts dealers saw 2.0% and 1.5% decreases, respectively, and gas station sales were down 3.5%. These had all been strong in November and December, particularly the latter, when the "automotive group" as a whole had sales up 3.8%.

Non-automotive sales (the total less all vehicle and parts dealers and gas stations) were sluggish in November, but came up well in December, by 1.5% and they continued on ahead by 0.9% in January. Several store groups participated, including furniture, consumer electronics and clothing. So the decline in vehicles and fuel seemed to make room for spending on other items.

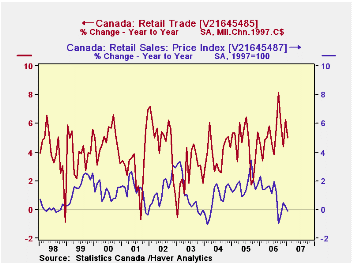

On a volume basis, price declines have pushed total volume growth above nominal growth in several recent months. This was especially the case in September, but also in January, when sales in chained 1997 C$ expanded 5.0% year-on-year, compared with the nominal gain of 4.9%.

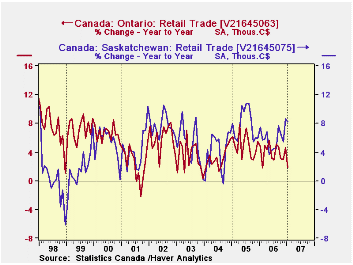

Sales performance among the Provinces has been uneven. Smaller ones on the East Coast -- Prince Edward Island and Nova Scotia -- showed moderate increases in January and those in the West, from Manitoba on all had sizable rises of more than 1%. But Quebec eked out only a 0.2% rise, while New Brunswick and Ontario had outright declines. A similar pattern holds for the year-to-year performance, with Ontario, which accounts for about one-third of the national total, experiencing just a 1.8% increase from January 2006 in contrast to 11.2% in Alberta. The western provinces are perhaps benefiting from high energy prices, which boost their income, compared with Ontario, where the people have to pay those prices instead.

The national data for Canada are contained in Haver's CANSIM database, with that for the Provinces in CANSIMR.

| CANADA (SA, % Chg) | Jan 2007 | Dec 2007 | Nov 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Retail Trade: All Groups | -0.2 | 2.2 | 0.3 | 4.9 | 6.2 | 6.3 | 4.7 |

| All Motor Vehicles & Parts Dealers | -1.9 | 3.2 | 0.7 | 5.6 | 5.7 | 5.8 | 0.1 |

| Total less MV & P | 0.3 | 1.9 | 0.1 | 4.7 | 6.4 | 6.5 | 6.2 |

| Gasoline Stations | -3.5 | 4.7 | 5.3 | 0.2 | 9.1 | 15.4 | 11.4 |

| Total less MV & P and Gasoline | 0.9 | 1.5 | -0.6 | 5.4 | 5.9 | 5.2 | 5.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.