Global| Feb 19 2021

Global| Feb 19 2021Vaccination and Adaptation

by:Andrew Cates

|in:Viewpoints

Summary

The performance of the world economy in coming months remains hostage to a number of factors but the evolution of the COVID-19 virus is the most important. As we discuss below, however, recent evidence on the virus front has been very [...]

The performance of the world economy in coming months remains hostage to a number of factors but the evolution of the COVID-19 virus is the most important. As we discuss below, however, recent evidence on the virus front has been very encouraging: globally case numbers and fatalities have continued to decline while estimates of the Reproduction rate have continued to fall. Even more encouragingly the evidence so far on vaccination efficacy has been positive. Backward looking macroeconomic data in the meantime have continued to surprise forecasters on the upside. And that's notwithstanding more stringent lockdown policies in some countries in recent weeks.

If there is an over-riding message from these observations it concerns the degree to which the world has adapted to the virus in recent months. Adjustments to healthcare policies and economic policies, technological breakthroughs on vaccines, and day-to-day adjustments in consumer and corporate behaviour have been impressive and often under-estimated in recent months. In combination they surely account for a good chunk of the world economy's better-than-expected performance. The same logic moreover may equally apply to any coming rebound in global growth in the period ahead.

In what follows we briefly discuss these views with reference to a few exhibits.

Falling cases numbers, falling fatalities

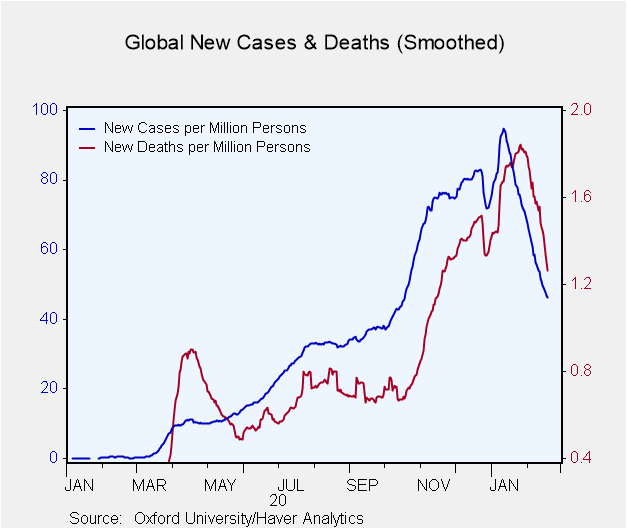

Firstly on COVID-19 the latest data shows that global weekly incidence and mortality have continued to decline steadily. Weekly mortality has decreased sharply since a peak in mid-January. And the current weekly incidence (measured per million persons) is the lowest since mid-November 2020. At the regional level, moreover, only the Eastern Mediterranean Region is currently reporting increasing case incidence. Every other major region is seeing retreating case numbers.

Figure 1: Global COVID case numbers and fatalities

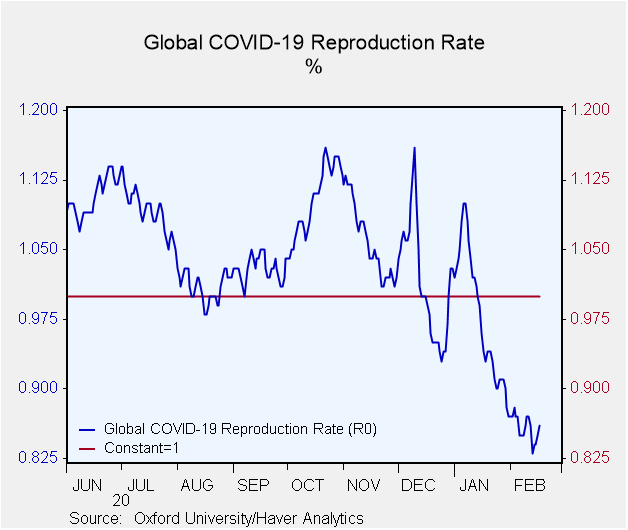

Latest estimates moreover from Oxford University suggest that the Reproduction (R0) rate has continued to decline in most countries and - on average – is now well below 1 at the global level (see figure 2 below). This clearly matters for likely incidence levels in the weeks ahead. Indeed by definition it suggests that COVID case numbers will continue to fall.

Figure 2: World COVID reproduction rate

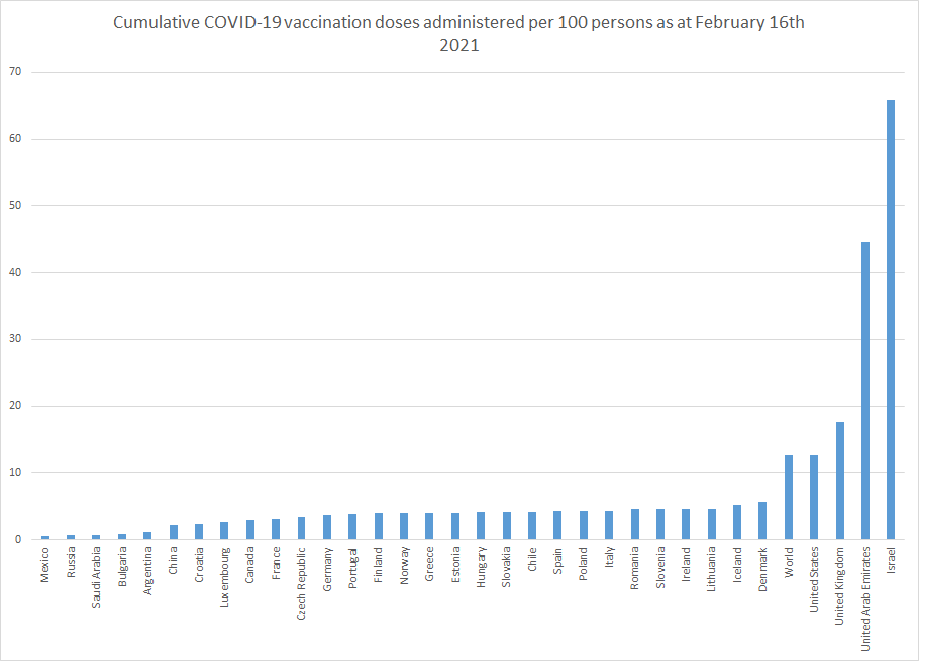

As for vaccinations the global rollout has continued apace. Oxford University's ‘Our World in Data' reports that 188.4 million vaccines had been administered up to February 18th, a 20% increase compared to the same period a week ago. Vaccination efforts have been reported in at least 86 countries and territories. Still, progress remains somewhat uneven between and among developed and developing countries (see figure 3 below).

Figure 3: Cumulative vaccinations per 100 persons

Source: University of Oxford

Evidence on vaccination efficacy

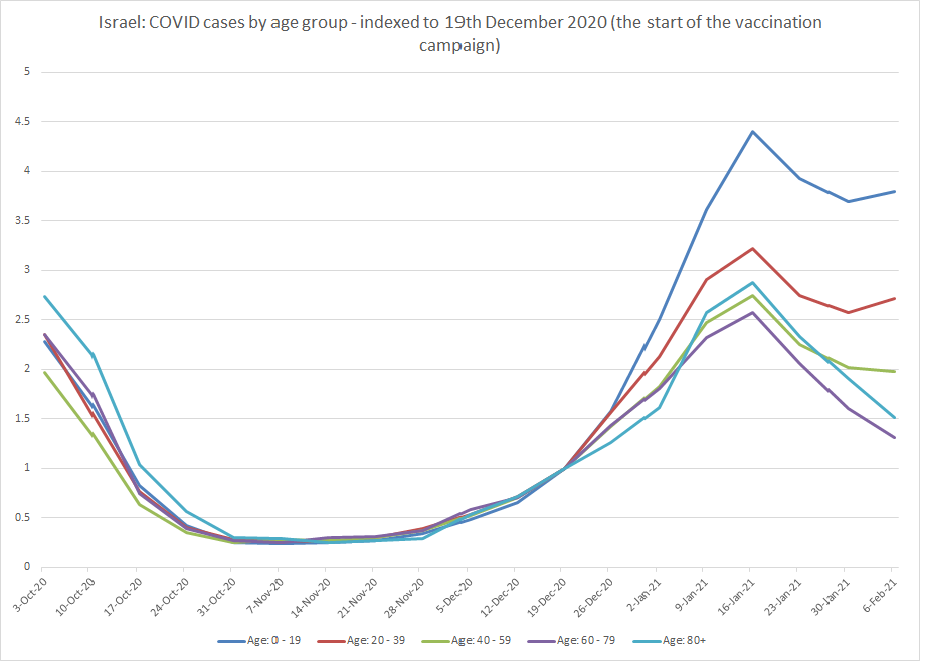

As noted though the most encouraging element of the vaccine rollout so far concerns it efficacy. Israel – the country that is in the lead in its vaccine rollout so far – has reported a 94% decrease in symptomatic COVID-19 cases among 600,000 individuals who have received 2 doses of the Pfizer-BioNTech vaccine, compared to those who have not yet been vaccinated. Figure 4 below showing cases of COVID-19 by age group reinforces that message. Those age cohorts that were vaccinated early on in the campaign - primarily those aged 60 and over - have seen much bigger declines in case numbers relative to other age cohorts.

Figure 4: Israel's weekly COVID cases by age group

Source: Rossman, Shilo, Meir, Gorfine, & Segal (2021): Patterns of COVID-19 pandemic dynamics following deployment of a broad national immunization program.

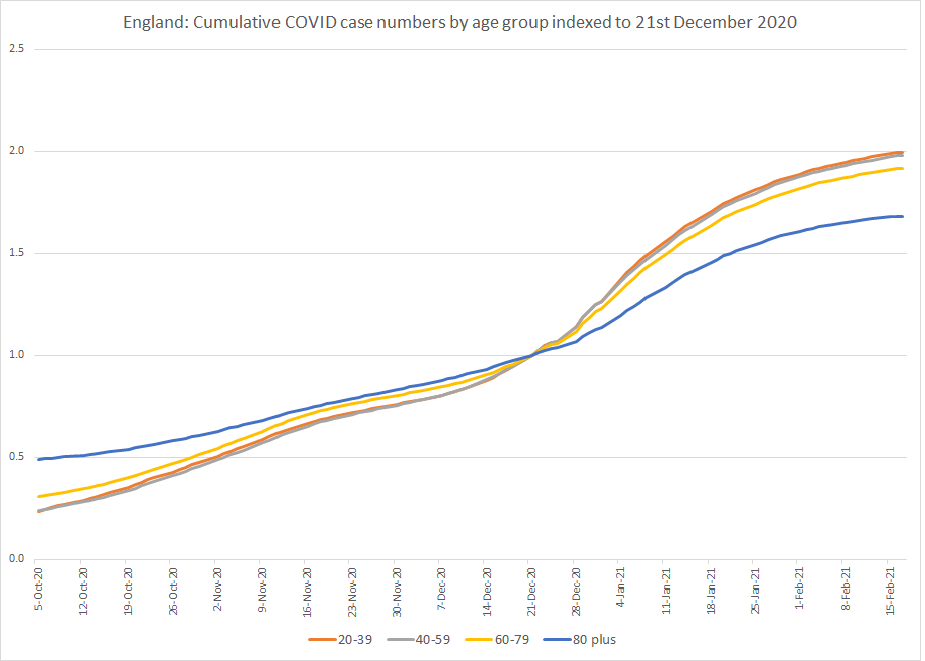

A similar message can be gleaned from England, where the vaccination effort has also been relatively solid. The conclusion here is not as strong possibly because of the new more virulent strain of COVID-19 that emerged in the UK toward the end of 2020. Even so cumulative case numbers by age group reveal a very sharp slowdown in the 80 plus age cohort that has so far been vaccinated heavily relative to those cohorts that have not (as evidenced in figure 5 below).

Figure 5: England: Cumulative COVID case numbers by age group

Source: University of Oxford/Haver Analytics

Incoming macroeconomic data still beating expectations

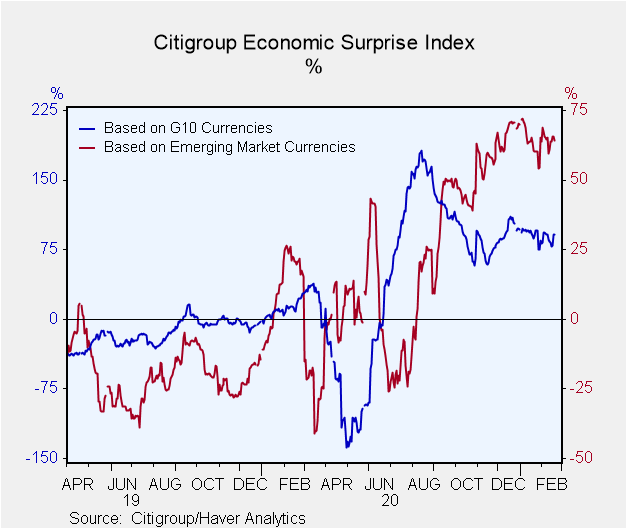

It's noteworthy against this backdrop that incoming economic growth data have continued to exceed forecasters' expectations in recent weeks. This extends an impressive run of form from Citigroup's global economic surprise indices, as evidenced in figure 6 below. A trend toward positive surprises has been in train for several months now, following a slump in Q2 last year. This run of positive surprises moreover has been unusually long relative to the cyclical behavior exhibited by this index in the past.

Figure 6: Economic surprise indexes – G10 and emerging economies

A number of factors can account for this impressive performance including ample policy support, an earlier-than-expected revival in China's economy and under-appreciated base effects from last year's initial shock. But the behavioural adjustments from consumers and companies, the role of policies that have been designed to tackle the virus and particularly of late the successful launch and rollout of a vaccination programme should not be under-estimated. In short, the world's population has adapted. And the world economy is poised to rebound strongly as a result.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.