Global| Jan 04 2007

Global| Jan 04 2007Corporate Profitability Strengthens in UK; Return on Capital Reaches Record 15.2% in Q3

Summary

UK corporations had a record operating surplus in Q3 2006 and earned record rates of return on capital. All private nonfinancial corporations returned 13.4% in gross operating surplus against gross capital stock and 15.2% on a net [...]

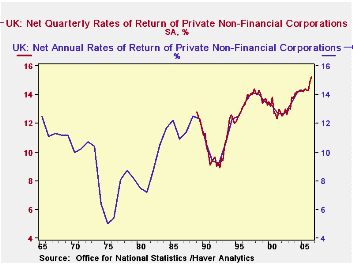

UK corporations had a record operating surplus in Q3 2006 and earned record rates of return on capital. All private nonfinancial corporations returned 13.4% in gross operating surplus against gross capital stock and 15.2% on a net basis. The gross return compared with 13.2% in Q2 and 13.0% in Q3 2005. Before this latest period, only four other quarters since 1989 had been as high as 13%. The net return comparison is even stronger: Q2 was 14.9% and besides these two latest periods, the high since 1989 was 14.4%. Annual data go back to 1965 and the earlier years were no higher, giving greater weight to the current, precedent-setting performance.

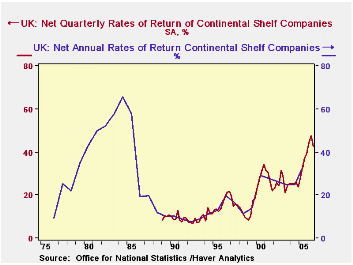

Clearly some of this has to do with high profitability in the oil industry. The second graph shows the recent strength in that sector, referred to as the UK Continental Shelf, with net returns in the mid-40% range. Q2 2006 does, though, appear to have been a peak and current performance is well off the highs of the mid-1980s.

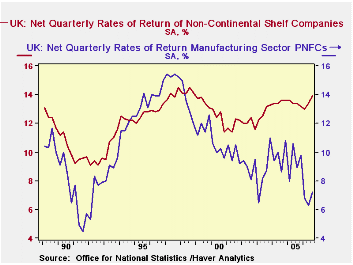

"Non-continental shelf companies" are also doing well. Nonfinancial services are the source of considerable gain, and "other" industries contribute too (these include utilities, construction, agriculture and mining, not published separately). Service companies have returned more than 19% on capital so far in 2006, about 0.75% above the previous record of 18.5% in 1998. Manufacturing, by contrast, is lagging. The operating surplus in those industries reached a peak of just under £35 billion in 1997, when the yield on capital was 15.3%. By 2005, the surplus had decreased to £20.6 billion and has apparently fallen further in the first three quarters of 2006. This is still, however, better than in the late 1970s and early 1980s, which saw surpluses nearly vanish, generating meager returns as low as 1.3% (1981) and less than 5% for 10 years running.

These rate-of-return data all come from Haver's UK database, sourced from the UK Office for National Statistics. While they are issued with considerable lag -- more than three months after the end of the quarter they describe -- they appear to be quite helpful in assessing aggregate and sector corporate performance. Note also that the operating surplus figures that form the basis of these returns were reported two weeks ago on December 21. The published capital data are only annual, but within some limits, they could be inferred from the returns and the surplus data that are available. The ONS cautions though that these data are subject to more revision than other of their series, a common situation with residual information like profits.

| PNFC* Rates of Return (%, ex as noted) |

Q3 2006 | Q2 2006 | Q3 2005 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Gross Operating Surplus (Bil.£) | 61,773 | 58,980 | 56,995 | 228,030 | 219,738 | 202,479 |

| % Change | 4.7 | 3.5 | 8.7 (Y/Y) | 3.8 | 8.5 | 6.6 |

| Rate of Return: Gross | 13.4 | 13.2 | 13.0 | 12.9 | 12.9 | 12.4 |

| Net | 15.2 | 14.9 | 14.4 | 14.3 | 14.2 | 13.4 |

| Continental Shelf Companies (Net) | 42.9 | 47.6 | 37.0 | 34.1 | 25.1 | 24.9 |

| Non-Continental Shelf Companies (Net)** | 13.9 | 13.4 | 13.4 | 13.4 | 13.5 | 12.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.