French Inflation Moves Up But Stays Low

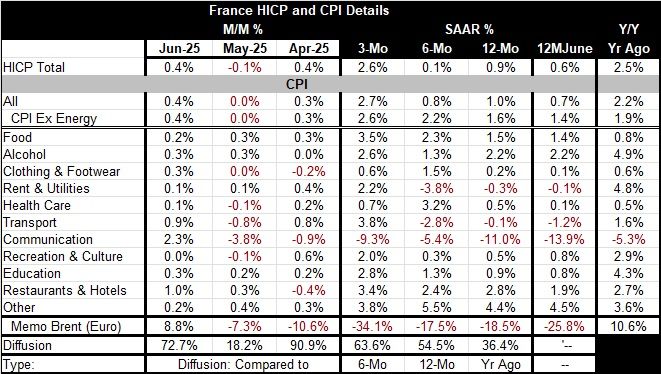

French inflation jumped in June, rising by 0.4% in the month on the HICP metric, the same as the monthly rise for France’s CPI and its CPI excluding energy. Not surprisingly the monthly diffusion reading tracks the breadth of inflation rise monthly to 72.7% in June affirming that the breadth of the gain in monthly inflation was substantial. Breadth is sharply higher in June after looking very weak at 18.2% in May. But the month of May followed a broad acceleration with breadth at 90.9% in April. Monthly breadth reading can be quite unstable. Diffusion values above 50% revel inflation acceleration period a period in which inflation acceleration is more common than deceleration.

However, breadth over the sequential periods 3-months, 6-months and 12-months shows inflation acceleration is creeping up as the breadth reading advances on the timeline from 36.4% over 12 months, to 54.5% over 6 months, and to 63.6% over 3 months.

France has been an inflation success story and a growth failure story. The HICP headline inflation last higher than 2% in August 2024 and the domestic CPI excluding energy was over 2% for its 12-month gain in March of 2024. And while the HICP has signs of ongoing slowing, the domestic CPI excluding energy has been relatively stable since September 2024. The CPI excluding energy inflation is running at a weak and well contained pace of 1.6% over 12 months and the weakening HICP undoubtedly has benefited from the ongoing drop in energy prices where Brent costs in euro-terms show an 18.5% drop over 12 months.

The headline HICP for France shows a mixed trend from 12-months to 6-months to 3-months. The domestic CPI is closer to showing steady acceleration. The CPI excluding energy shows persistent acceleration. But the domestic CPI gauge also shows inflation at a pace of just 2.2% over 6 months and 2.6% over 3 months compared to a low 12-month pace of 1.6%. The acceleration in French inflation is mild and the pace of inflation is really controlled.

France does not look like a percolating pot of inflation, but it may be migrating more to a 2% mode. Much of the improved inflation performance has been on the back of weak economic conditions. France has logged S&P composite PMI readings below 50%, indicating private sector contraction in the economy, since May 2023.

France is the weakest of the big four EMU economies on the PMI metric and on GDP especially since early 2023. Italy, and Spain have PMI readings over 50% going back five-months; for Spain reading is over 50% back to the end of 2023. Germany has posted five composite PMI readings above 50 over the last six months. Even the U.K. that has been struggling has PMI readings above 50% back to 2023 with just one exception.

The EU Commission indexes have Germany as the weakens EMU economy among the Big Four since late 2023; however, that survey has France worsening sharply in weakening in the current month and showing a weaker reading than German in June.

Now that growth in Europe is set to take root, we will see where fundamental inflation progress is able to persist. The Trump tariff threats are still out here and the deadline for imposition is approaching. Trump seems willing to put relatively large tariffs in place. Trump tariffs are going to be a big factor in how all of this will shake out. And a good part of that is going to be how much other countries want to retaliate. The U.S. is simply a huge source of demand for the global economy. If the U.S. current account deficit were a county it would be the 13th largest country in the world; if its imports were a county, they would be the fifth or sixth largest country in the world. The U.S. is a massive source of global demand. And the international community has leaned on the U.S. to provide demand and export markets and jobs for them. But the U.S. now finds itself with massive current account deficit- one that has existed for 33 years in a row. And the U.S. also faces large fiscal deficits. It is in a position where the goose needs to attend its own diet if it is to continue to produce golden eggs. So, the evolution of U.S. tariffs, global growth, and future inflation, all are intertwined. The future remains obscure.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates