Global| Oct 03 2007

Global| Oct 03 2007Australia Retail Sales Show Some Vigor Through August

Summary

Retail sales in Australia extended their recent surge through a third month in August as they recovered from a dip in April-May. They were up 0.7% in August alone and 3.2% over the last three months, the strongest 3-month gain since [...]

Retail sales in Australia extended their recent surge through a third month in August as they recovered from a dip in April-May. They were up 0.7% in August alone and 3.2% over the last three months, the strongest 3-month gain since late in 2003. At least one forecast survey looked for only half as much increase in August.

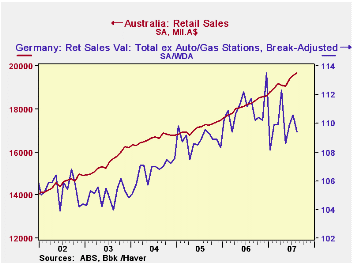

In a number of other countries, we have noted recently that consumer spending has been lagging. Germany is a prime example, with a 1.4% drop in August, and the entire Euro-Area saw a minuscule 0.7% rise in August. This does not seem to be the case in Australia. The country's economy is benefiting from the commodity boom and also is experiencing a growing surplus in its balance of trade in services. Further, it seems not to have been hit with a downturn in the housing market. Lending for home purchase looks fairly steady and significantly, prices of established homes are rising, especially in Melbourne, Brisbane and Adelaide. So the environment for consumer spending is favorable.

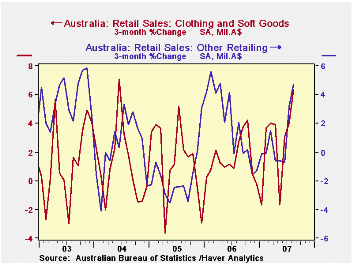

The upturn in reported retail sales in the last few months has occurred in several categories. All the reported categories were stronger in the June-August period than in the prior three months. But the biggest turns were in clothing, from a decline of 1.7% in February-May to a gain of 6.3% in the later span. The "other" retailing sector similarly went from a decrease of 0.6% to a gain of 4.7%. Household goods were basically flat from February through May, but then grew 3.1% from May through August.

So the retail sector in Australia is firm with a diversity of gains. One wire service said today (Wednesday in New York) that this would add to evidence that the Reserve Bank would want to raise rates soon. The mere expression of such sentiments at this time also sets the Australia economy and its policymakers apart from those in other parts of the world.

All of these data are included in Haver's ANZ database with some summary items in G10. Note that retail sales data in Australia do not include motor vehicles or motor fuel.

| Australia: Retail Sales, SA | Aug 2007* | July 2007* | Aug/- May | May/- Feb | Monthly Averages | ||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Total, Mil.A$ | 19684 | 19542 | -- | -- | 18161 | 17144 | 16680 |

| Yr/Yr % Chg | 8.3 | 7.2 | -- | -- | 5.9 | 2.8 | 7.3 |

| Mo/Mo % Chg | 0.7 | 0.8 | 3.2 | 0.7 | -- | -- | -- |

| Food | 1.0 | 0.7 | 3.1 | 1.5 | 6.8 | 3.6 | 7.2 |

| Clothing/Soft Goods | -0.1 | 1.0 | 6.3 | -1.7 | 4.4 | 5.2 | 7.2 |

| Household Goods | 2.4 | -0.6 | 3.1 | 0.2 | 5.7 | 5.5 | 8.9 |

| "Other" Retailing | 1.5 | 1.5 | 4.7 | -0.6 | 5.9 | -4.1 | 5.9 |

| Hospitality | 1.2 | -0.6 | 2.1 | 0.8 | 8.3 | 2.6 | 7.7 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.