Global| Nov 13 2020

Global| Nov 13 2020A Vaccine Game Changer And What It Might Mean

by:Andrew Cates

|in:Viewpoints

Summary

The announcement this week concerning a potential vaccine for COVID-19 should be a game changer for the world economy. Financial markets have certainly greeted this news by pricing in a rosier global economic scenario (see figure 1 [...]

The announcement this week concerning a potential vaccine for COVID-19 should be a game changer for the world economy. Financial markets have certainly greeted this news by pricing in a rosier global economic scenario (see figure 1 below). While there are still several hurdles to clear before we can be truly confident that a vaccine will be successful, it's worth pondering how the global economic landscape may now unfold if it is.

In what follows we lay out a few key cyclical and structural considerations that will determine the shape of that landscape. We then look briefly at a few charts that illustrate some of the key data that could be worth monitoring in the weeks and months ahead.

Our key conclusions are as follows:

• Activity in the world economy ought to rebound strongly in the coming months if we can assume the vaccine does indeed bring relief. That's because there is a great deal of pent-up demand that can be vented as uncertainty about the future comes out of the equation. The lacklustre pace of business and consumer spending in recent months and the by-product of this, namely high corporate and household saving rates, certainly speak to a high level of pent-up demand in most major economies.

• The strength of any rebound, however, will still hinge on the speed and effectiveness of a vaccine roll-out. It will depend too on how swiftly governments unlock their economies. On that last point it's worth recalling that the world economy is mired in recession ostensibly because governments in many major economies have either shut down or severely inhibited supply side channels. Recessions in the post-WW2 period in contrast have typically been generated by shocks that – initially at least – inhibited aggregate demand. That said if – as seems likely – both fiscal and monetary policy remain very accommodative in the immediate months ahead, recovery progress will be much easier.

• The pace of economic recovery will also hinge, however, on the underlying exposure of output to sectors that have been disproportionately hit as a result of lockdown stringency and other restrictions (e.g. on international travel). The hospitality sector is one example; tourism is another.

• Lessons from history nevertheless suggest that recoveries from pandemics can take time. Scarring in labour markets, higher levels of government debt, a greater structural proclivity to hoard savings and a reduced proclivity to invest are some of the reasons.

• It's worth recalling too that the issues that had bedevilled the global economic environment prior to the virus are still with us. Global imbalances are still acute, inequality in a number of countries is still high, existential environmental challenges persist and populist politics is still in vogue (notwithstanding recent political events).

• This means that while optimism is certainly warranted about the near-term trajectory for the world economy, we should remain guarded about the longer-term outlook. Now, more than ever, the trajectory of productivity growth in the world's major economies will hold the key for how sustainable any revival is likely to be.

• Many observers are optimistic about that productivity trajectory based on recent advances in new technologies and how the virus has potentially beefed up intentions to invest in them. These technologies for the record include things like artificial intelligence, 3D printing, robotics and nanotechnology. But some observers were optimistic too about the potential for biotechnology to make a contribution via healthcare. And on that last point who can doubt that potential from the seeming speed at which a vaccine for COVID-19 has been uncovered?

In the remainder of this note we look very briefly at a few of the key indicators that are worth tracking to assess the likely timing and pace of a cyclical recovery in the world economy in the period ahead. We also touch on some of the aforementioned structural issues and highlight some of the trends that are worth tracking to monitor these as well.

The first set of indicators simply concern financial markets and in particular financial assets, such as equities, that are typically good leading indicators of economic activity (see figure 1 below).

Figure 1: Equity markets have responded positively to recent news

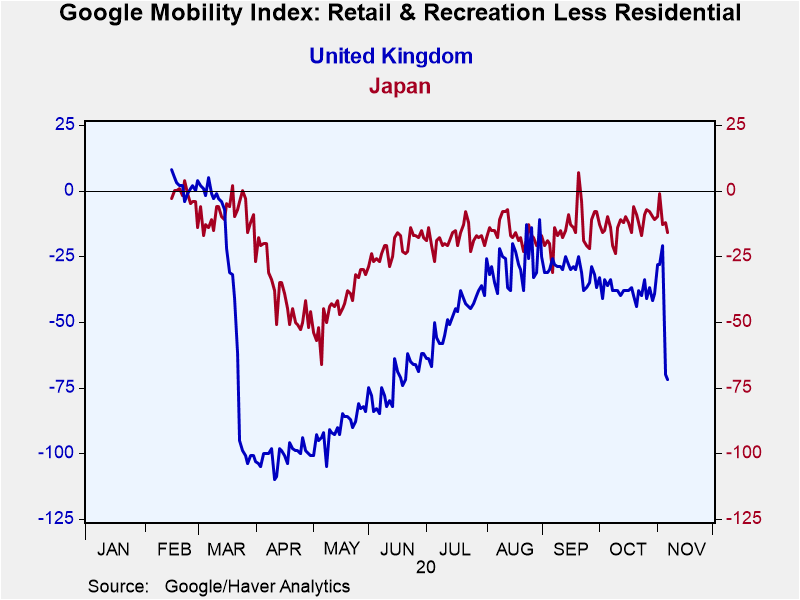

Mobility indicators are next on our list and also worth keeping a close eye on. That's firstly to assess the relative stringency of lockdown restrictions and secondly to assess the underlying fear that may persist among various populations and how that might be impeding a population's ability to engage in economic activity. The gap between Google's index for retail and recreation activity and its residential index in our view offers a particularly neat perspective on relative mobility patterns (see figure 2 below).

Figure 2: Google mobility index for the UK and Japan

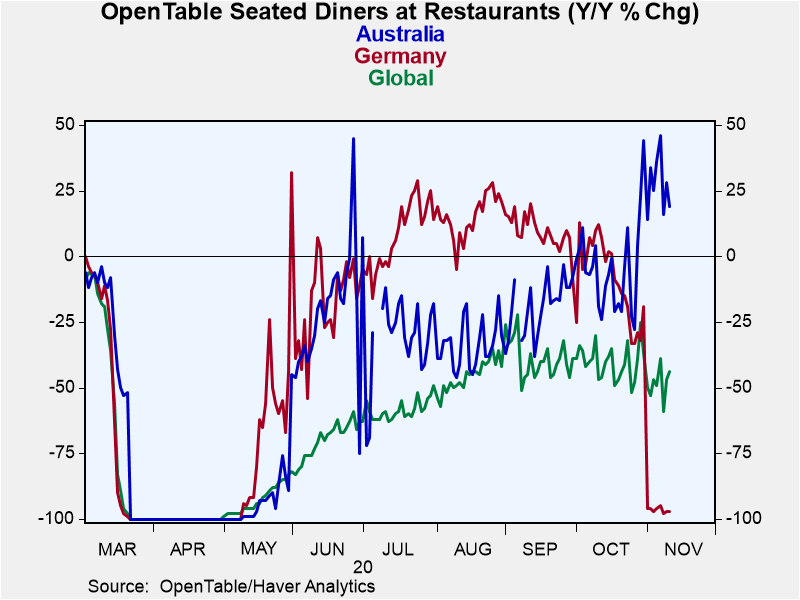

Another mobility indicator that ought to prove helpful will be Opentable's indicators of restaurant diners. That's because of the relative importance of the hospitality sector in the economic contractions during previous lockdown restrictions and equally its importance as those lockdown restrictions come to an end. The relative performance of this indicator in Australia (where lockdown restrictions in Melbourne have lately been eased) and Germany (where they have been tightened) is notable on this score, as evidenced in figure 3 below.

Figure 3: Opentable indicators of restaurant diners

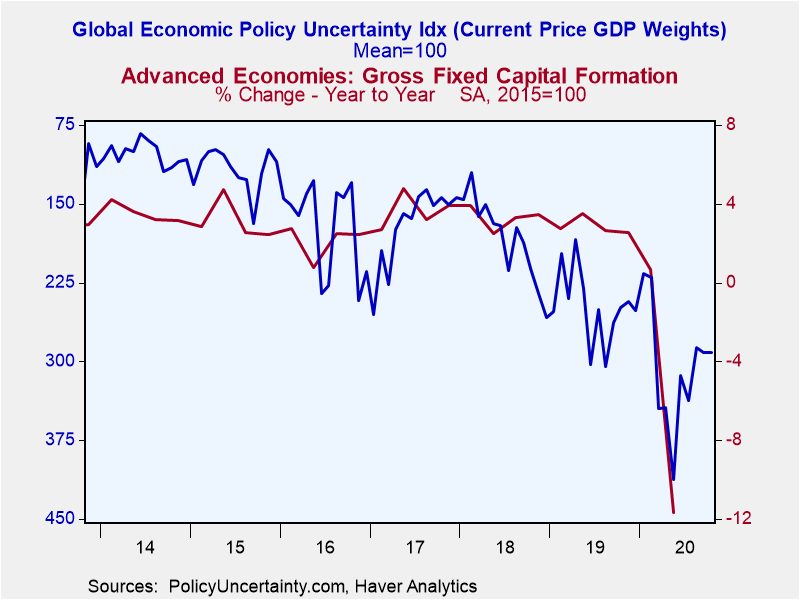

Consumer and business confidence indicators should also be closely watched for gauging any lingering fears about the virus. These indicators are a good proxy for uncertainty in all its forms and how that manifests itself in decisions to hire labour, spend income, commit savings and invest profits. Gauges of economic policy uncertainty are also helpful in this regard. Their relatively high levels in recent years in many major economies have arguably provided a fair explanation for lacklustre capital investment activity (see figure 4 below). And insofar as the lessons from previous pandemics (see The Long Economic Hangover of Pandemics from the IMF) suggest that proclivities to save and invest can respectively climb and fall for a long time after the crisis has ended, this could be a particularly helpful gauge for assessing both the cyclical and structural consequences.

Figure 4: Global economic policy uncertainty versus capex in advanced economies

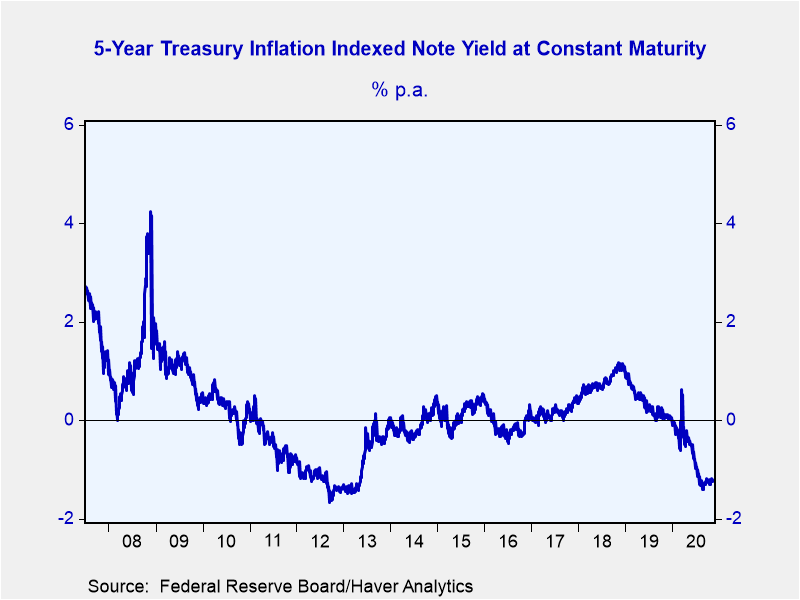

That brings us to the next financial market indicator on our list namely longer-term real interest which is a measure of how financial market participants are viewing the longer-term growth and return prospects for the world economy. That the 5-year rate on inflation indexed securities in the US is still hovering at around -1.2%, and has been little-moved in recent days, speaks to the longer-term pessimism that persists in markets about the US (and broader global) economic outlook. That being said on the policy front low real yield levels are clearly in part a product of extraordinarily loose monetary policies and quantitative easing programmes in particular. The expectations of Central Bankers are thus an important consideration when interpreting these data as well.

Figure 5: 5-year US real yields still in negative territory

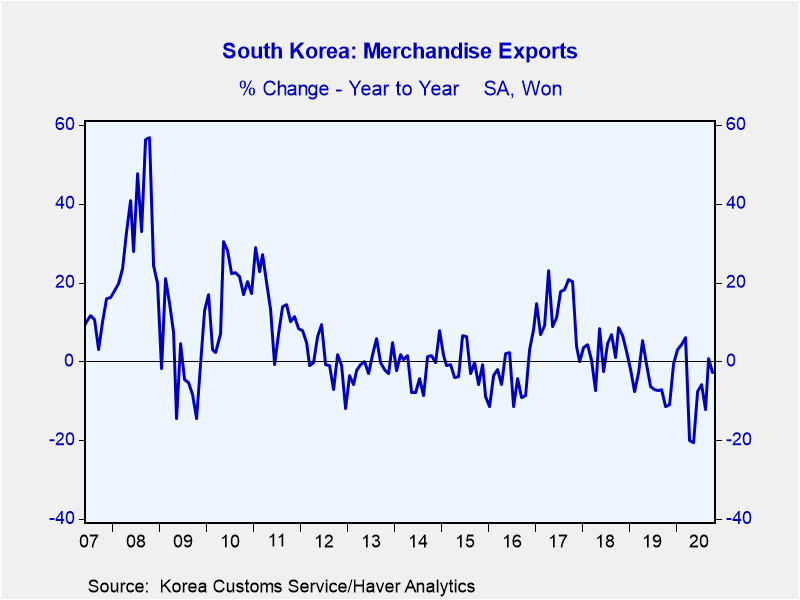

For even more of a global perspective though we would suggest keeping a close eye on the monthly export data from South Korea. Insofar as these numbers are published for the first 10 and 20 days of each month (and available in our EMERGEPR database) they provide a very early high frequency representation of how world trade is evolving.

Figure 6: South Korea's export growth

Turning to more structural matters, and the longer-term pessimism that they induce, there are several issues of concern. They include record high levels of sovereign indebtedness in many major economies; potential ramifications from labour market scarring and specifically higher structural levels of youth unemployment; a further shift to de-globalize the world economy from efforts to onshore economic activity; a perpetuation of inequality trends; and ongoing challenges from climate change.

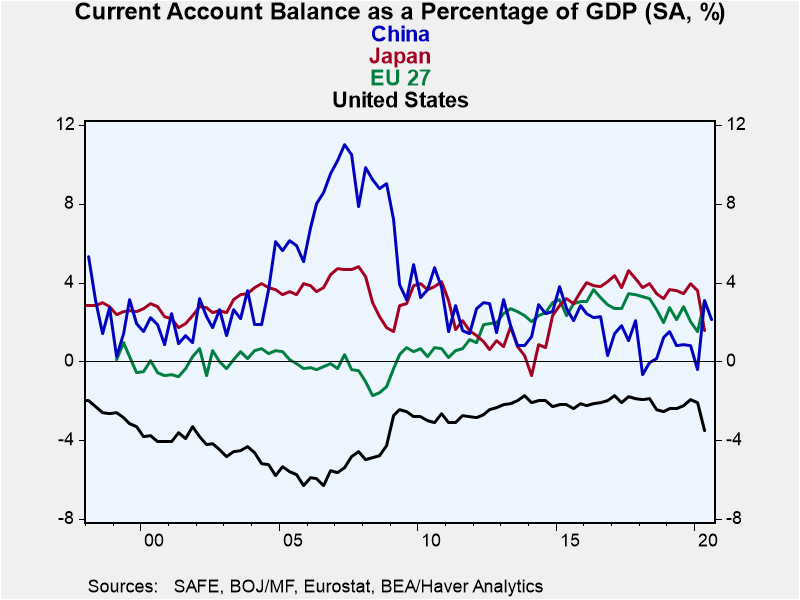

Policy considerations on these issues arguably matter above all else. But one set of indicators that's worth keeping any eye on are current account balances and how that data are evolving for creditor countries such as Germany, Japan and China vis a vis debtor countries such as the US and the UK (see figure 7 below). It's admittedly a simplistic explanation but not too far of a stretch to argue that much of the economic, financial and political instability that has reared its head in recent years can be traced, at least in part, to the underlying tensions from these trade and capital flow imbalances.

Figure 7: Global current account balances

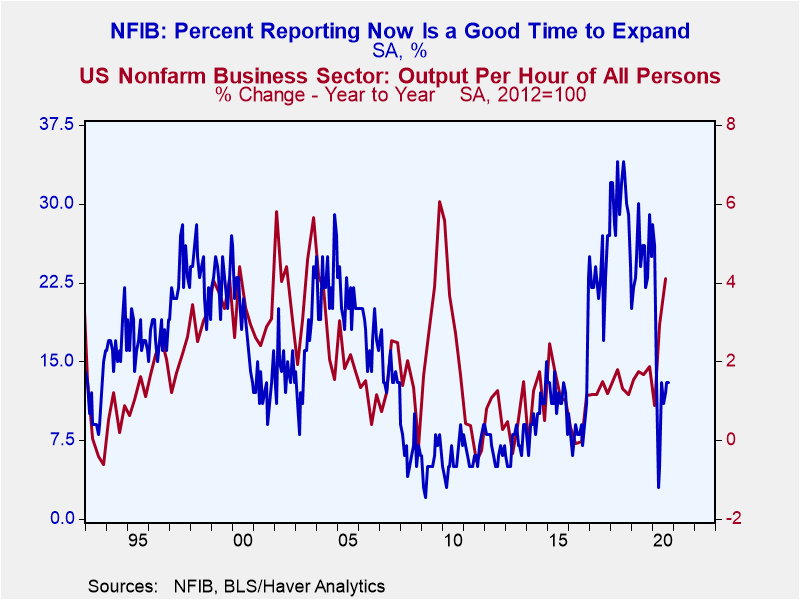

How though can some of those tensions be alleviated and more generally for the world economy to experience a more vigorous and sustainable revival in the period ahead? Firmer productivity growth is our answer as we discussed above. Measuring that in real time is again fraught with problems but we would recommend keeping a close eye on economic data surprises (see figure 1 above) and the tendency in particular for incoming growth data to surprise on the upside at the same time as inflation data are surprising on the downside. Business confidence gauges, particularly in the small company sector, also ought to be instructive for gauging dynamism as well as spending intentions toward new technologies (see figure 8 below).

Figure 8: US productivity growth versus the willingness to expand in the small business sector

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.