Global| Oct 24 2007

Global| Oct 24 2007Existing Home Sales Drop 8% in September; All Regions Feel the Pain

Summary

Oh, my. A month ago here, Robert Brusca made a fairly calm assessment of home sales in most of the country. "...holding their year-to-year declines to less than 10%" for instance. Only the drop in the West was nettlesome to him. This [...]

Oh, my.

A month ago here, Robert Brusca made a fairly calm assessment of home sales in most of the country. "...holding their year-to-year declines to less than 10%" for instance. Only the drop in the West was nettlesome to him.

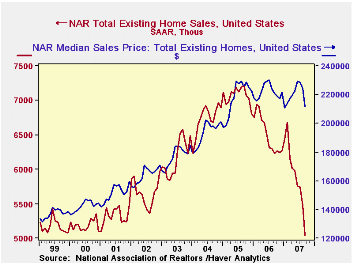

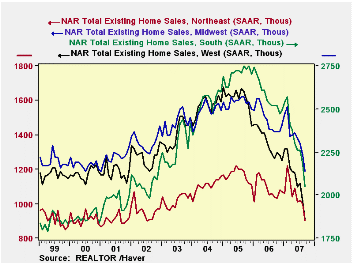

This month is different. Total existing home sales across the country fell 8.0% from August amounts. All regions had sharp declines, the smallest in the South, 6.0%. And the Northeast, which had held up pretty well, dropped the most, by 10.0%. All the regions now have quite substantial year-on-year declines, ranging from 16.9% in the Northeast to 31.4% in the West.

The National Association of Realtors counts these sales at time of closing. So the September transactions would have gone to contract in June mostly, with some from May or July and a few in other months. That is, the bulk of these sales reflect market conditions earlier in the summer, before the worst of July and August's financial market distresses. So possibly the reaction to that is yet to appear in these data. Alternatively, as some analysts suggest this morning, the reduced number of closed sales may also reflect an increase in the rate at which previously contracted sales fell through as market conditions worsened. The latter condition would actually be preferable going forward, since it would mean that some of the dislocations have already been absorbed. One can hope.

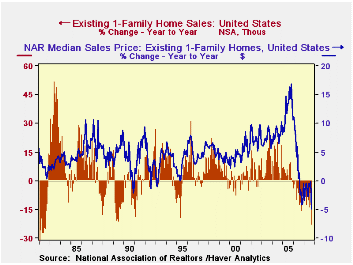

Meantime, of course, we can make numerous historically unattractive comparisons. Using single-family-home data, which has a far longer history than total existing home sales, we see that the current sales volume is the lowest since January of 1998; the not-seasonally- adjusted figures show the lowest September value, 356,000, since 1997 at 351,000. Sales have been down on a year-to-year basis for 19 months, the most protracted contraction in these data since the double-digit interest rate period in 1980-81. Home prices are presently down on a year-to-year basis for 14 consecutive months, a completely unprecedented situation in the nearly 40-year history of the series; the longest previous period of yearly price decline was two months at the end of 1990. Prices were sluggish during 1992 and late in 1994, but still dipped below year-earlier levels on only isolated occasions.

| Sept 2007 | Aug 2007 | Year Ago | 2006 | 2005 | 2004 | |||

|---|---|---|---|---|---|---|---|---|

| Number | M/M% | Y/Y% | ||||||

| Total Sales | 5,040 | -8.0 | -22.7 | 5,480 | 6,230 | 6,478 | 7,076 | 6,778 |

| Northeast | 900 | -10.0 | -16.9 | 1,000 | 1,040 | 1,086 | 1,169 | 1,113 |

| Midwest | 1,190 | -7.0 | -20.2 | 1,280 | 1,420 | 1,483 | 1,588 | 1,550 |

| South | 2,050 | -6.0 | -22.4 | 2,180 | 2,520 | 2,563 | 2,702 | 2,540 |

| West | 910 | -9.9 | -31.4 | 1,010 | 1,260 | 1,346 | 1,617 | 1,575 |

| Single-Family | 4,380 | -8.6 | -22.9 | 4,790 | 5,460 | 5,677 | 6,180 | 5,958 |

| Median Price, Total, $ | 211,700 | n.m. | -4.9 | 224,400 | 220,900 | 222,000 | 218,217 | 193,233 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates