Global| Mar 02 2007

Global| Mar 02 2007Household Expenditures in Japan Show First Yr/Yr Rise in 13 Months; Unemployment Holds at 4.0% for a Third Month

Summary

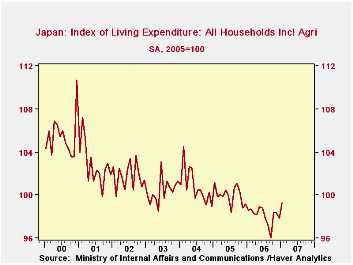

Consumer spending appears to be recovering in Japan. After a three-month-long decline last summer and early autumn, the index of household living expenditures gained 1.4% in January to 99.3 (seasonally adjusted, 2005=100), the highest [...]

Consumer spending appears to be recovering in Japan. After a three-month-long decline last summer and early autumn, the index of household living expenditures gained 1.4% in January to 99.3 (seasonally adjusted, 2005=100), the highest value since October 2005, according to a report today by the Statistics Bureau of the Ministry of Internal Affairs and Communications. In real terms, the index was also up 1.4% in January.

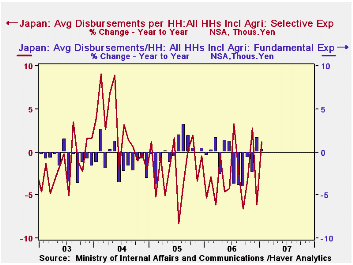

The average spending amounts per household are published in yen on a nominal, not seasonally adjusted basis. The January figures show a 0.63% rise from a year ago, the first year-on-year increase since December 2005. By types of goods and services, the biggest advances were in clothing (8.3%), transportation & communication (6.6%) and recreation & culture (4.4%). The Statistics Bureau also reports a division by motivation: fundamental or selective. Spending on "fundamental" items was up 0.26%, while "selective" outlays gained 1.17%; each of these has shown a positive year-ago comparison in recent months, but this is the first time both have moved ahead in the same month.

Labor market data were also reported today for January, and they might be seen as helping to give consumer spending a firmer base. The number employed did decline in each December and January, by 210,000 and 220,000, respectively. But that followed four consecutive increases totaling almost the same: 440,000. So the January level of employment, 63.730 million, was about the same as the 63.720 million in July. The accompanying unemployment data show January as the third month running at 4.0%, an almost nine-year low. With the skittish conditions for employment, the low unemployment rate is obviously due in part to a downtrend in labor force participation, not a totally healthy development. Still, progress of sorts is being made in the Japanese economy. The base that is forming in the labor market and the consumer sector may well be better for longer-term expansion than spikes that might be followed by frightening plunges.

| JAPAN: Household Living Expenditures | Jan 2007 | Dec 2006 | Nov 2006 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Index, Nominal, SA, 2005=100 | 99.3 | 97.9 | 98.4 | 98.6 | 98.1 | 100.0 | 100.8 |

| Real, SA, 2005=100 | 99.1 | 97.7 | 98.3 | 98.5 | 97.8 | 100.0 | 100.5 |

| Amounts, NSA, Y/Y %Chg | |||||||

| Total | 0.63 | -1.46 | -0.26 | -1.86 | -0.81 | 0.38 | |

| Fundamental Items | 0.26 | 1.63 | -2.40 | -0.96 | 0.09 | -1.23 | |

| Selective Items | 1.17 | -6.09 | 2.80 | -3.05 | -1.97 | 2.55 | |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.