Global| Jul 31 2019

Global| Jul 31 2019FOMC Lowers Fed Funds Rate Citing Global Concerns

by:Tom Moeller

|in:Economy in Brief

Summary

The Federal Reserve lowered the target for the Fed Funds rate by 25 basis points to a range of 2.00% to 2.25%. The cut followed nine increases from a low just above zero at the end of 2015. The action was expected in the Action [...]

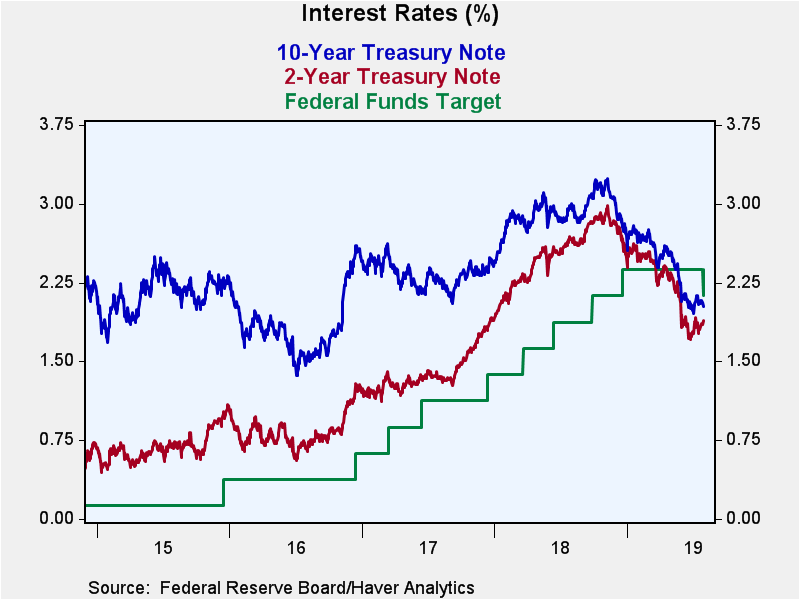

The Federal Reserve lowered the target for the Fed Funds rate by 25 basis points to a range of 2.00% to 2.25%. The cut followed nine increases from a low just above zero at the end of 2015. The action was expected in the Action Economics Forecast Survey, which foresees another cut to 1.875% in October. The Fed today stated that it will "act as appropriate to sustain the expansion."

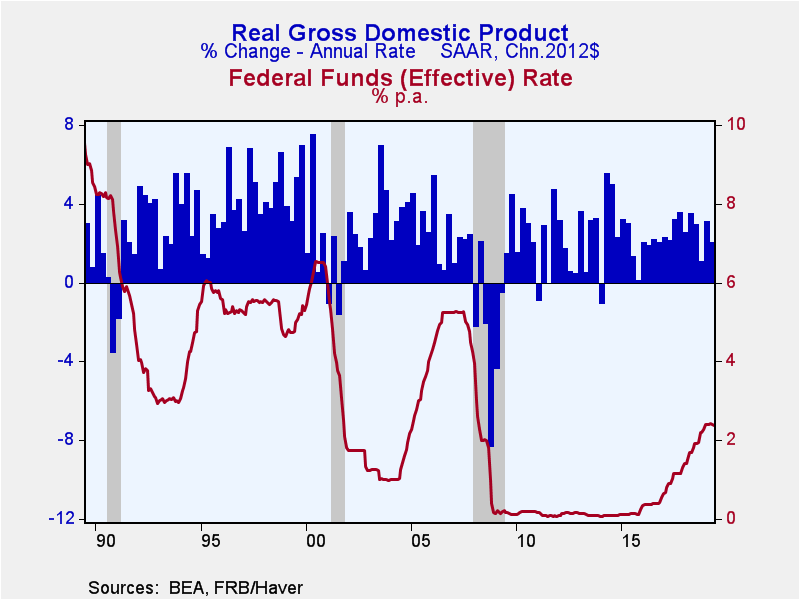

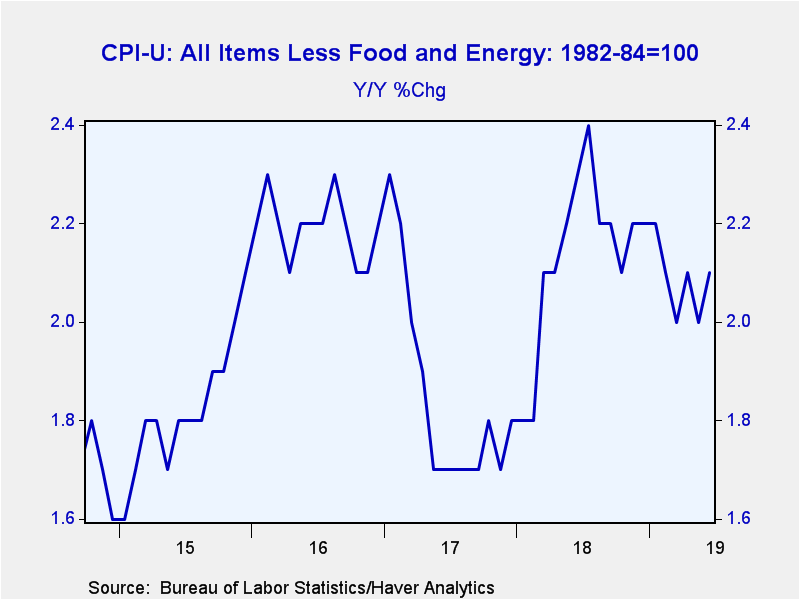

In the Fed's press release, the rationale for today's action was taken "in light of the implications of global developments for the economic outlook as well as muted inflation pressures." In the U.S., economic growth slowed last quarter to 2.1% from 2.9% during all of last year. Consumer price inflation also moderated to 1.7% y/y from 2.9% as of last July.

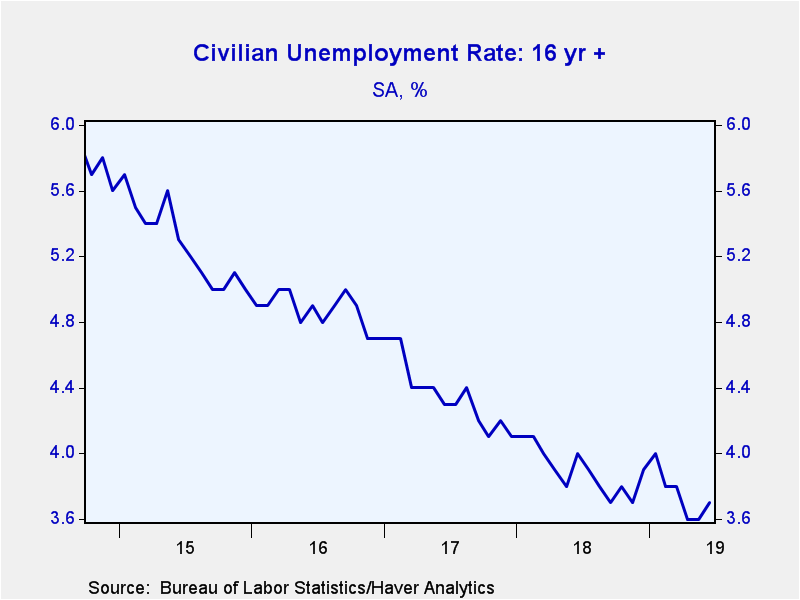

Despite these misgivings, the Fed continued to characterize economic growth as "moderate" and the labor market as "strong."

Precedence for this type of "mid-course" correction to policy trends occurred in 1995 and 1998, followed subsequently by higher rates which led to recession in 2001.

Most members of the FOMC voted for the rate cut with the exception of two members who voted to hold rates steady.

The press release for today's FOMC meeting can be found here.

| Current | Last | 2018 | 2017 | 2016 | 2015 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate Target | 2.00% - 2.25% | 2.25% - 2.50% | 1.82% | 1.00% | 0.40% | 0.13 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates