Global| Oct 30 2013

Global| Oct 30 2013FOMC Reaffirms the Need to Maintain An Easy-Money Posture

by:Tom Moeller

|in:Economy in Brief

Summary

At today's meeting of the Federal Open Market Committee, the Fed elected to continue purchasing $85 billion per month of agency mortgage-backed and Treasury securities. It "reaffirmed its view that a highly accommodative stance of [...]

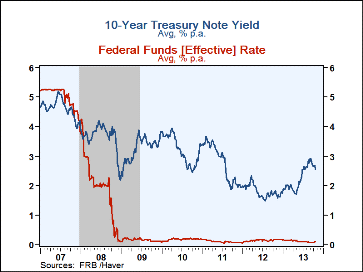

At today's meeting of the Federal Open Market

Committee, the Fed elected to continue purchasing $85 billion per month of

agency mortgage-backed and Treasury securities. It "reaffirmed its

view that a highly accommodative stance of monetary policy will remain

appropriate for a considerable time after the asset purchase program ends

and the economic recovery strengthens." The Federal funds rate was left

unchanged in a range of 0.00% - 0.25% and the discount rate remained at

0.75%.

At today's meeting of the Federal Open Market

Committee, the Fed elected to continue purchasing $85 billion per month of

agency mortgage-backed and Treasury securities. It "reaffirmed its

view that a highly accommodative stance of monetary policy will remain

appropriate for a considerable time after the asset purchase program ends

and the economic recovery strengthens." The Federal funds rate was left

unchanged in a range of 0.00% - 0.25% and the discount rate remained at

0.75%.

The Fed painted a picture of modest economic improvement. "Economic activity has continued to expand at a moderate pace. Indicators of labor market conditions have shown some further improvement, but the unemployment rate remains elevated. Available data suggest that household spending and business fixed investment advanced, while the recovery in the housing sector slowed somewhat in recent months. Fiscal policy is restraining economic growth."

To the upside, "Taking into account the extent of federal fiscal retrenchment over the past year, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program as consistent with growing underlying strength in the broader economy."

Regarding inflation, "Apart from fluctuations due to changes in energy prices, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable."

Reiterated was that "a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens."

The press release for today's FOMC meeting can be found here.

Haver's SURVEYS database contains the projections from the Federal Reserve Board.

| Current | Last | 2012 | 2011 | 2010 | 2009 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate, % (Target) | 0.00-0.25 | 0.00-0.25 | 0.14 | 0.10 | 0.17 | 0.16 |

| Discount Rate, % | 0.75 | 0.75 | 0.75 | 0.75 | 0.72 | 0.50 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates