Global| May 01 2020

Global| May 01 2020An Employment Report Like No Other

|in:Viewpoints

Summary

Given the sudden dive in economic activity due to the COVID-19 pandemic, the April 2020 employment report will be both historic and eye-popping. The unemployment rate is likely to rise to its highest level since the Great Depression, [...]

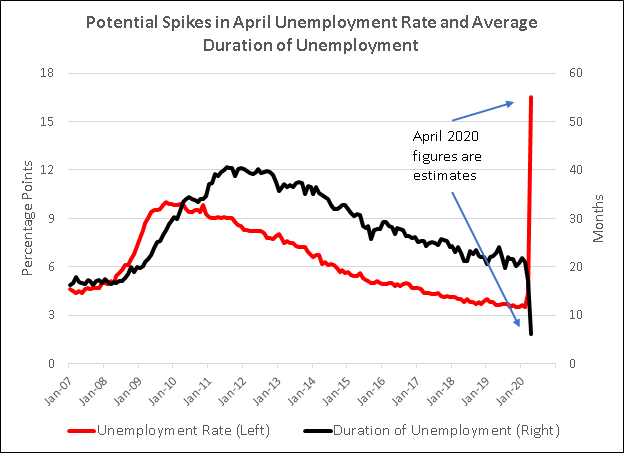

Given the sudden dive in economic activity due to the COVID-19 pandemic, the April 2020 employment report will be both historic and eye-popping. The unemployment rate is likely to rise to its highest level since the Great Depression, with consensus estimates in the 16 to 17 percent range. The single month rise of about 12 percentage points would be multiples of the biggest increases of the past 70 years. Meanwhile, the April drop in payrolls could be in the tens of millions, dwarfing any previous monthly decline. These figures no doubt will be the focus of the headlines after the employment report. However, there will be other historic changes in the employment report that will bear watching for clues about the impact of the work stoppages on the labor market. Some economic data – namely, the average duration of unemployment and average hourly earnings – will move in counterintuitive directions.

Given the sudden dive in economic activity due to the COVID-19 pandemic, the April 2020 employment report will be both historic and eye-popping. The unemployment rate is likely to rise to its highest level since the Great Depression, with consensus estimates in the 16 to 17 percent range. The single month rise of about 12 percentage points would be multiples of the biggest increases of the past 70 years. Meanwhile, the April drop in payrolls could be in the tens of millions, dwarfing any previous monthly decline. These figures no doubt will be the focus of the headlines after the employment report. However, there will be other historic changes in the employment report that will bear watching for clues about the impact of the work stoppages on the labor market. Some economic data – namely, the average duration of unemployment and average hourly earnings – will move in counterintuitive directions.

The ADP employment report, scheduled for release on May 6, is the next place to look for information about the loss of jobs, following the unprecedented surge in initial claims. This report is designed to give an early reading on the official payroll report. The size of the decline in these data and the establishment survey depends on whether employers kept workers on the books in April.

Importantly, there is information in the ADP report that is not included in payrolls – specifically, a breakdown of employment changes based on size of employer. Since there is widespread concern that the COVID-19 restrictions have predominantly impacted small businesses, at least initially, these data may give valuable insights into the extent of that impact.

When the payroll report itself is released, we will see that unemployment soared and payrolls collapsed. However, the likely change in the average duration of unemployment and average hourly earnings may cause some head scratching.

The average duration of unemployment is a weighted average of the length of unemployment stretches. Typically, we associate short average durations with strong labor markets and long average durations with weak labor markets. This characterization is reasonable, because unemployed workers may find it more difficult to find work and remain unemployed for longer during downturns and vice versa.

Counterintuitively, in the current environment with millions of people suddenly losing their jobs, the average duration of unemployment is likely to drop precipitously. A jump in the unemployment rate to the 16 to 17 percent range would be consistent with a decline in the average duration from 17.1 months in March to roughly 6 months in April. That would be the lowest reading and the sharpest change in the gauge's history dating back to 1948. The steep decline would reflect the fact that there are so many short-term unemployed workers, out of work for a month or less, which will drive down the average.

Gains in average hourly earnings typically rise in tight labor markets and decline in soft labor markets. That is why a sudden rise in earnings, coinciding with a jump in the unemployment rate, will come as a surprise. However, a pickup in earnings gains would merely reflect a change in weighting away from low wage workers. By most accounts, retail and low skilled workers bore the brunt of the layoffs and cutbacks in hours, while higher skilled workers and those who could work from home remained employed. Without these low wage worker hours in the calculations, the rise in average hourly earnings could jump to 6 percent or more, a gain not seen since the early 1980s.

There is an important caveat to April payroll report readings, because the sample size for the survey likely will be extremely small for a first pass. Many firms probably were not available to fill out the survey due to closures or remote work. So, there could be unusually large revisions to the April data in coming months.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Peter D'Antonio

AuthorMore in Author Profile »Peter started working for Haver Analytics in 2016. He worked for nearly 30 years as an Economist on Wall Street, most recently as the Head of US Economic Forecasting at Citigroup, where he advised the trading and sales businesses in the Capital Markets. He built an extensive Excel system, which he used to forecast all major high-frequency statistics and a longer-term macroeconomic outlook. Peter also advised key clients, including hedge funds, pension funds, asset managers, Fortune 500 corporations, governments, and central banks, on US economic developments and markets. He wrote over 1,000 articles for Citigroup publications. In recent years, Peter shifted his career focus to teaching. He teaches Economics and Business at the Molloy College School of Business in Rockville Centre, NY. He developed Molloy’s Economics Major and Minor and created many of the courses. Peter has written numerous peer-reviewed journal articles that focus on the accuracy and interpretation of economic data. He has also taught at the NYU Stern School of Business. Peter was awarded the New York Forecasters Club Forecast Prize for most accurate economic forecast in 2007, 2018, and 2020. Peter D’Antonio earned his BA in Economics from Princeton University and his MA and PhD from the University of Pennsylvania, where he specialized in Macroeconomics and Finance.