Global| Jan 18 2007

Global| Jan 18 2007CPI Rises 0.5% with Pick-Up in Energy

Summary

The December consumer price index (CPI-U) rose 0.5% after November's flat reading. In fact, this was the first increase since August. The monthly change was in line with consensus expectations at a 0.5% rise. The 12-month inflation [...]

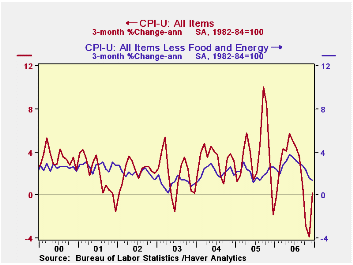

The December consumer price index (CPI-U) rose 0.5% after November's flat reading. In fact, this was the first increase since August. The monthly change was in line with consensus expectations at a 0.5% rise. The 12-month inflation was 2.6%, less than 3.4% in 2005.

Prices less food & energy were up 0.2%; they had been unchanged in November. This too matched consensus expectations, at a 0.2% increase. The December-on-December rate was 2.6%, the same as the total.

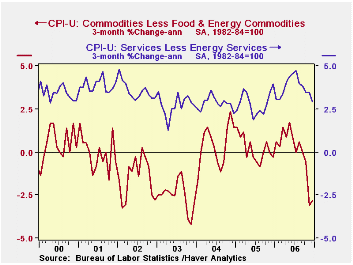

Core goods prices were unchanged in December, following three consecutive declines; the year-on-year pace was +0.2%. The December mix included gains in apparel (0.6%), tobacco (1.5%) and personal care products (1.9%). Declines included new & used motor vehicles (-0.3%), medical care commodities (0.2%) and audio/video equipment (0.7%). Computer prices were unchanged.

Core services prices repeated their November 0.2% increase. In fact, carried to a second decimal place, December, at 0.20%, had the smallest increase since last January, 0.17%. Shelter slowed back to a 0.3% rise from 0.4% in November; public transportation continued to fall, but just 0.2% in December after 1.9% in November. Information technology and services were down 1.8%, but this was the smallest decline in recent months, following, for instance, 4.2% in November. Medical services were up just 0.2% and education increased 0.5%. Despite the huge rise in personal care products, personal care services inched up only 0.1%.

Energy prices rebounded sharply, up 4.6% on the month. This put them up 3.1% from December 2005. Gasoline prices surged 8.0% in December, heating oil rose 3.2% and piped gas and electricity were up 1.2%.

Food & beverage prices were unchanged in December. Fruits and vegetables prices dropped 1.5%, their second consecutive sizable decline. Cold weather in the South this month, though, may make such declines short-lived. Nonalcoholic beverages, alcoholic beverages and cooking fats and oils also declined. Dairy product prices steadied with a 0.1% rise after their November fall of 0.6%, and prices for meats, poultry, fish & eggs also rose 0.1%, a bit slower than November's 0.2%. Cereals were up 0.4%, the same as in November.

The chained CPI, which adjusts for shifts in the mix of consumer purchases, was up just 0.1% in December and the chained "core" fell 0.2%.

| Consumer Price Index | December | November | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total | 0.5% | 0.0% | 2.6% | 3.2% | 3.4% | 2.7% |

| Total less Food & Energy | 0.2% | 0.0% | 2.6% | 2.5% | 2.2% | 1.8% |

| Goods less Food & Energy | 0.0% | -0.4% | -0.1% | 0.2% | 0.5% | -0.9% |

| Services less Energy | 0.2% | 0.2% | 3.7% | 3.4% | 2.8% | 2.8% |

| Energy | 4.6% | -0.2% | 3.1% | 11.1% | 16.9% | 10.8% |

| Food & Beverages | 0.0% | -0.1% | 2.2% | 2.3% | 2.4% | 3.4% |

| Chained CPI: Total (NSA) | 0.1% | -0.2% | 2.4% | 2.9% | 2.9% | 2.5% |

| Total less Food & Energy | -0.2% | -0.2% | 2.3% | 2.3% | 1.9% | 1.7% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.