Global| Aug 10 2007

Global| Aug 10 2007Fed Funds Futures Price in Easing, Dealer Trading Volume Favors Treasuries: More on Haver's Short-Term Financial Data

Summary

It's just past noon in New York as we're writing today and news services tell us stock markets have just turned positive on the day's trading. Current conditions in financial markets and among financial institutions suggest that we [...]

It's just past noon in New York as we're writing today and news services tell us stock markets have just turned positive on the day's trading. Current conditions in financial markets and among financial institutions suggest that we might benefit from a look at more of Haver's short-term financial data offerings besides the yield spreads we examined here about a week ago.

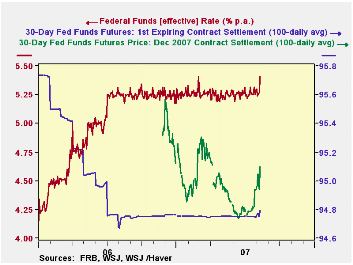

Yesterday - Thursday - the federal funds rate spiked well above the Federal Reserve's target, with an effective rate for the day of 5.41%. Generally, as seen in the table and the first graph, this rate runs just a few basis points either side of the target. So even the seemingly modest 16 basis points was a major move and indicative of tightening conditions in money markets. At the same time, this very market stress was reflected in rising prices of federal funds rate futures. These higher prices correspond to lower rates, signaling that market participants are starting to price in an easing by the Fed, through a reduction in their target funds rate. Again, we see in the graph that the nearby contract has hardly budged since July 2006, when markets were still anticipating more tightening. So the little blip we see over the very last few days is the most movement there's been in a year and it shows markets are starting to look seriously for the Fed to ease. The performance of the December contract, pushing up through 95 yesterday, indicates that traders expect the rate to be moved to 5% by December and with a non-trivial chance for 4.75%. These series, along with other Fed funds futures contracts, are in the "Interest Rates" menus of Haver's DAILY database.

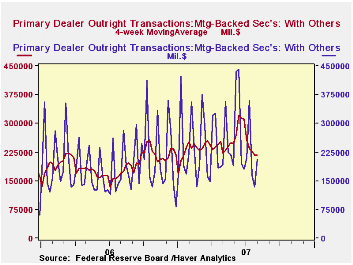

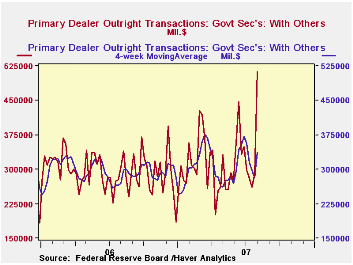

In the WEEKLY database, we can find some information about altered trading patterns and credit aggregates. The Federal Reserve collects data on transactions volume from the group of security dealers it trades with, known as "primary dealers". This dataset includes US Government securities, federal agency debt, the so-called "agency" mortgage-backeds (those issued by the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation), and corporate securities. We show here the dealers' trading volume in MBS and Governments. That in MBS has declined noticeably in the last three weeks. These figures are highly variable, but even using a four-week moving average, we see that the recent experience has the lowest turnover since January, which is typically a slow month. In contrast, trading in Governments has increased; the latest week, ended August 1, averaged $513.1 billion a day with customers ("Others" in this dataset, in contrast to inter-dealer brokers). This is a record by far, but with variability here, the four-week average does not yet exhibit such an extreme. It seems unlikely, though, that trading in Treasuries would have been much reduced in the subsequent periods. We'll watch that data closely next week to be sure.

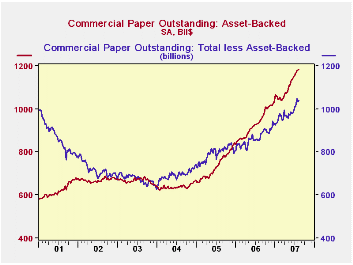

Finally, some packaged bonds and loans are financed in the short-term money markets through the vehicle of asset-backed commercial paper. Traditionally, commercial paper was unsecured debt issued by businesses to finance inventories or other aspects of daily operations. In the last several years, though, asset-backed paper has grown rapidly and is now larger than the more customary type of paper. The risks, even if only perceived risks, in asset-backed credit now involve this segment of the money markets, as well as the bond markets.

| DAILY | Aug 9 | Aug 8 | Aug 7 | Week Ago | Month Ago | 3 Mos. Ago |

|---|---|---|---|---|---|---|

| Fed Funds Rate | 5.41 | 5.27 | 5.26 | 5.24 | 5.22 | 5.21 |

| Fed FundsFutures Price: Sept | 94.875 | 94.775 | 94.755 | 94.785 | 94.760 | 94.795 |

| Dec | 95.100 | 94.940 | 94.965 | 94.965 | 94.765 | 94.920 |

| WEEKLY | Aug 8 | Aug 1 | July 25 | 4-Week Averages ending | ||

| June 27 | May 30 | Jan 3 | ||||

| Primary Dealer Transactions in Gov't Securities | --* | 513.1 | 290.1 | 371.4 | 270.3 | 246.0 |

| Primary Dealer Transactions in MBS | --* | 205.1 | 135.7 | 312.3 | 248.1 | 167.3 |

| Commercial Paper Outstanding | 2223.5 | 2212.7 | 2224.6 | 2127.4 | 2092.4 | 1970.5 |

| Asset-Backed | 1182.9 | 1180.8 | 1177.7 | 1143.5 | 1113.8 | 1038.6 |

by Robert Brusca August 10, 2007

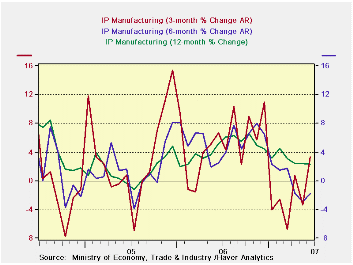

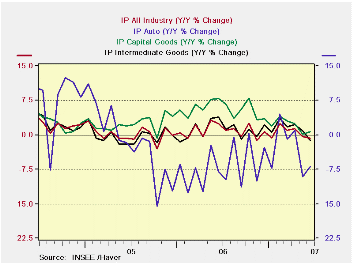

Industrial production in Japan has clearly been slowing down. But the three-month pace is showing more lift. Still, this is the volatile measure and its greater lift does not mean that will remain force. For the time being Japan appears to be doing better, but its momentum remains uncertain. By sector, manufacturing is strong over three months but still lower over 6 months and one year and its gain is based on the first monthly rise in four months. Investment and mining categories have a bit more of an uptrend in place; mining is up over 3-month, 6-month and one-year period. This sector does not look solid enough to justify a rate hike anytime soon.

| m/m % | Saar % | Yr/Yr | |||||

| Jun-07 | May-07 | Apr-07 | 3-mo | 6-mo | 12-mo | Yr-Ago | |

| Mining & Manufacturing | 1.3% | -0.3% | -0.2% | 3.4% | -2.0% | 2.3% | 5.3% |

| Total Industry | 1.2% | -0.6% | 0.3% | 3.4% | -2.7% | 2.3% | 4.9% |

| Manufacturing | 1.3% | -0.3% | -0.2% | 3.4% | -1.8% | 2.3% | 5.3% |

| Food & Tobacco | -1.5% | 0.7% | -0.6% | -5.4% | -0.9% | -0.7% | -0.3% |

| Textiles | 1.1% | 0.2% | 0.0% | 5.3% | -1.6% | -3.7% | -2.9% |

| Transportation | 0.7% | 4.2% | -2.4% | 9.5% | -5.4% | 5.8% | 6.4% |

| Product | |||||||

| Consumer Goods | 3.5% | -3.4% | 0.6% | 2.4% | -2.5% | 0.8% | 4.2% |

| Intermediate Goods | 1.3% | -0.5% | -0.3% | 1.7% | -0.7% | 4.4% | 5.7% |

| Investment Goods | 0.1% | 2.0% | 0.6% | 11.4% | 0.0% | -1.2% | 5.7% |

| Mining | 4.1% | 0.6% | 0.4% | 21.9% | 18.5% | 9.1% | 5.5% |

| Electricity & Gas | 0.3% | -2.6% | 2.0% | -1.4% | -1.7% | 2.9% | 1.4% |

by Robert Brusca August 10, 2007

For the second quarter as whole, industrial production is off in France at a 1% pace. This drop is led by weakness in auto output that has fallen at a 9.2% annual rate in the quarter. But the output of consumer goods and intermediate goods has gone flat in the quarter. Capital goods output is still expanding at a slightly slower 1.3% annual rate in Q2 over Q1. IP had risen by 3.8% (saar) in Q1 with auto output up by 10.7 (saar) in the quarter.

For June itself the intermediate goods sector is the most surprising with output falling by 1.4% adding to the weakness in often volatile autos where output is off by an even sharper 2.3%. For autos it is the second monthly drop in a row. For intermediate goods the drop comes after a gain of 0.7% in May.

| Saar except m/m | Jun-07 | May-07 | Apr-07 | 3-mo | 6-mo | 12-mo |

| IP total | -0.5% | 0.5% | -1.0% | -3.8% | -0.2% | -0.8% |

| Consumer goods | 0.2% | 1.0% | -1.1% | 0.0% | 2.7% | 1.0% |

| Capital goods | 0.9% | 0.1% | -0.7% | 1.1% | 3.3% | 0.7% |

| Intermediate goods | -1.4% | 0.7% | -0.5% | -4.8% | -2.4% | -1.3% |

| Memo | ||||||

| Auto | -2.3% | -2.7% | 0.7% | -16.2% | -4.4% | -6.9% |

by Tom Moeller August 10, 2007

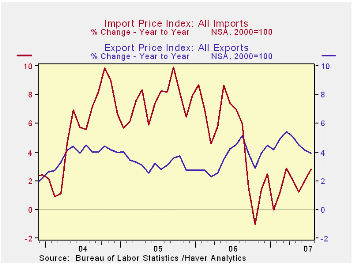

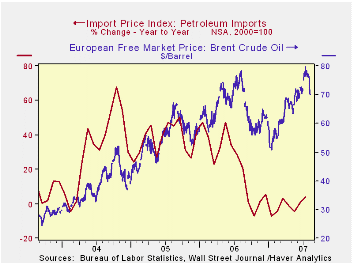

A jump in petroleum prices, last month by 7.0%, again was the strength behind a 1.5% surge in overall July import prices. The surge was the largest since March and was ahead of Consensus expectations for a 1.1% increase.

An 8.2% (4.2% y/y) rise in crude oil prices was behind the strength in petroleum prices, overall. Higher fuel oil prices also contributed with an 11.5% (9.3% y/y) spike. Early in August, a decline yesterday in the price of Brent crude oil to $69.97 from an average $76.97 during July promises a reversal of perhaps all the strength during that month.

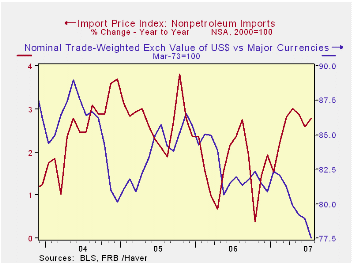

During the last ten years there has been a 66% (negative) correlation between the nominal trade-weighted exchange value of the US dollar vs. major currencies and the y/y change in non oil import prices. The correlation is a reduced 47% against a broader basket of currencies. Why a Dollar Depreciation May Not Close the U.S. Trade Deficit from the Federal Reserve Bank of New York is available here

Prices for industrial supplies & materials excluding petroleum fell 0.1% (+8.3% y/y). Paper & paper base stock prices fell 0.3% (-1.3% y/y) and metal prices fell 0.3% (+16.4% y/y). Building material prices rose 2.7% (-0.6 y/y). These detailed import price series can be found in the Haver USINT database.

Capital goods prices rose 0.2% (0.1% y/y) for the second month, led down again by a 0.2% (-5.9% y/y) drop in computers, peripheral and semiconductors. Less the high tech sector, capital goods prices rose a strong 0.4% (2.6% y/y) for the second month.

Prices for imported non-manufactured consumer goods were firm with a 0.5% ( 3.2% y/y) rise. Prices for most other nonauto consumer goods were little changed, except apparel prices which rose 0.3% (1.2% y/y).

Overall export prices rose 0.2% and the 3.9% y/y gain was the weakest since November of last year. Agricultural prices rose 1.5% (17.8% y/y) but nonagricultural export prices were unchanged (+2.8% y/y).

Today's statement by the Federal Reserve on Providing Liquidity to Financial Markets can be found here.

| Import/Export Prices (NSA) | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Import - All Commodities | 1.5% | 0.9% | 2.8% | 4.8% | 7.5% | 5.6% |

| Petroleum | 7.0% | 4.4% | 4.1% | 20.6% | 37.6% | 30.5% |

| Non-petroleum | 0.2% | 0.1% | 2.8% | 1.7% | 2.7% | 2.6% |

| Export- All Commodities | 0.2% | 0.3% | 3.9% | 3.6% | 3.2% | 3.9% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.