Global| Nov 01 2007

Global| Nov 01 2007Australian Economy Remains Strong, But Strong A$ May Already Be Generating Some Restraint

Summary

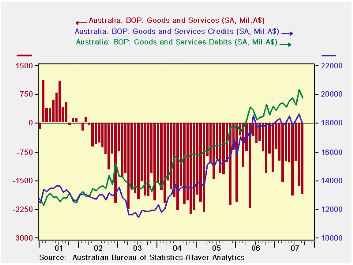

The deficit in Australia's trade in goods and services increased further in September as exports declined and an accompanying decline in imports was smaller. The overall deficit was A$1,862 million, up from A$1,665 million in August [...]

The deficit in Australia's trade in goods and

services

increased further in September as exports declined and an accompanying

decline in imports was smaller. The overall deficit was A$1,862

million, up from A$1,665 million in August (seasonally adjusted). The

year-ago figure was A$761 million.

The deficit in Australia's trade in goods and

services

increased further in September as exports declined and an accompanying

decline in imports was smaller. The overall deficit was A$1,862

million, up from A$1,665 million in August (seasonally adjusted). The

year-ago figure was A$761 million.

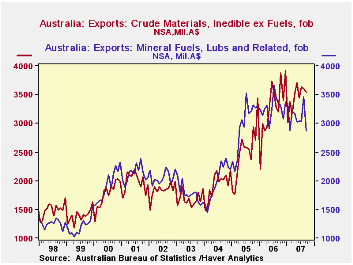

We have highlighted here before (See May 4, 2007 commentary) the role of raw materials, particularly mineral resources, in Australia's international trade. The SITC 3 categories, "crude materials, inedible, ex fuels" and "mineral fuels, etc" together constitute about half of the nation's total goods exports. These exports have brought considerable revenue into the Australian economy. Australia's economy has been strong recently. Indeed, today, a report of September retail trade shows a gain of 0.9% in that month, extending a trend of notable growth in consumer spending.

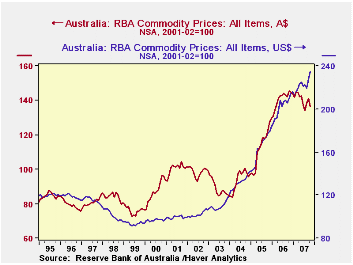

However, the commodities markets are priced in US dollars. The Australian dollar, perhaps bolstered by the vigorous economy, has risen markedly. Yesterday, according to the New York Federal Reserve Bank, it was priced at US$0.9271, the highest month-end value since March 1984. [In fact, a retail purchase in New York City yesterday came right at par.] This rapid increase in the exchange rate means that world commodities, with US dollar prices, bring relatively fewer Australian dollars than before. Thus, it is not surprising to see a moderation in the value of these key Australian exports, which have averaged over the last six months only 0.5% above a year ago.

This point is more clearly made in the commodity price index compiled by the Reserve Bank of Australia; the RBA publishes this in both US$ and A$. See the difference in the third graph. Flexible currency values are, of course, one of the important transmission mechanisms for global trade adjustment and for monetary policy. The strong Australian dollar can help restrain inflation in Australia and by slowing the Australian-dollar value of tradable goods, it can also modulate economic activity, an "automatic stabilizer". Still, today's strong retail trade report brought further talk the the RBA might raise interest rates at its next policy meeting. This talk too can bring more strength to the currency -- at least until it is evident that that very strength is restraining the economy.

| AUSTRALIA (Mil.A$) | Sept 2007 | Aug 2007 | Jul 2007 | Sept 2006 | Monthly Averages | ||

|---|---|---|---|---|---|---|---|

| 2006 | 2005 | 2004 | |||||

| Balance on Goods & Services | -1,862 | -1,665 | -1,011 | -761 | -969 | -1,399 | -1,985 |

| Goods Credits (Exports) | 13,764 | 14,558 | 14,200 | 14,009 | 13,809 | 11,690 | 9,881 |

| Goods Debits (Imports) | 15,848 | 16,408 | 15,408 | 14,908 | 14,871 | 13,147 | 11,922 |

| Balance on Services | 223 | 185 | 190 | 138 | 93 | 58 | 58 |

| Raw Material Exports* (NSA) | 6,404 | 7,077 | 6,681 | 6,556 | 6,544 | 5,475 | 3,908 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates