Global| Dec 23 2019

Global| Dec 23 2019Festivus 2019 – I Got A Lot of Problems With You People About Wages!

|in:Viewpoints

Summary

Well it's Festivus 2019 and time for the airing of grievances. My big beef with you people this Festivus is why you are having trouble explaining tepid wage growth in the face of a low unemployment rate. Firstly, let's examine why the [...]

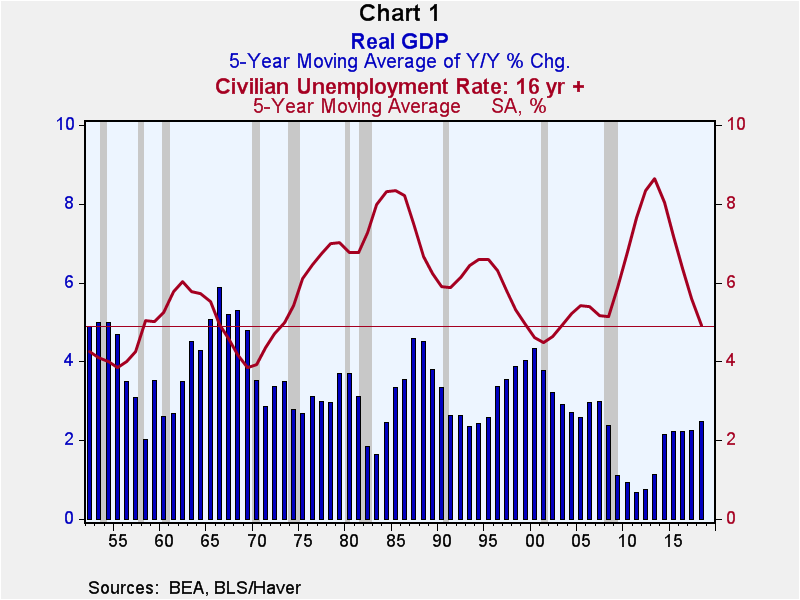

Well it's Festivus 2019 and time for the airing of grievances. My big beef with you people this Festivus is why you are having trouble explaining tepid wage growth in the face of a low unemployment rate. Firstly, let's examine why the unemployment rate is so low. Chart 1 tells us it is not because of strong real GDP growth. In the five years ended 2018, the unemployment rate averaged 4.9%. (In November 2019, the unemployment rate had fallen to 3.5%). The last time the five-year moving average of the unemployment rate had descended to 4.9% was 1999, when the five-year moving average in year-over-year growth in real GDP was 4.0%. In 2018, the five-year moving average of the year-over-year growth in real GDP was a mere 2.5%. Back in 1966, when the five-year moving average of the unemployment had descended to 4.9%, the five-year moving average of the year-over-year percent change in real GDP was a whopping 5.9%. So, strong real GDP growth is not accounting for the relatively low current level of the unemployment rate.

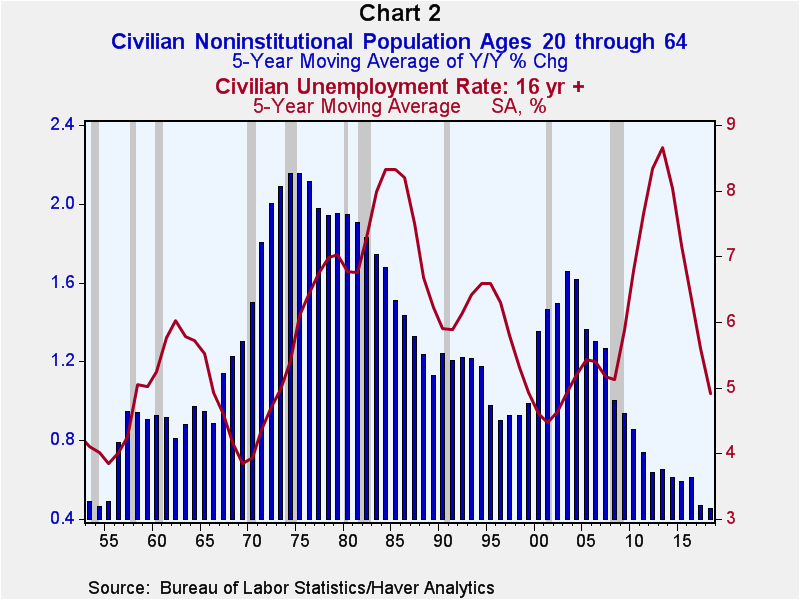

What I would argue is accounting for the current low level of the unemployment rate is exceptionally low growth in the population of working-age folks. This is illustrated in Chart 2 in which are plotted the five-year moving average of the year-over-year growth in the noninstitutional population (people not in jail or in the military) of 20- to 64-year olds (blue bars) and the five-year moving average of the unemployment rate (red line). In 2018, the five-year moving average of the year-over-year percent change in this population was 0.46%, the lowest since 1954. So, one reason the current unemployment rate is so low is that the available supply of labor is growing quite slowly. These days, if you can read, write, show up for work on time four days out of five and pass a drug test, you're hired! Heck, if you can just pass a drug test, you're hired.

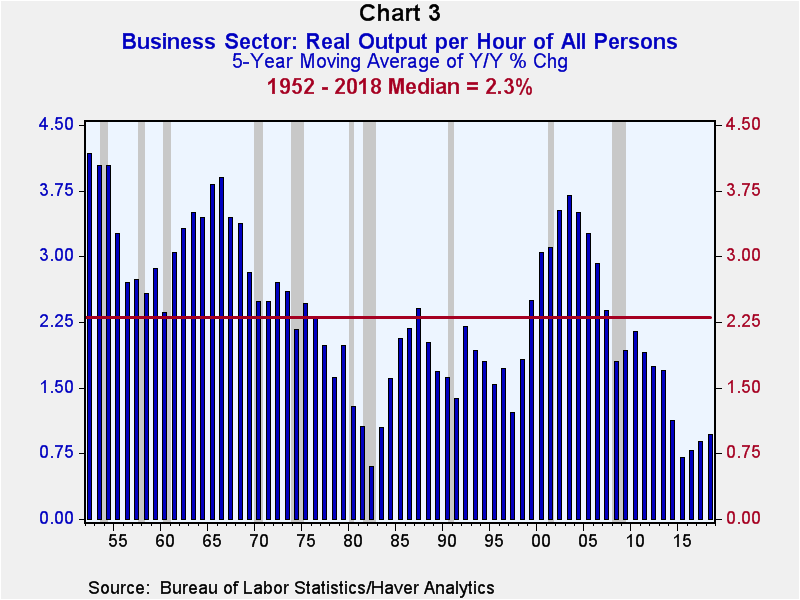

Another factor contributing to the current low level of the unemployment rate is the tepid growth in labor productivity in recent years, which is shown in Chart 3. If output per worker is growing slowly, a business needs more workers in order to attain a given rate of output.

The slow growth in labor productivity of late also helps explain the slow growth in real wages of late despite the low unemployment rate. Businesses pay workers according to what they contribute to businesses' revenues via workers' output. This can be expressed as:

Nominal Wage Rate = Output per Worker x Price of Product, or

Nominal Wage Rate/Price of Product = Output per Worker.

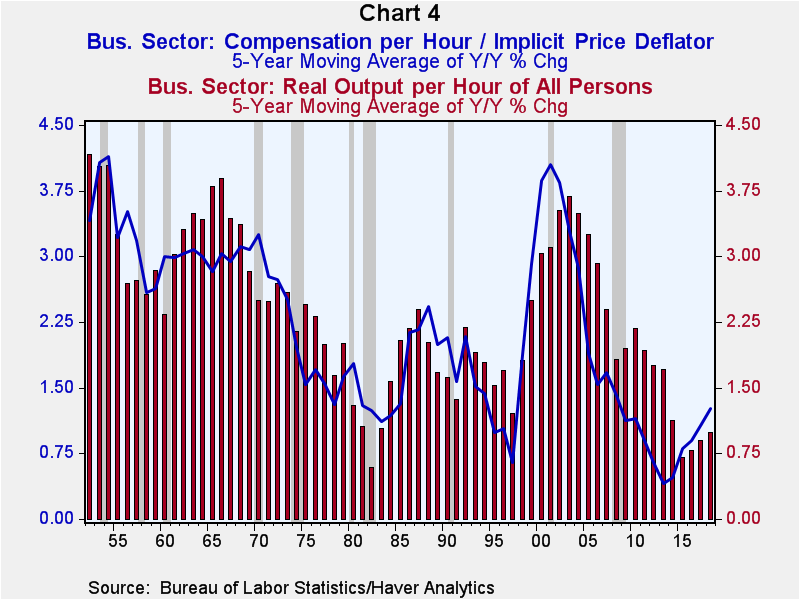

So, the proper way to measure the real wage is to divide the nominal wage rate by the selling price of the product. In terms of the aggregate business sector, the selling price of product would be the implicit price deflator of business sector output. Therefore, growth in real wages of the business sector ought to be positively related to the growth in business-sector labor productivity. Plotted in Chart 4 are the five-year moving averages of the year-over-year percent changes in business-sector worker compensation per hour divided by the business-sector implicit price deflator for output (blue line) and business-sector output per worker or labor productivity (red bars). Sure enough, in the post-WWII era, growth in real wages is positively associated with growth in labor productivity. The recent relatively slow growth in real wages appears to be related to the recent relatively slow growth in labor productivity.

Now, let's try to discern why growth in recent labor productivity has been so slow. Labor productivity is thought to be positively related to the amount of capital (equipment) available per worker. Let me give you a real world example of this. When I first joined the economics department of The Northern Trust Company way back in August 1986, it took three senior-level economists and two research assistants three weeks to produce an inaccurate macroeconomic forecast. By the time I retired from The Northern in April 2012, the economics department, consisting of only two senior-level economists, could knock out an inaccurate macroeconomic forecast in a couple of days. Why the increase in our productivity? We had more capital per economist, most importantly, Haver Analytics! As an aside, our forecasts were not always inaccurate inasmuch as Asha Bangalore and I won the award for the most accurate forecast over a four-year period among the 50+ economic forecasters surveyed by Blue Chip. But I digress.

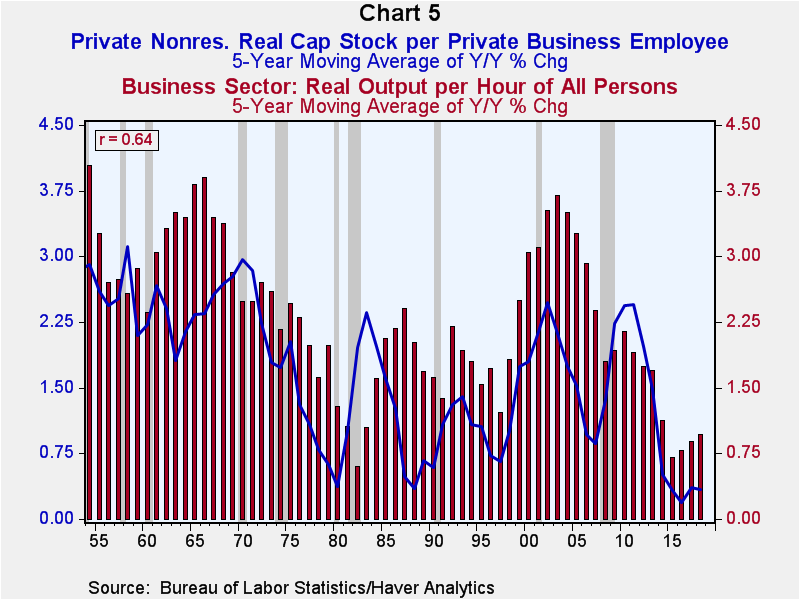

Plotted in Chart 5 are the five-year moving averages of the year-over-year percent changes in capital-to-labor ratio for the business sector (blue line) and the labor productivity of the business sector (red bars). There is a positive relationship between the growth in the capital-to-labor ratio and labor productivity. The correlation coefficient between the two series is 0.64 on a contemporaneous basis; 0.69 when growth in the capital-to-labor ratio leads. The recent slowest growth in the capital-to-labor ratio in the post-WWII era is associated with some of the slowest growth in labor productivity.

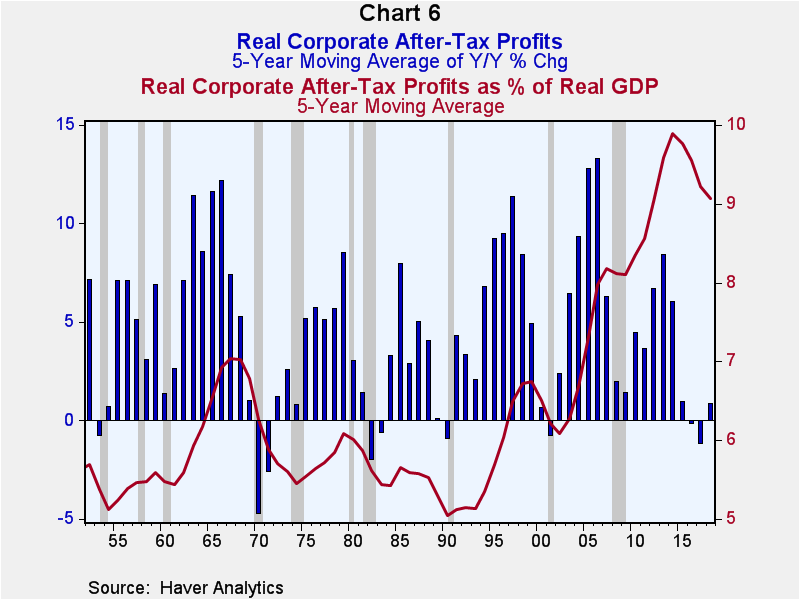

Why has growth in the capital-to-labor ratio been so slow in recent years? Is it because after-tax corporate profits have been inadequate to finance net investment in fixed capital assets? Growth in real after-tax corporate profits has been anemic in recent years (blue bars in Chart 6). Relative to real GDP, however, real after-tax corporate profits remain high (red line in Chart 6). Growth in real after-tax corporate profits has been weak in recent years because real growth in the economy has also been weak. After all, if profits accounted for 100% of GDP but GDP growth were weak, profit growth also would be weak. This recent weak growth in real after-tax profits may have contributed to the recent slow growth in the capital-to-labor ratio.

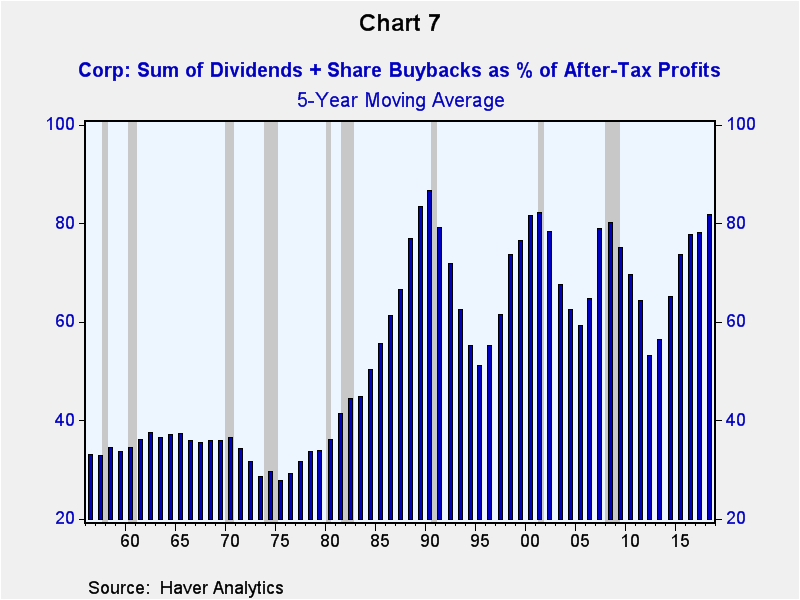

In addition to slow growth in real after-tax corporate profits being a contributor to the slow growth in the capital-to-labor ratio in recent years, how those profits were used by the corporations also is a contributing factor to the recent slow growth in the capital-to-labor ratio. Plotted in Chart 7 are the five-year moving averages of the sum of dividends paid by corporations plus corporate share buybacks as a percent of corporate after-tax profits. Starting in the 1980s and continuing through today, corporations have greatly increased the amount of their after-tax profits to fund dividend payouts and share buybacks, leaving less for net investment in fixed capital assets. Perhaps federal tax laws have something to do with corporations preference for using after-tax profits more for dividend payouts and share buybacks than for investment in fixed capital assets. Share buybacks, all else the same, will increase the value of outstanding shares, which would represent capital gains for stockholders. Capital gains are taxed at a lower rate than ordinary income. If equity shares are held a certain number of days before dividends are paid, then these "qualified" dividends are taxed at the capital gains rate rather than at the ordinary income rate. Also, some corporate executive compensation is positively related to the performance of the corporation’s stock price. This creates an incentive for corporate management to authorize the use of profits for share buybacks.

(See "Short-Term Thinking Is Poisoning American Business", The New York Times, December 21, 2019, for additional discussion on this.)

In addition to slow growth in real after-tax corporate profits being a contributor to the slow growth in the capital-to-labor ratio in recent years, how those profits were used by the corporations also is a contributing factor to the recent slow growth in the capital-to-labor ratio. Plotted in Chart 7 are the five-year moving averages of the sum of dividends paid by corporations plus corporate share buybacks as a percent of corporate after-tax profits. Starting in the 1980s and continuing through today, corporations have greatly increased the amount of their after-tax profits to fund dividend payouts and share buybacks, leaving less for net investment in fixed capital assets. Perhaps federal tax laws have something to do with corporations preference for using after-tax profits more for dividend payouts and share buybacks than for investment in fixed capital assets. Share buybacks, all else the same, will increase the value of outstanding shares, which would represent capital gains for stockholders. Capital gains are taxed at a lower rate than ordinary income. If equity shares are held a certain number of days before dividends are paid, then these "qualified" dividends are taxed at the capital gains rate rather than at the ordinary income rate. Also, some corporate executive compensation is positively related to the performance of the corporation’s stock price. This creates an incentive for corporate management to authorize the use of profits for share buybacks.

(See "Short-Term Thinking Is Poisoning American Business", The New York Times, December 21, 2019, for additional discussion on this.)

Well, I feel better after airing my grievance about economists' inability to come up with a coherent explanation as to why the unemployment rate is so low in the face of relatively slow economic growth and why wage growth has been so tepid in the presence of the low unemployment rate. So, let's stop our kvetching, gather round the old Festival pole, lift a glass of single-malt and sing together "O' Festivus":

O' Festivus

Lyrics by Katy Kasriel

To the melody of O' Tannenbaum

O' Festivus, O' Festivus,

This one's for all the rest of us.

The worst of us, the best of us,

The shabby and well-dressed of us.

We gather ‘round the ‘luminum pole,

Air grievances that bare the soul.

No slights too small to be expressed,

It's good to get things off our chest.

It's time now for the wrestling tests,

Feel free to pin both kin and guests,

O'Festivus, O' Festivus,

The holiday for the rest of us.

And a contentious Festivus 2019 to all.

Paul L. Kasriel

AuthorMore in Author Profile »Mr. Kasriel is founder of Econtrarian, LLC, an economic-analysis consulting firm. Paul’s economic commentaries can be read on his blog, The Econtrarian. After 25 years of employment at The Northern Trust Company of Chicago, Paul retired from the chief economist position at the end of April 2012. Prior to joining The Northern Trust Company in August 1986, Paul was on the official staff of the Federal Reserve Bank of Chicago in the economic research department. Paul is a recipient of the annual Lawrence R. Klein award for the most accurate economic forecast over a four-year period among the approximately 50 participants in the Blue Chip Economic Indicators forecast survey. In January 2009, both The Wall Street Journal and Forbes cited Paul as one of the few economists who identified early on the formation of the housing bubble and the economic and financial market havoc that would ensue after the bubble inevitably burst. Under Paul’s leadership, The Northern Trust’s economic website was ranked in the top ten “most interesting” by The Wall Street Journal. Paul is the co-author of a book entitled Seven Indicators That Move Markets (McGraw-Hill, 2002). Paul resides on the beautiful peninsula of Door County, Wisconsin where he sails his salty 1967 Pearson Commander 26, sings in a community choir and struggles to learn how to play the bass guitar (actually the bass ukulele). Paul can be contacted by email at econtrarian@gmail.com or by telephone at 1-920-559-0375.