Discover Haver!

Data

Software

Connectivity

Research

University

Archive

Economic Commentary

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

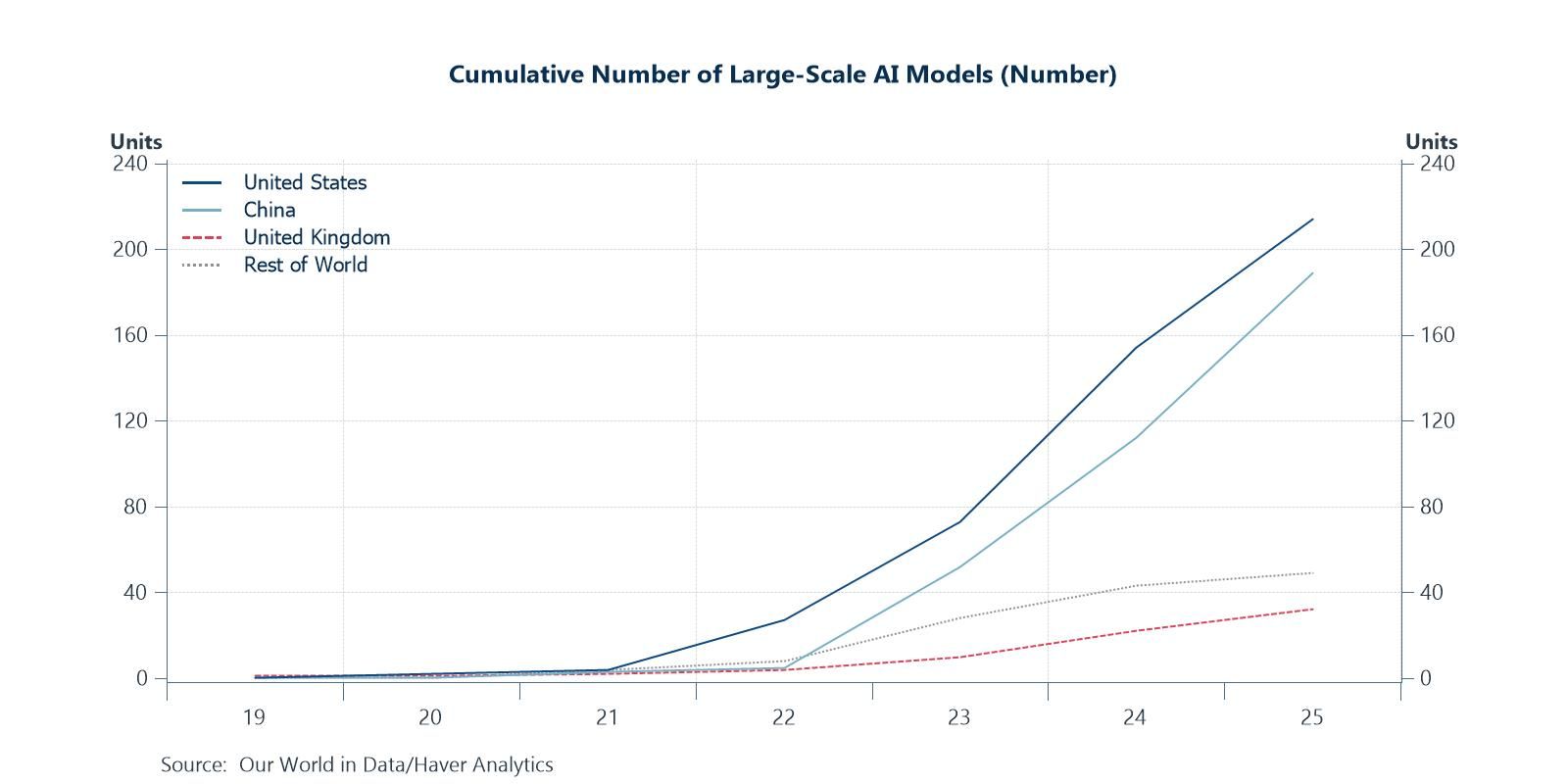

Financial markets have experienced renewed gyrations in recent weeks, as shifting geopolitical risks, questions around Federal Reserve independence, renewed talk of US dollar “debasement,” and ongoing enthusiasm surrounding artificial intelligence have combined to drive volatility across asset classes. These cross-currents have also contributed to a degree of rotation away from high-flying technology stocks, as investors reassess valuations and the timing of anticipated AI-driven gains. Against this backdrop, the charts in this week’s COTW highlight several important themes. Policy rate expect...

by:Andrew Cates

|in:Economy in Brief

Recent Commentaries

German IP Reveals Chaotic Trends

Germany| Feb 06 2026From Foundries to Fortunes: Taiwan in the AI Era

Taiwan| Feb 06 2026U.S. JOLTS: Openings Drop to Lowest Level Since Sept. ’20; Hiring Rebounds in December

USA| Feb 05 2026U.S. Initial Unemployment Claims Surged in Latest Week

USA| Feb 05 2026German Orders Gain Pace- Clear Uptrend

Germany| Feb 05 2026U.S. ISM Services PMI Holds Steady in January; 19 Straight Months of Expansion

USA| Feb 04 2026