Global| Aug 03 2007

Global| Aug 03 2007Gasoline Prices Ease Further; Refining Margins Reduced

Summary

Higher crude oil prices were a contributing factor in the recent stock price gyrations, as West Texas Intermediate (WTI) looked to be approaching $80/barrel. The high spot price came Tuesday, July 31, at $78.22; by yesterday, it had [...]

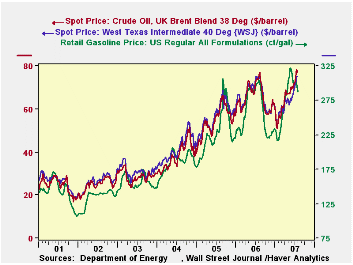

Higher crude oil prices were a contributing factor in the recent stock price gyrations, as West Texas Intermediate (WTI) looked to be approaching $80/barrel. The high spot price came Tuesday, July 31, at $78.22; by yesterday, it had eased to $76.87. For UK Brent, yesterday's close was $76.29 after several days over the last couple of weeks that were above $78.00, with a high of $79.09 on July 20.

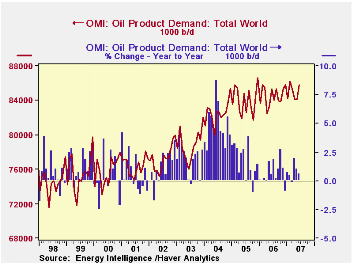

The most recent demand data show world petroleum use of 86.1 million barrels/day (mb/d) in June, up 2.1% from May and the fourth largest monthly amount ever. This estimate is from Oil Market Intelligence and is included in the OMI database that Haver markets in partnership with OMI's parent, Energy Intelligence. Generally, as seen in the second graph here, while the latest month's demand is up, the last 18 months or so have kept to a range around a fairly flat trend; growth over the year-ago period was a modest 0.6% in June.

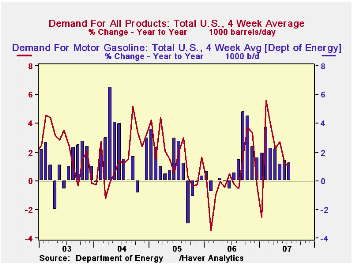

In the US, demand has been steady in recent weeks just over 20.9 mb/d, down from the spring's highs of about 21.3 mb/d. For July, this was about 1.0% above year-earlier amounts. As we have mentioned before here, US product demand, especially for gasoline, did not ease last winter as is usually the case. Thus, in the last three months, while US use of gasoline has remained higher than a year ago, that growth has slowed markedly from what it was in the mild wintertime. Even so, inventories have stayed tight, and the days' supply measure remains at just 21.4, noticeably below anytime prior to last winter (except during severe hurricanes).

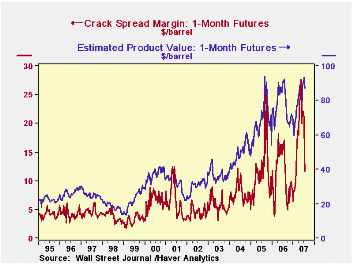

Despite higher crude prices and the tight supply of gasoline, the latest retail gasoline prices have been down a bit. In the July 30 week, the national average for regular was $2.876/gallon, off 8.2 cents from the prior week and below the year-ago $3.004. This combination impacts petroleum refiners. With gasoline prices a bit lower when crude is higher, there is considerable pressure on the refining margin, or the "crack spread". In the July 27 week, it was $11.71/barrel, down from $20.50 just two weeks earlier and and an average of $22.85 across April, May and June. While this latest is much lower than just a few weeks ago, it is not "low" historically. Prior to 2004, this weekly figure had been above $10 only about half-a-dozen times. At the same time, on a percentage basis, the current number is more representative: it is 13.5% of the "estimated product value", a ratio well within the range of the last five or six years and indeed below the customary amount in prior times.

Sometimes, when oil prices rise, the stock market can respond favorably, as oil companies may see higher profits. But the current restraint on gasoline prices and the squeeze on refining margins suggests that this may not necessarily be the present outcome.

The weekly oil-market data are contained in Haver's OILWKLY database, maintained in conjunction with the Oil and Gas Journal. Daily prices are in the DAILY database.

| Select Oil Market Indicators | Aug 2 (Day) | July 27, 2007 | July 20, 2007 | July 28, 2006 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Gasoline, US Regular Grade (cents/gal) | -- | 287.6 | 295.8 | 300.4 | 257.2 | 227.0 | 185.2 |

| Crude: WTI ($/barrel) | 76.87 | 75.24 | 74.95 | 73.97 | 66.13 | 56.50 | 41.33 |

| Crude: UK Brent ($/barrel) | 76.29 | 77.22 | 78.35 | 73.39 | 65.19 | 54.58 | 38.10 |

| Gasoline Stocks: Days' Supply | -- | 21.4 | 21.4 | 22.2 | 22.7 | 22.8 | 23.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates