Global| Sep 11 2020

Global| Sep 11 2020Hard Times and Great Expectations

by:Andrew Cates

|in:Viewpoints

Summary

Officiandos of the works of Charles Dickens will recognize the book titles that head up this commentary. 'Hard Times' certainly seems apt when assessing the global economic damage that's been generated by the current crisis and the [...]

Officiandos of the works of Charles Dickens will recognize the book titles that head up this commentary. 'Hard Times' certainly seems apt when assessing the global economic damage that's been generated by the current crisis and the likely absence of any major motors that might drive a meaningful recovery. Yet 'Great Expectations' also seems apt at the same time as this as hopes still seem quite high in some quarters about what lies ahead. Any realignment of those expectations in coming weeks could generate some challenges for policymakers not least if it has consequeces for financial markets at the same time.

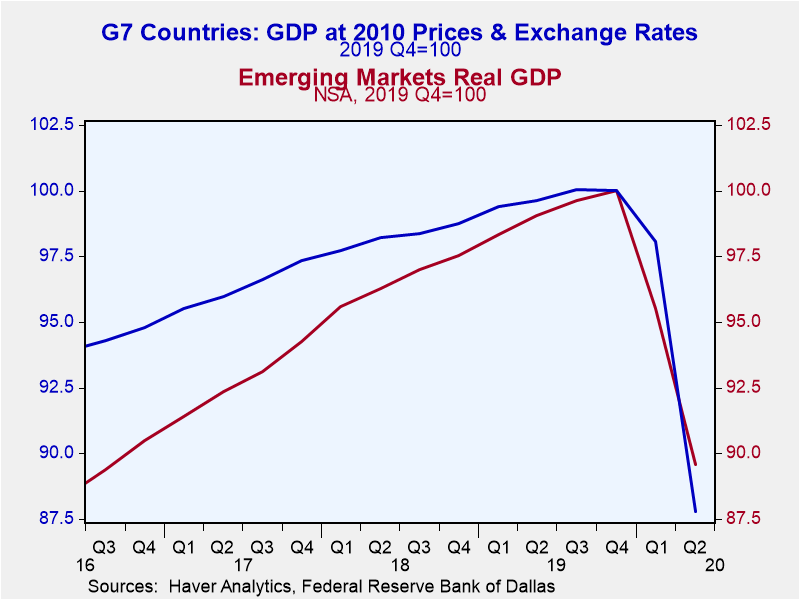

On the economic damage we look first at the large hole the world economy now finds itself in. Measured with reference to Haver's aggregation of real GDP levels in the G7, output in the advanced economies fell by 10.5% in Q2 to lie some 12% below the pre-COVID level established in Q4 2019. In emerging markets, meanwhile, calculations by the Dallas Fed sugget that output may have fallen by 6.2% in Q2 to lie some 11.5% below pre-COVID levels (see first figure below).

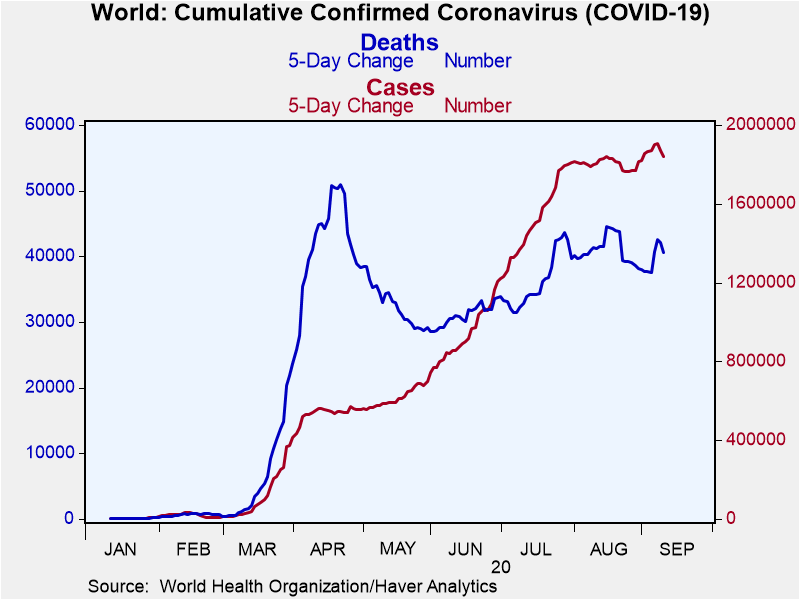

It's certainly true to argue that much of this damage can be blamed on the virus and the lockdown restrictions and social distancing policies that have been enacted to deal with it. And if the virus was being successfully driven away by those – and other healthcare - policies there would not be much scope for alarm. Sadly of course those policies have - so far - met with mixed results as global case numbers have continued to rise and as countries ranging from Australia to Zimbabwe and the Netherlands to Norway have succumbed to a second wave (see second figure below).

It's little wonder of course against this backdrop that the global economic environment is saddled with so much uncertainty. Challenges concerning populist politics and heightened protectionism, among others, that were with us before the crisis had already however generated tremendous challenges for many companies and consumers. A dearth of capital spending growth (see third figure below) and weaker underlying productivity trends have arguably been important consequences. This matters though when thinking about the fundamental drivers – or the motors – for an economic recovery. If animal spirits are absent, if consumer and companies are cautious and if productivity is flagging, the aforementioned economic holes in the world economy's GDP levels are unlikely to be filled that swiftly.

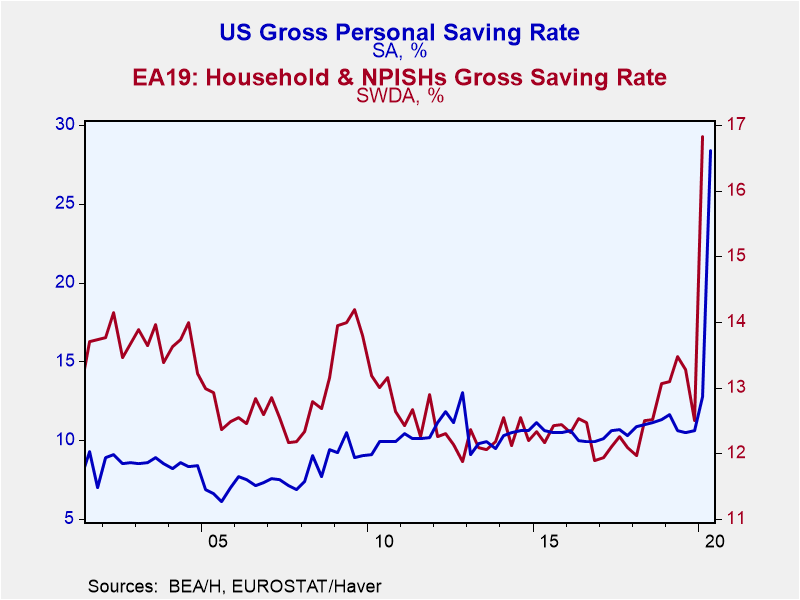

It's worth noting here on the consumer front and reflecting a generic air of inhibition that saving rates in the major economies have moved sharply higher in recent months (see fourth figure below). In some respects that could add some fuel to a recovery if and when virus levels fade and lockdown restrictions are eased as there is a high reservoir of surplus funds that are waiting to be spent. But it will likely take some time, however, before normality resumes in consumers' shopping habits not least if companies now embark on greater cost cutting initiatives.

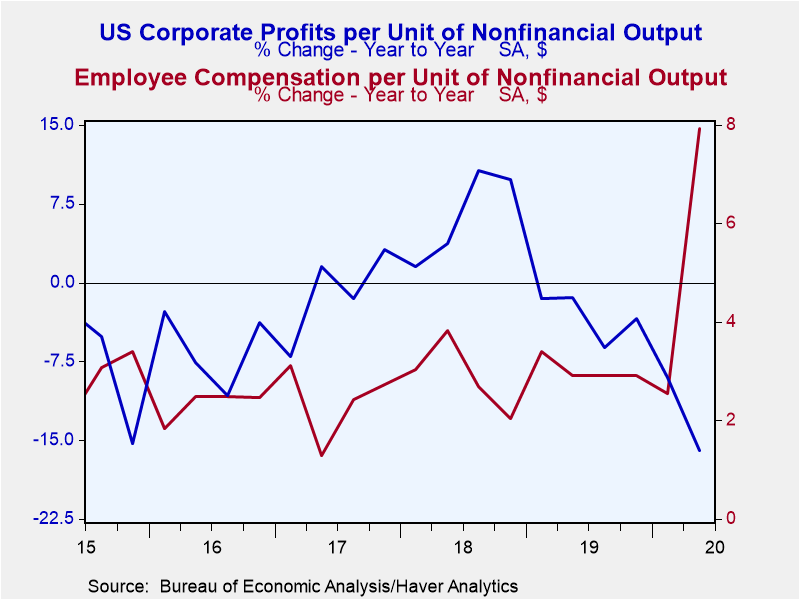

Detailed specifics on aggregate corporate profits and unit cost pressures are not yet available for most major economies but there are certainly some strong suggestions from the US in the details of its Q2 GDP data that there could be much greater effort to restore profitability by shedding more labour in the period ahead (see fifth figure below).

What about those lofty expectations? This is, as ever, a grey area in empirical analysis. But here are a few observations:

• First the strength of equity markets in recent months has coincided with a period – from early May through to mid-August - where incoming global economic data has surprised forecasters on the upside (see sixth figure below). In other words the expectations of economic forecasters were arguably too low back in late April. As financial markets and economists have now re-set those expectations as the dataflow bettered forecasts, it will arguably be much more difficult for the incoming data from now on to post positive surprises.

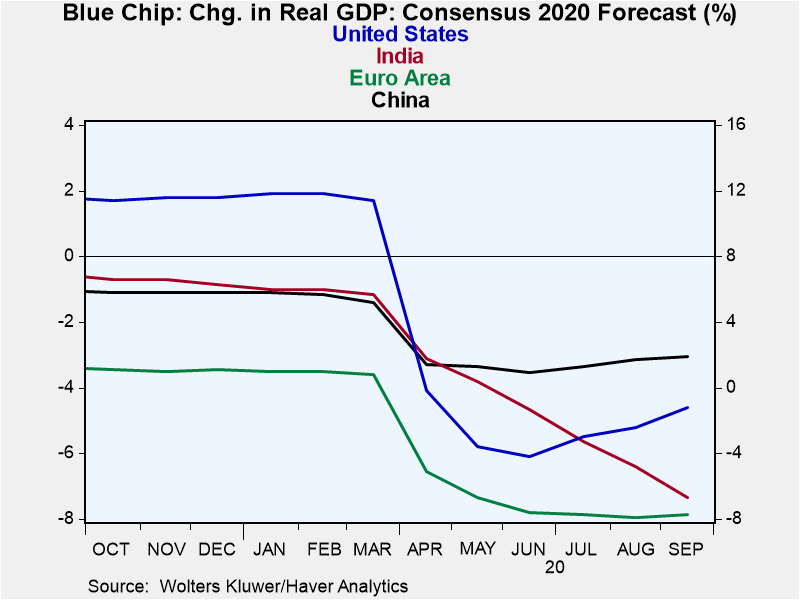

• Second this development has unfolded even though forecasters' expectations for medium-term GDP growth (e.g. average levels for 2020) have – on the whole – and with the notable exception of the US - shifted lower in recent months. This can be seen via the adjustment in our Blue Chip survey of economic forecasters and the evolution of GDP forecasts in many major economies for 2020 (see seventh figure below).

• And third in those surveys that ask respondents about their expectations as well as for their assessments of underlying current economic conditions there are big disparities. In the Global Sentix investor survey of economic conditions, for example, there has been a modest recovery in assessments of current economic conditions. But that pales into insignificance relative to the pick-up in expectations (see eighth figure below).

It is possible that these expectations will be validated of course not least if more tangible medical progress is made toward overcoming the virus and in particular if a vaccine is successfully uncovered. But in the absence of this progress those expectations seem somewhat lofty. Returning to Charles Dickens, there was a six year gap between the publication of Hard Times (in 1854) and Great Expectations (in 1860). Restoring the world economy to normality will hopefully not take that length of time. There are, however, arguably some metrics that we've cited above that suggest some folks think it will take less than 6 months. That will clearly be very tough.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.