Global| Jun 21 2007

Global| Jun 21 2007UK, Euro-Zone Industrial Surveys Show Improvement in June

Summary

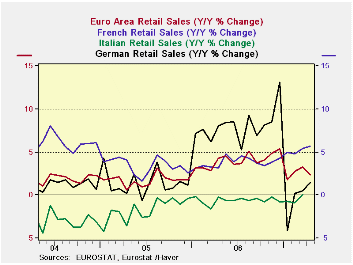

Industrial activity in Europe and the UK is showing signs of picking up. Surveys for June released this morning by the Confederation of British Industry and NTC Economics both indicate improvements. The report from NTC is a new one. [...]

Industrial activity in Europe and the UK is showing signs of picking up. Surveys for June released this morning by the Confederation of British Industry and NTC Economics both indicate improvements.

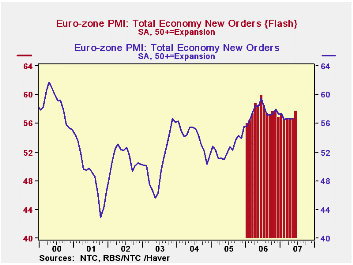

The report from NTC is a new one. This compiler of global purchasing manager data began today to issue a "flash" estimate for the total Euro-Zone. It covers 85-90% of the full NTC panel in those countries, and for the period since its compilation, beginning January 2006, most components have run very close to their full-month counterparts. So here's an advance tool for assessing the condition of industry in Europe.

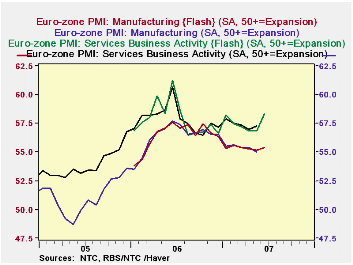

Numbers in this survey have not been weak, but they have edged gradually lower since the middle of last year. The overall index for manufacturing has run in the mid-50s, indicating net gains at slightly more than half of the responding firms. The gauge, though, has lost about 2-1/2 points since June 2006. In today's "Flash", it turned up modestly, only the fourth positive monthly move since that time. In the service sector, the peak was also in June 2006; the index lost several points almost immediately and has hovered in a narrow band since last August. So this month, the "Flash" for service sector "business activity" was up almost 1-1/2 points, putting it at the highest level since July 2006. In total, output in manufacturing and services combined, the so-called "composite output" index, rose just over 1 point in June. This index had dipped in April and May, so what we're noticing here as a welcome rebound may just be a reaction to those lower figures. We can only wait to see if this is a new trend or just a blip in an otherwise stagnating pattern. The final June data will be reported July 2 for manufacturing and July 4 for services and the composite figure.

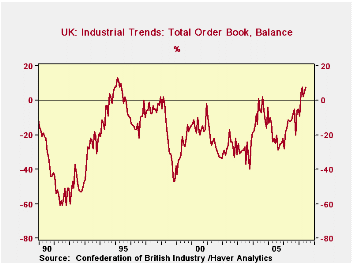

In this context of a hesitant upturn on the Continent, the UK's Confederation of British Industry survey looks that it might be providing corroborating evidence of improvement. Respondents' planned output over the coming 3 months has averaged +22 since February. This is the highest average over such a long period since mid-1995; the value for June alone was +25. More striking is the behavior of order books. These readings are generally well into negative territory, reaching as low as -48 in late 1998 and averaging lower than -20 for a whole year as recently as 2005 (-21). But this order book measure has been positive now also since February and in two of these months, March and June, it has been +8, the highest readings since May 1995.

We see in the final graph here that the movement in the CBI output series is not a bad indicator of actual industrial production. Indeed, the correlation of year-to-year % changes in total industrial production and the output measure itself is a substantial 67%. So it's worth paying attention to the favorable moves of these CBI measures in judging the condition of British industry, which just might be getting better.

The NTC-PMI data are in Haver's PMI database, and the CBI Industrial Trends Survey is in the UK database, as well as INTSRVYS.

| Business Surveys: UK & Euro-Zone | June 2007 | May 2007 | Apr 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| CBI: Order Book | 8 | 5 | 2 | -12 | -13 | -21 | -9 |

| Output Next 3 Mos | 25 | 18 | 18 | 14 | 10 | 4 | 12 |

| Selling Prices, Next 3 Mos | 16 | 25 | 16 | 8 | 9 | 0 | 4 |

| Euro-Zone PMI Output "Flash"* | 57.66 | 56.62 | -- | -- | -- | -- | -- |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.