Global| Apr 11 2007

Global| Apr 11 2007March/April Calendar Quirk, Big Refunds Raise March Budget Deficit. Year-to-Date Down $45 Billion

Summary

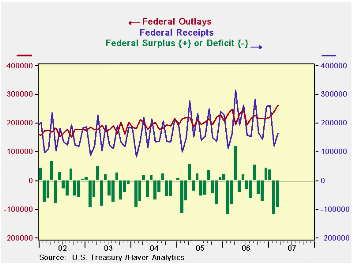

The U.S. federal government ran a deficit of $96.3B during March, well ahead of last March's $85.3B and also larger than consensus forecasts of $89B. This performance brought the fiscal-year-to-date deficit to $258.4B, down from [...]

The U.S. federal government ran a deficit of $96.3B during March, well ahead of last March's $85.3B and also larger than consensus forecasts of $89B.

This performance brought the fiscal-year-to-date deficit to $258.4B, down from $302.9B through March last year.

Summary data for the monthly budget, reported in the Monthly Treasury Statement, are available Haver's USECON database. Details are carried in the GOVFIN database.

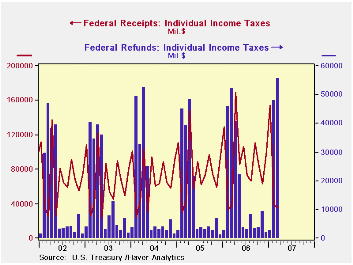

The excess of the monthly deficit over the forecast amount may result from the acceleration into March of April payments for veterans' benefits, supplemental security income and some Medicare outlays; these are ordinarily paid on the first day of each month, but are moved forward when the First falls on a weekend. April outlays will be commensurately reduced. Additionally, individual income tax refunds reached a record for a single month, $55.5B. The previous records were $52.4B in April 2004 and $52.2B in March last year. This is possibly due to earlier filing by taxpayers, and April and May refunds could turn out to be somewhat smaller.

In total, net revenues were $166.5B in March, up just 1.2% from March 2006; for the fiscal-year-to-date, they were 8.0% above the comparable period of fiscal 2006. Individual income tax receipts were $35.4B in March, down 9.8% from March 2006, but fiscal 2007-to-date saw $479.2B, up 10.8%. Corporate income taxes were $40.2B, a record for March and up 11.8% from a year ago. Social insurance taxes were $76.5B in the month, up 6.2% from a year ago.

The U.S. Government's net outlays grew 5.2% from March 2006, reaching $262.8B, with the cumulative total for the first six fiscal months up 2.9%. Defense outlays were $52.0B in the month, up 2.4% on the year earlier. Social security outlays (benefits and administrative costs) were $48.9B, up 5.9%. Net interest turned somewhat higher, reaching $21.1B, up 8.8% on March a year ago, while smaller amounts in previous months put the total for the fiscal year so far up only 2.5%.

This report gives an inconclusive read on the state of the budget, since key tax payments are going on this month and the timing of other tax filing seems to be changing from year to year. Major outlay patterns are also erratic from month to month. Nonetheless, overall, revenues are continuing to grow faster than outlays and the budget deficit is continuing to diminish.

| US Government Budget, Bil.$ | Mar 2007 | Feb 2007 | Oct 2006 Mar 2007 |

Oct 2005 Mar 2006 |

FY 2006 | FY 2005 | FY 2004 |

|---|---|---|---|---|---|---|---|

| Budget Balance | -96.3 | -120.0 | -258.4 | -302.9 | -248.2 | -318.7 | -411.1 |

| Net Revenues | 166.5 | 120.3 | 1120.9 | 1037.6 | 11.8% | 14.6% | 5.4% |

| 8.0% | 10.5% | ||||||

| Net Outlays | 262.8 | 240.3 | 1379.3 | 1340.6 | 7.4% | 7.9% | 6.2% |

| 2.9% | 8.7% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.