Global| Mar 16 2010

Global| Mar 16 2010German Investors More Cautious: Concerns Over Greece?

Summary

The ZEW March survey of German institutional investors and analysts shows that they are a little more cautious regarding macroeconomic expectations. The excess of optimists over pessimist declined by 0.6 percentage points from 45.1% [...]

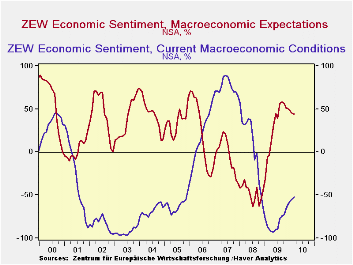

The ZEW March survey of German institutional investors and analysts shows that they are a little more cautious regarding macroeconomic expectations. The excess of optimists over pessimist declined by 0.6 percentage points from 45.1% in February to 44.5% in March. This is the sixth monthly decline from the high point of 57.7% reached last September. The participants are slightly less pessimistic about current conditions than they were in February. The excess of pessimists declined 2.9 percentage points from 54.8% to 51.9% in March. The attached chart shows the appraisals of the German financial community of macroeconomic conditions and expectations

The improvement in their appraisal of current conditions and their improved expectations for profits in each of the industries surveyed (as can be seen in the table below) suggest that something else has been bothering the participants in the survey in their causing them to lower their macroeconomic expectations. No doubt the problems in Greece have been of particular concern to the financial types that make up the participants in the ZEW survey and have affected their macroeconomic expectations adversely. The survey was conducted between March 1 and March 15, a period in which there was a great deal of uncertainly about the measures the European Union might take in dealing with its debt-ridden member. It was not until the last day, March 15, that the finance ministers of the Euro Area announced that they had devised a plan for emergency loans to Greece in the event that the tax increases and wage cuts Greece has undertaken fail to prevent fiscal disaster. While there has been some relief that a plan has been worked out, the details of the plan are yet to be revealed. Greece's problems are likely to continue to cast shadows on the macroeconomic expectations of the ZEW participants.

| ZEW SURVEY (% balance) | Mar 10 | Feb 10 | Mar 09 | M/M Chg | Y/Y Chg | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|

| Macroeconomic Expectations | 44.5 | 45.1 | -3.5 | -0.6 | 48.0 | 29.9 | 47.5 | -3.0 |

| Macroeconomic Conditions | -51.9 | -54.8 | -89.4 | 2.9 | 37.5 | -80.5 | 7.3 | 75.9 |

| Profit Expectations | ||||||||

| Banks | 18.8 | 15.8 | -31.6 | 3.0 | 50.4 | 6.2 | -59.5 | -3.5 |

| Insurance | 12.4 | 11.0 | -34.2 | 1..4 | 46.6 | -3.6 | -45.4 | 9.7 |

| Vehicles/automotive | -25.4 | -29.7 | -70.2 | 4.3 | 44.8 | -50.3 | -55.6 | 8.6 |

| Chemicals/Pharmaceutical | 40.6 | 35.8 | -49.6 | 4.8 | 90.2 | -8.1 | -8.6 | 35.3 |

| Steel/metal | 28.3 | 23.8 | -64.1 | 4.5 | 92.4 | -21.4 | -19.4 | 25.5 |

| Electronics | 29.8 | 22.0 | -57.2 | 7.8 | 87.0 | -19.8 | -16.8 | 29.1 |

| Machinery | 36.7 | 29.6 | -69.4 | 7.1 | 106.1 | -26.6 | -14.1 | 54.5 |

| Consumption/trade | -15.6 | -18.9 | -40.2 | 3.3 | 24.6 | -32.9 | -37.9 | 16.1 |

| Construction | 4.8 | 4.2 | -30.5 | 0.6 | 35.3 | -12.5 | -41.5 | 18.5 |

| Utilities | 23.0 | 21.4 | -17.6 | 1.6 | 40.6 | 4.4 | 5.5 | 11.6 |

| Services | 24.0 | 22.1 | -28.6 | 1.9 | 52.6 | -5.0 | -4.8 | 35.9 |

| Telecommunications | 9.3 | 6.4 | -16.1 | 2.9 | 25.4 | -7.7 | -16.9 | -12.3 |

| Information technology | 36.9 | 33.5 | -33.6 | 3.4 | 705 | -3.5 | -2.7 | 32.6 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates