Global| Mar 17 2021

Global| Mar 17 2021What Have We Learned So Far This Year?

by:Andrew Cates

|in:Viewpoints

Summary

In many respects this year has started where last year left off. The daily news cycle is still dominated by stories about COVID-19 and about how governments are responding to its ebb and flow. A by now familiar pattern has established [...]

In many respects this year has started where last year left off. The daily news cycle is still dominated by stories about COVID-19 and about how governments are responding to its ebb and flow. A by now familiar pattern has established itself in a number of countries. Firstly soaring case numbers stretch healthcare capacity to a point where lockdown enforcement is enacted, and mobility and economic activity are impaired. This, though, eventually eases those capacity strains by reducing case numbers yielding less stringent lockdown policies and subsequent economic improvement before the cycle begins again.

A key difference now, however, that ought to help cut the chains of transmission in this cycle concerns vaccinations. What were only a few weeks ago vague hopes for some resumption of normality are now slowly morphing - at least in some countries - into heightened certainty about the outlook as a consequence.

This vaccination effort is therefore beginning to generate some broader macroeconomic effects that ought to have ramifications for the future. In what follows we outline a few of the key themes that have established themselves in recent weeks. In short, these themes suggest a positive outlook that carries even more upside risk. It is this upside risk moreover that's at the root of climbing bond yields and the inflation fears that have gripped financial markets in recent weeks. The degree of that upside risk though – to both growth and inflation - still hinges, in part, on the pace of vaccination rollout, on government policy responses and on how households and companies now voluntarily unshackle themselves from lockdown fatigue.

More resilience and more adaptability

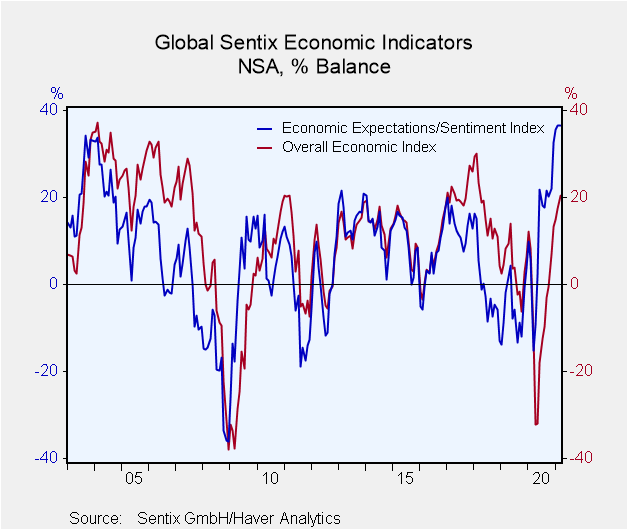

The first theme to highlight here concerns the increased resilience of the world economy in recent weeks. Incoming economic data have - on the whole - continued to surprise consensus forecasts on the upside. Forward looking survey data, in particular, have struck an upbeat tone and expectations components from many of these surveys now lie at very high levels (see figure 1 below).

Figure 1: The expectations component of the global sentix survey is at a twenty year high

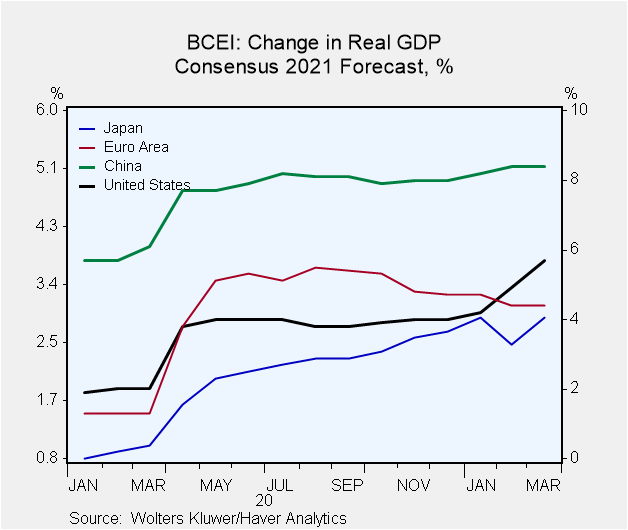

Economic forecasters have also tended to strike a more upbeat note in recent weeks. The latest Blue Chip surveys, for example, reveal that positive revisions to the GDP consensus for 2021 have been made since the start of this year for a number of major countries, including the US, Japan and China, but not the Euro area (see figure 2 below).

Figure 2: Evolution of consensus GDP growth forecasts for 2021

There are undeniably specific local factors that account for these revisions and most notably for the US the fiscal stimulus package worth $1.9 trillion that was lately enacted by Congress. Still, a pattern of positive revisions in China, Japan and the US and negative revisions in Europe also chime with the still-key influence of COVID-19. Rising case numbers in several European countries combined with heightened lockdown stringency and a relatively slow vaccination programme have hampered confidence and yielded less upside – indeed some downside - for the economic outlook relative to elsewhere. We will return to this again below.

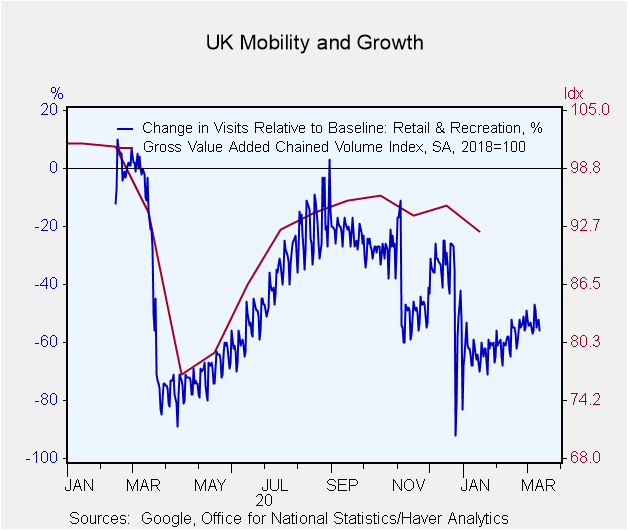

Another feature though of the recent economic dataflow that speaks more to increased resilience is the reduced sensitivity of that data to impaired mobility. Over the past 12 months alternative data indicators such as Oxford University's policy stringency indices and Google and Apple mobility data have proved useful for gauging the economic impact from the pandemic. In recent weeks, however, they have proved far less useful (see figure 3 below for the UK). One reason for this could be that households and companies are now much more able to operate with lockdown restrictions in place. In addition to this though sectors such as hospitality are already severely depressed which has reduced the overall sensitivity of the economy when they become slightly more (or less) depressed.

Figure 3: Reduced mobility is not impairing growth as much as it used to

Uneven vaccination rollout implies an uneven recovery

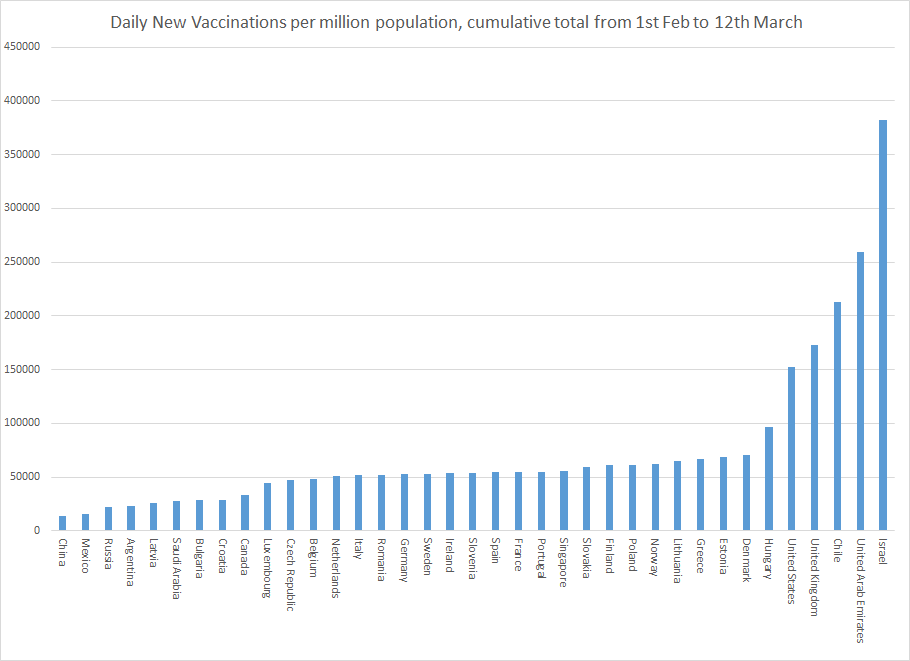

What the discussion above suggests is that lockdown stringency is not as important for macroeconomic outcomes as it used to be. Instead, how people now behave as vaccinations are rolled out could be more important. On that score it's worth highlighting how uneven the global pace of vaccinations has proved to be in recent weeks. In figure 4 below we show the cumulative numbers for new vaccinations per million population for a number of developed and developing countries. Those on the right hand side of this chart, including Israel, the UAE, Chile, the UK and US are clearly some way ahead of many others. There are few countries on the left hand side of this chart too though, including China, Mexico and Russia, that are some way behind.

Figure 4: An uneven pace of vaccination rollout

Source: University of Oxford/Haver Analytics

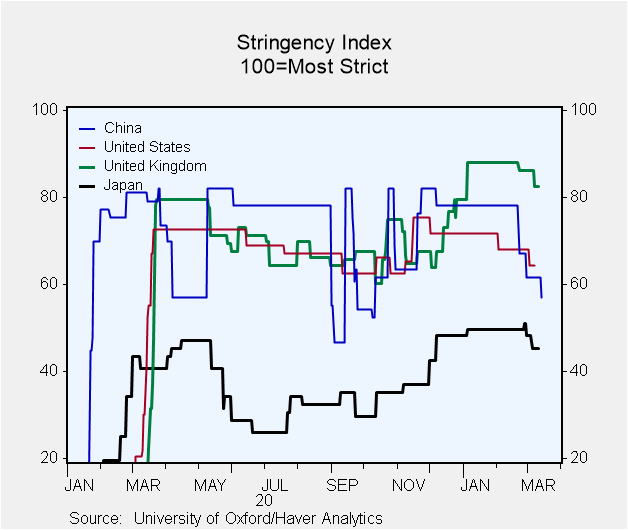

Vaccination success though does not necessarily imply looser stringency and vice versa. Notwithstanding its relatively successful vaccine rollout, the UK is still in the throes of a severely restrictive lockdown regime compared with, for example, the US, whose vaccination rollout has been similarly successful (see figure 5 below). Equally of note, however, China's overall policy stringency has been relatively tight and has only recently been loosened notwithstanding a relatively slow pace of vaccination rollout.

Figure 5: Policy toward lockdowns is more stringent in Europe than in the US or Japan

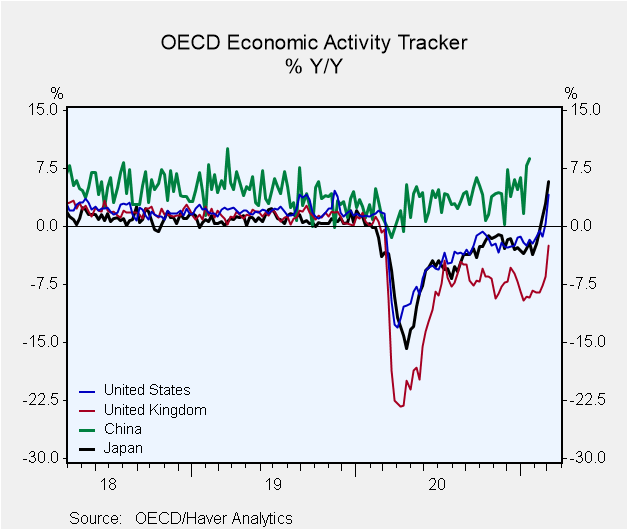

As discussed above, these policy considerations haven't necessarily generated the one-for-one economic consequences that might have been expected based on behaviours that were in evidence last year. The latest batch of weekly economic activity trackers from the OECD, for example, show that China has been enjoying a tremendously strong economic rebound in recent months that's incidentally been magnified by a stellar trade performance in recent weeks. Even so, the relative vigour that's in evidence in Japan and to a lesser extent the US vis a vis the UK (and other major European countries) in figure 6 below is undeniably in part a function of the ongoing restrictions to the latter population's mobility. Fear of easing lockdown stringency too soon seems to be manifest in the UK at present, and that could be impairing mobility unnecessarily and thereby restricting economic growth compared with elsewhere.

Figure 6: OECD Economic Activity trackers illustrate differing recovery speeds among major economies

More confidence in a recovery, less confidence about inflation

A final theme that's been in evidence in recent weeks concerns rising bond yields. The resilience of the world economy in recent weeks and heightened optimism about the outlook have helped propel bond yields to much higher levels. More accommodative fiscal policy in the US and mixed messages from some Central Banks have been contributory factors. As a result of this, there is now an active debate about whether rising yields is a harbinger of higher inflation and, in turn, on whether or not Central Banks are making a mistake in keeping monetary policy too loose.

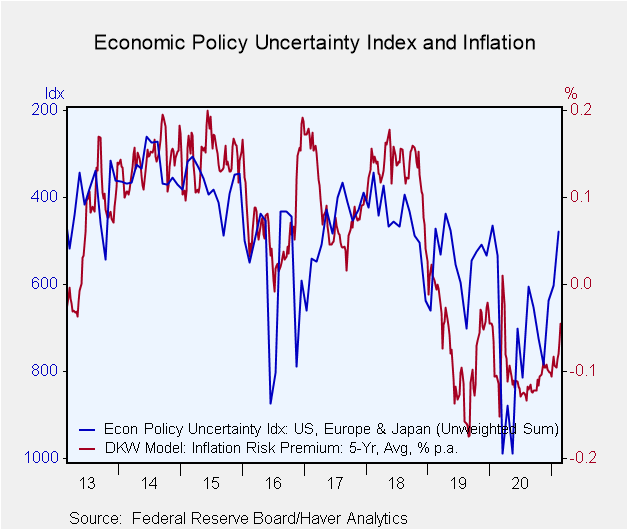

Without wishing to wade too much further into that debate, we simply make a nod to our final chart that hopefully puts some of the recent angst about these matters into perspective. It concerns the relationship that naturally exists between bond yields and economic uncertainty. Heightened fear about the future has clearly depressed growth (and inflation outcomes) in recent months. Equally, the greater certainty about the economic outlook that's taken hold of late has generated a little more uncertainty about prospective inflation outcomes at the same time. That last linkage is shown in figure 7 below via the correlation between a global policy uncertainty index (summed for the US, Europe and Japan) - and inverted in the chart - against a (Fed) measure of the inflation risk premium that's embedded in 5 year bond yields. The chart suggests there has been nothing out of the ordinary in the market's heightened inflation alert in recent weeks, indeed those worries may have further to run in the weeks ahead. From a broader perspective, however, and from the base that these metrics are rising (or falling) from, the current angst does not seem to be that alarming. Indeed one might view it instead as a healthy consequence of the likely return to economic normality in the period ahead.

Figure 7: Reduced economic uncertainty implies higher inflation risks

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.