Global| Sep 15 2016

Global| Sep 15 2016Business Inventories Unchanged in July as Sales Tick Down

Summary

Total business inventories decreased ever so slightly, -0.04% (+0.5% y/y), in July; June's 0.2% rise was unrevised. Total business sales slipped -0.2% (-0.8% y/y), pausing after June's 1.0% gain, which was revised from 1.2%. Retail [...]

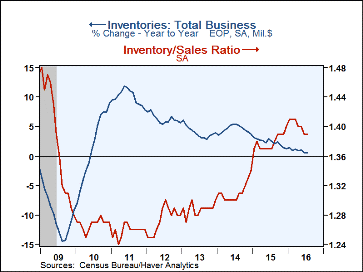

Total business inventories decreased ever so slightly, -0.04% (+0.5% y/y), in July; June's 0.2% rise was unrevised. Total business sales slipped -0.2% (-0.8% y/y), pausing after June's 1.0% gain, which was revised from 1.2%.

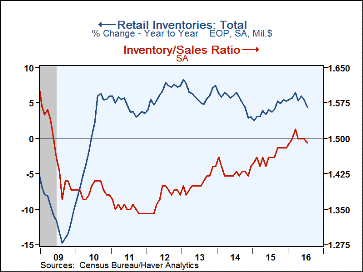

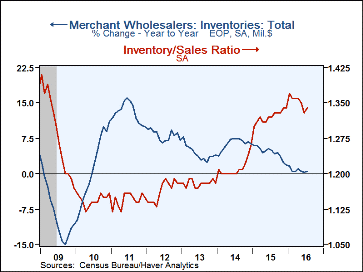

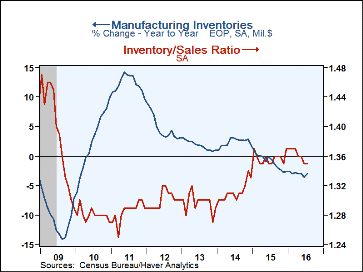

Retail inventories went down 0.3% in July (+4.4% y/y), reversing a rise of 0.4% in June; that was revised from 0.5% reported before. Inventories excluding motor vehicles and parts dealers also fell 0.3% (2.9% y/y) following a 0.2% rise. Motor vehicle & parts inventories decreased -0.2% (+8.8% y/y), pausing after June's 0.8% advance. Food & beverage store inventories, which had gained 0.5% in June, revised from 0.7%, also paused in July (+2.6% y/y) at almost June's exact same level - that is, -$2 million. Inventories at building material & garden supply stores rose 0.6% (+4.3% y/y), continuing a modest up-and-down pattern of the previous few months. Inventories at other retailers decreased modestly in the latest month. Merchant wholesalers' inventories were also basically flat in July (+0.5% y/y) after June's 0.3% rise, as reported last weak, and manufacturers' inventories ticked up 0.1% (-2.9% y/y), also as reported earlier.

Total business sales, as noted, were down 0.2% in July (-0.8% y/y), somewhat a reaction to June's 1.0% gain. The decreases were widespread, with wholesalers off 0.4% (+2.9% y/y) after their sizable 1.7% advance in June. Factory shipments lost 0.2% (-3.0% y/y) after their 0.6% June gain. Total retail sales edged higher 0.1% (+2.0% y/y), but the segment excluding motor vehicles and parts saw sales down 0.4% (+2.9% y/y), with the declines spread across all major store groups.

The inventory-to-sales ratio was unchanged at 1.39 in July, its lowest level since November. The retail sector ratio moved down to 1.49 from June's 1.50, while the I/S ratio excluding autos was flat at 1.27, still the lowest since August 2015. Stocks at motor vehicle & parts dealers were lower relative to sales, at 2.23 in July versus 2.28 in June. Among durable goods outlets other than autos, stocks rose relative to sales, with furniture, appliances & electronics at 1.55 in July, up from 1.54, and building materials & garden supplies inventories at 1.84 months of sales, compared to 1.81 in June. The I/S ratio among nondurable goods outlets was mixed, with marginal movements across food, clothing, and general merchandise centers. Merchant wholesalers' I/S ratio moved up in July to 1.34 from 1.33 in June, and that at manufacturers was flat at 1.35.

The manufacturing and trade data are in Haver's USECON database.

| Manufacturing & Trade | Jul | Jun | May | Jul Y/Y | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|

| Business Inventories (% chg) | -0.0 | 0.2 | 0.2 | 0.5 | 1.3 | 3.7 | 3.9 |

| Retail | -0.3 | 0.4 | 0.5 | 4.4 | 5.3 | 3.1 | 7.4 |

| Retail excl. Motor Vehicles | -0.3 | 0.2 | 0.3 | 2.9 | 4.1 | 2.6 | 4.8 |

| Merchant Wholesalers | 0.0 | 0.3 | 0.2 | 0.5 | 1.9 | 6.5 | 4.0 |

| Manufacturing | 0.1 | -0.0 | -0.1 | -2.9 | -2.6 | 1.8 | 1.0 |

| Business Sales (% chg) | |||||||

| Total | -0.2 | 1.0 | 0.3 | -0.8 | -2.6 | 2.8 | 2.9 |

| Retail | 0.1 | 0.9 | 0.1 | 2.0 | 1.6 | 3.9 | 3.8 |

| Retail excl. Motor Vehicles | -0.4 | 1.0 | 0.2 | 2.9 | 0.2 | 3.2 | 2.6 |

| Merchant Wholesalers | -0.4 | 1.9 | 0.7 | -1.0 | -4.3 | 3.6 | 3.1 |

| Manufacturing | -0.2 | 0.7 | 0.1 | -3.0 | -4.4 | 1.2 | 2.1 |

| I/S Ratio | |||||||

| Total | 1.39 | 1.39 | 1.40 | 1.37 | 1.38 | 1.31 | 1.29 |

| Retail | 1.49 | 1.50 | 1.50 | 1.46 | 1.46 | 1.43 | 1.41 |

| Retail excl. Motor Vehicles | 1.27 | 1.27 | 1.28 | 1.26 | 1.27 | 1.24 | 1.23 |

| Merchant Wholesalers | 1.34 | 1.33 | 1.35 | 1.32 | 1.32 | 1.21 | 1.18 |

| Manufacturing | 1.35 | 1.35 | 1.36 | 1.35 | 1.36 | 1.31 | 1.30 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates