Global| Mar 01 2007

Global| Mar 01 2007U.S. Personal Income Boosted by Bonuses; Core Prices Pick Up to 0.3%

Summary

Personal income surged by a full 1% in January, following unrevised gains of 0.5% and 0.3% in December and November, respectively. Consensus expectations had envisioned a 0.3% increase. Income was 5.3% ahead of January 2006. Wages & [...]

Personal income surged by a full 1% in January, following unrevised gains of 0.5% and 0.3% in December and November, respectively. Consensus expectations had envisioned a 0.3% increase. Income was 5.3% ahead of January 2006.

Wages & salaries jumped 1.2% (5.0% y/y). Factory sector wages turned down 0.3%, reversing December's 0.4% increase; wages in this sector are now down from a year ago, by 0.6%. Wage and salary income in the private service-producing industries gained 1.6% in January (6.1% y/y) after 0.8% in December. Large bonuses and the exercise of stock options caused the outsized January increase. The annual federal government pay increase also added to total wages.

Interest income advanced 0.8% in January, offsetting part of three consecutive monthly declines of 0.4%. Dividend income rose 0.9% in the month and is 12.0% higher than in January 2006.

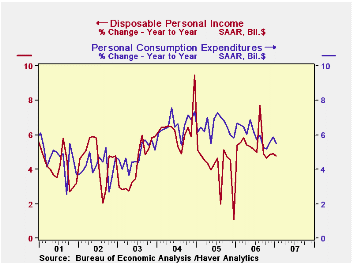

Personal current taxes increased 2.5% (8.7% y/y). Disposable personal income advanced 0.8% (4.8% y/y), better than the 0.5% increase during December. Real disposable personal income rose 0.8% (2.5% y/y) last month.

Personal consumption increased 0.5% in January after an unrevised 0.7% gain in December and was marginally above expectations for 0.4%. Spending for motor vehicles, clothing, other nondurables and medical care rose noticeably. The return of colder weather pushed up outlays for home heating, but falling gasoline prices brought some offset to December's huge rise in gasoline outlays. In real terms, consumer spending rose 0.3% following increases of 0.4% in both December and November.

The personal saving rate was -1.2% in January, marginally better than December's -1.4%, a downward revision.

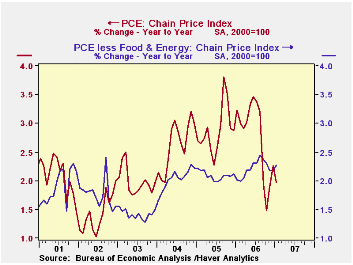

The increase in the PCE chain price index slowed to 0.2% in January from 0.3% in December. This overall PCE price gauge was up 2.0% from a year ago. Prices less food & energy were up 0.3% after 0.1% rises in December and November. The three-month change in core prices remained low at 1.8% (annualized), and December's value was revised to 1.5% from 1.7% reported before.

| Disposition of Personal Income | Jan 2007 | Dec 2006 | Nov 2006 | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Personal Income | 1.0% | 0.5% | 0.3% | 5.3% | 6.4% | 5.2% | 6.2% |

| Personal Consumption | 0.5% | 0.7% | 0.4% | 5.5% | 6.0% | 6.5% | 6.6% |

| Saving Rate | -1.2% | -1.4% | -1.1% | -0.3% (Jan 06) | -1.1% | -0.4% | 2.0% |

| PCE Chain Price Index | 0.2% | 0.3% | 0.0% | 2.0% | 2.8% | 2.9% | 2.6% |

| Less food & energy | 0.3% | 0.1% | 0.0% | 2.3% | 2.2% | 2.1% | 2.0% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.