Global| Jul 13 2007

Global| Jul 13 2007Gasoline Prices Stay Below Peaks; Will July & August Reverse This Improvement?

Summary

Gasoline prices turned up slightly in the latest week, ending July 9, but they remain below their May peaks. The latest reading from the Department of Energy (DOE) was $2.981/gallon, up 2.2 cents on the week. At least one reason for [...]

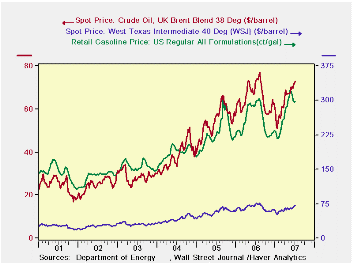

Gasoline prices turned up slightly in the latest week, ending July 9, but they remain below their May peaks. The latest reading from the Department of Energy (DOE) was $2.981/gallon, up 2.2 cents on the week. At least one reason for the week-to-week increase is the July 4 holiday and the beginning in earnest of the vacation driving season. The same week in 2006 saw $2.973/gallon, so the current level is less than a penny higher. Crude oil prices have also increased from week to week, and they are above their June levels. However, these are below year-ago prices.

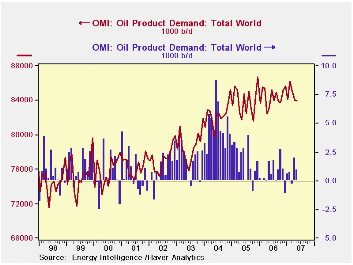

These steadier price trends suggest that pressures in the world oil market are diminishing. Indeed, conditions are easing, but relatively so. World product demand appears to have flattened out, with the latest estimate at about 84 million barrel/day through May, according to Oil Market Intelligence. [In Haver's OMI database; June figures are due out shortly.] This peaked in February at 86.2 mil. b/d. In the last several years, February has been each year's peak month, with June and August nearly as high. Year-on-year percentage increases are running somewhat slower than they did back in the autumn. So there are hints here that total demand has at least stopped accelerating, but potential increases due to seasonal needs over the summer keep us from a firm conclusion that it has stopped growing altogether.

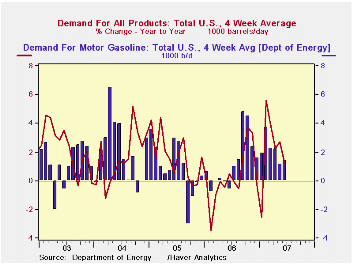

In the US, total product demand was 20.8 mil b/d in the latest DOE 4-week reading, almost exactly flat with a year ago. Aggregated to monthly averages, these data show an abrupt slowing of demand growth in June after 4 months that ran 2% to as much as 5.6% ahead of a year ago. Gasoline usage, similarly, is still increasing year-to-year, but noticeably less in the last 2 months than earlier this year. [These US product demand data are in OILWKLY; we have used the "Aggregation" feature of DLXVG3 to facilitate the monthly comparisons here.]

|

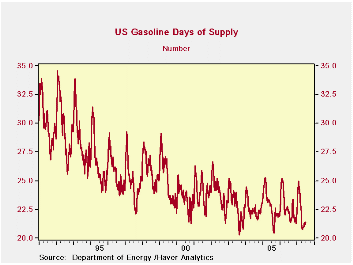

| · The tightness in these markets can be gauged by the adequacy of inventories. Here again, year-ago comparisons are still unfavorable, but they have been less bad lately than in prior months. The size of US gasoline stocks is down 3.3% in the July 9 week from the 2006 week, but in mid-May, they had been down 5.7% from the year-ago amount. With the less weak inventories and the less strong demand growth, the sector's version of an "inventory/sales ratio", the "days' supply" has stopped eroding. Gasoline stocks stood at 21.4 days' worth of gasoline demand last week, the same as the week before. The year-ago figure was 22.2 days; so this inventory measure is down from a year ago, but actually better than in late April, when it sank as low as 20.8 days. That was the lowest days' supply reading in the 16-1/2 years of this series, apart from those impacted by hurricanes in 2003 and 2005. Again, July and August are the most sensitive seasonal periods, so the performance of this measure too in the immediately coming weeks will tell more definitively about the vulnerability of oil and gasoline markets to higher prices. |

|---|

| Select Oil Market Indicators | July 9 | July 2 | June | Year- Ago Week | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Gasoline, US Regular Grade (cents/gal) | 298.1 | 295.9 | 305.6 | 297.3 | 257.2 | 227.0 | 185.2 |

| Crude: WTI ($/barrel) | 71.79 | 69.19 | 66.87 | 75.30 | 66.13 | 56.50 | 41.33 |

| Crude: UK Brent ($/barrel) | 72.75 | 71.69 | 70.58 | 73.80 | 65.19 | 54.58 | 38.10 |

| Gasoline Stocks: Days' Supply | 21.4 | 21.4 | 21.4 | 22.2 | 22.7 | 22.8 | 23.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.