- Job openings down 5.6% (-12.9% y/y) to 6.542 mil., third straight m/m decline.

- Hiring up 3.4% (-1.5% y/y) to 5.293 mil., first m/m increase since September.

- Separations rise to a three-month high; quits reach a six-month high; layoffs rebound.

Introducing

Winnie Tapasanun

in:Our Authors

Winnie Tapasanun has been working for Haver Analytics since 2013. She has 20+ years of working in the financial services industry. As Vice President and Economic Analyst at Globicus International, Inc., a New York-based company specializing in macroeconomics and financial markets, Winnie oversaw the company’s business operations, managed financial and economic data, and wrote daily reports on macroeconomics and financial markets. Prior to working at Globicus, she was Investment Promotion Officer at the New York Office of the Thailand Board of Investment (BOI) where she wrote monthly reports on the U.S. economic outlook, wrote reports on the outlook of key U.S. industries, and assisted investors on doing business and investment in Thailand. Prior to joining the BOI, she was Adjunct Professor teaching International Political Economy/International Relations at the City College of New York. Prior to her teaching experience at the CCNY, Winnie successfully completed internships at the United Nations. Winnie holds an MA Degree from Long Island University, New York. She also did graduate studies at Columbia University in the City of New York and doctoral requirements at the Graduate Center of the City University of New York. Her areas of specialization are international political economy, macroeconomics, financial markets, political economy, international relations, and business development/business strategy. Her regional specialization includes, but not limited to, Southeast Asia and East Asia. Winnie is bilingual in English and Thai with competency in French. She loves to travel (~30 countries) to better understand each country’s unique economy, fascinating culture and people as well as the global economy as a whole.

Publications by Winnie Tapasanun

- USA| Feb 05 2026

U.S. JOLTS: Openings Drop to Lowest Level Since Sept. ’20; Hiring Rebounds in December

- ISM Services PMI 53.8 in Jan. & Dec., above expectations and the 12-month avg. of 51.8.

- Business Activity (57.4, 19th straight month of expansion), New Orders (53.1, eighth consecutive month of expansion), Employment (50.3, second successive month of expansion), and Supplier Deliveries (54.2 vs. 51.8).

- Prices Index (66.6) shows prices rising since June ’17, the fastest pace in three mths.

- ISM Mfg. PMI up to a higher-than-expected 52.6 in Jan.; first expansion since Jan. ’25.

- Production (55.9) expands for the fourth time in five mths.; new orders (57.1) expand for the first time since Aug.; both at their highest since Feb. ’22.

- Employment (48.1) contracts for the 28th straight mth. after expanding in Sept. ’23.

- Prices Index (59.0) shows prices rising for the 16th consecutive mth., the fastest increase in four mths.

- Exports (50.2) expand for the first time since Feb. ’25; imports (50.0) unchanged after nine mths. of contraction.

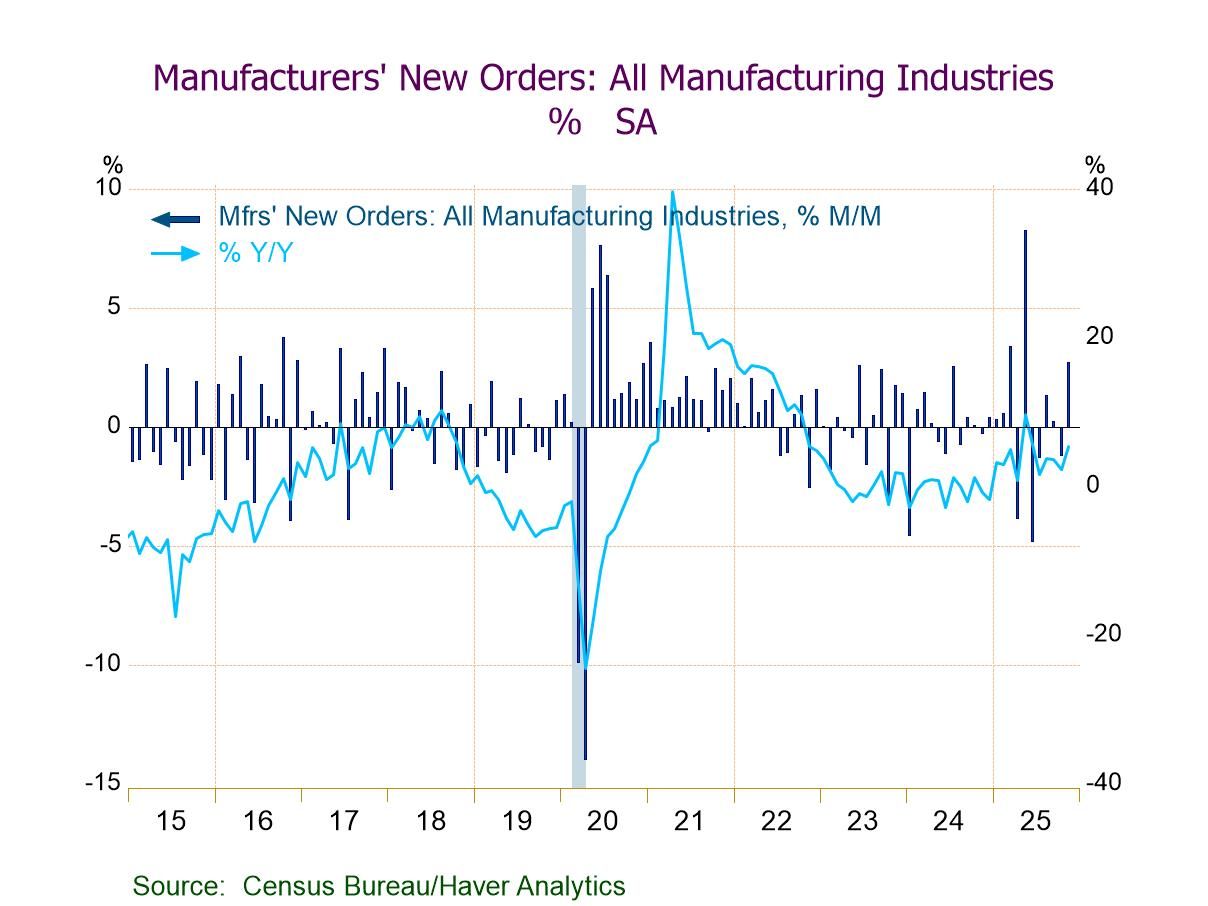

- Factory orders +2.7% m/m in Nov.; +5.4% y/y, largest y/y increase since June.

- Durable goods +5.3% m/m; nondurable goods orders flat; shipments marginally down.

- Transportation orders +14.7% m/m, led by a 97.6% surge in nondefense aircraft orders.

- Unfilled orders +1.4%, biggest of four straight m/m gains.

- Inventories +0.1% after October’s flat reading.

- USA| Jan 27 2026

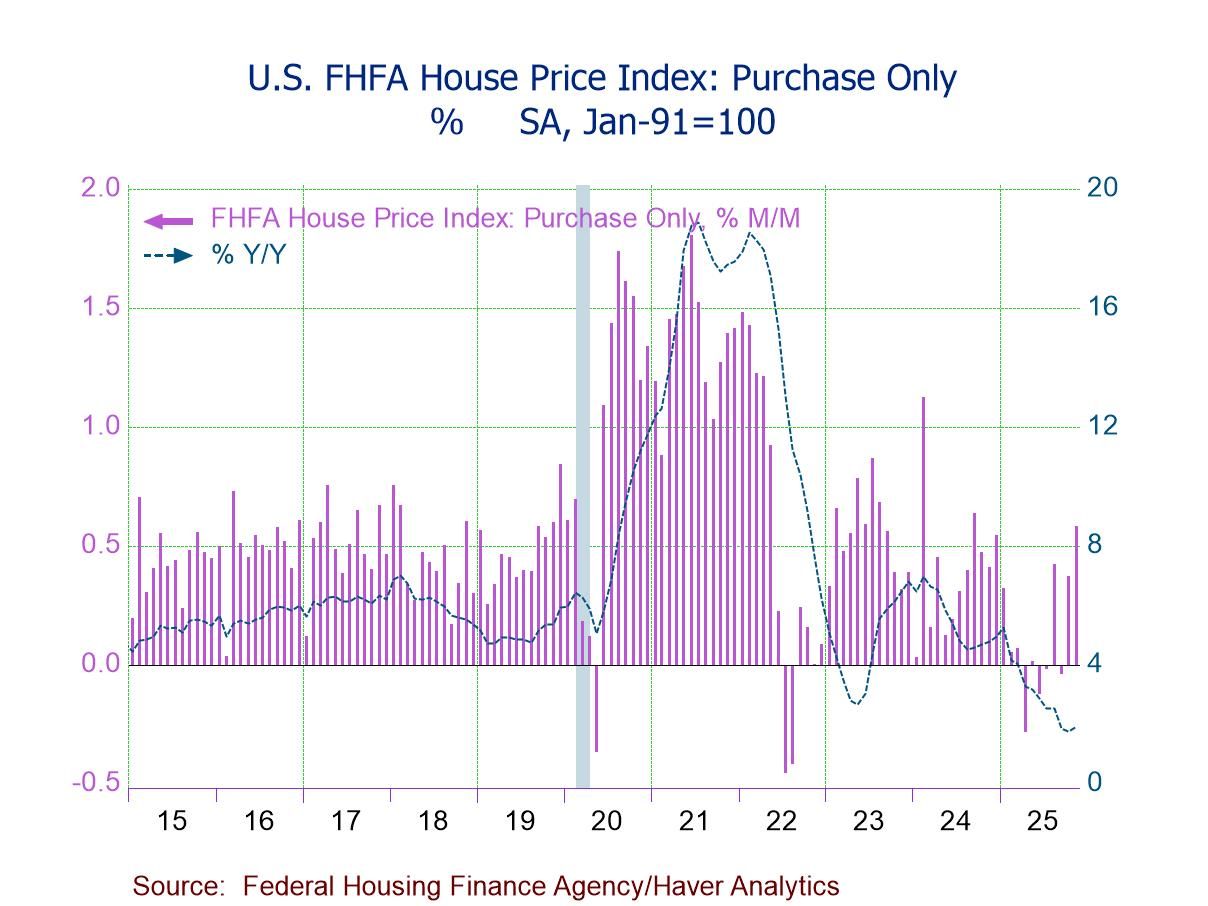

U.S. FHFA House Prices Advance in November

- FHFA HPI +0.6% (+1.9% y/y) in Nov., third m/m gain in four months.

- House prices up m/m in eight of nine census divisions, led by East South Central (+1.1%); prices flat m/m in Middle Atlantic.

- House prices up y/y in six of nine regions, led by East North Central (+5.1%), but down in Pacific (-0.4%) and Mountain (-0.1%); prices flat y/y in South Atlantic.

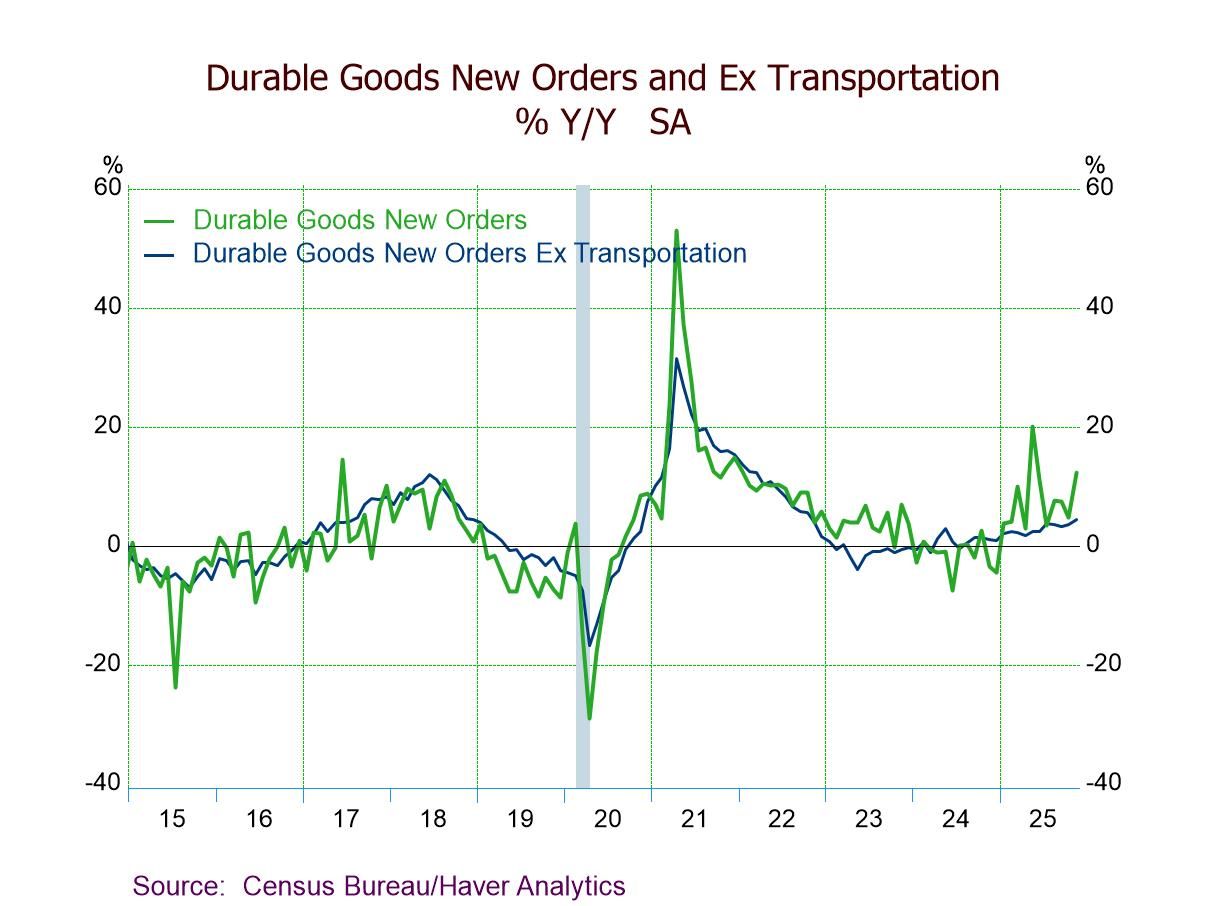

- Headline orders +5.3% (+12.3% y/y) in Nov., third m/m rise in four months.

- Nondefense aircraft orders surge 97.6% m/m vs. a 17.8% Oct. drop.

- Transportation orders rebound 14.7% m/m; orders ex transportation rise 0.5%.

- Core capital goods shipments +0.4%, sixth m/m gain in seven months, adding to Q4’25 momentum.

- Durable goods shipments -0.2%; unfilled orders +1.3%; inventories +0.2%.

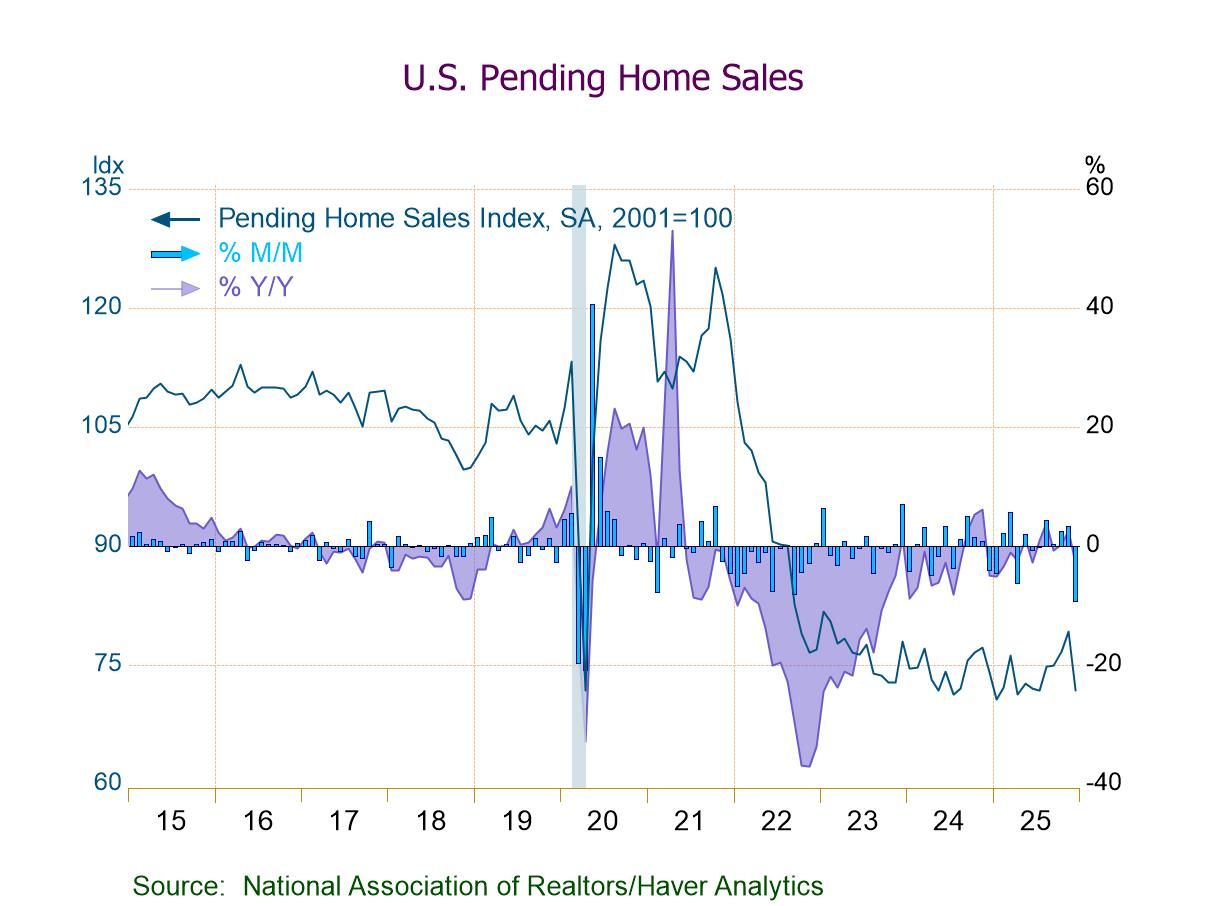

- PHSI -9.3% m/m (-3.0% y/y) to 71.8 in Dec., lowest index level since July.

- Home sales m/m down in all four major regions, w/ the Midwest seeing the steepest drop (-14.9%).

- Home sales y/y down in the Northeast, Midwest, and West, but up in the South (+2.0%).

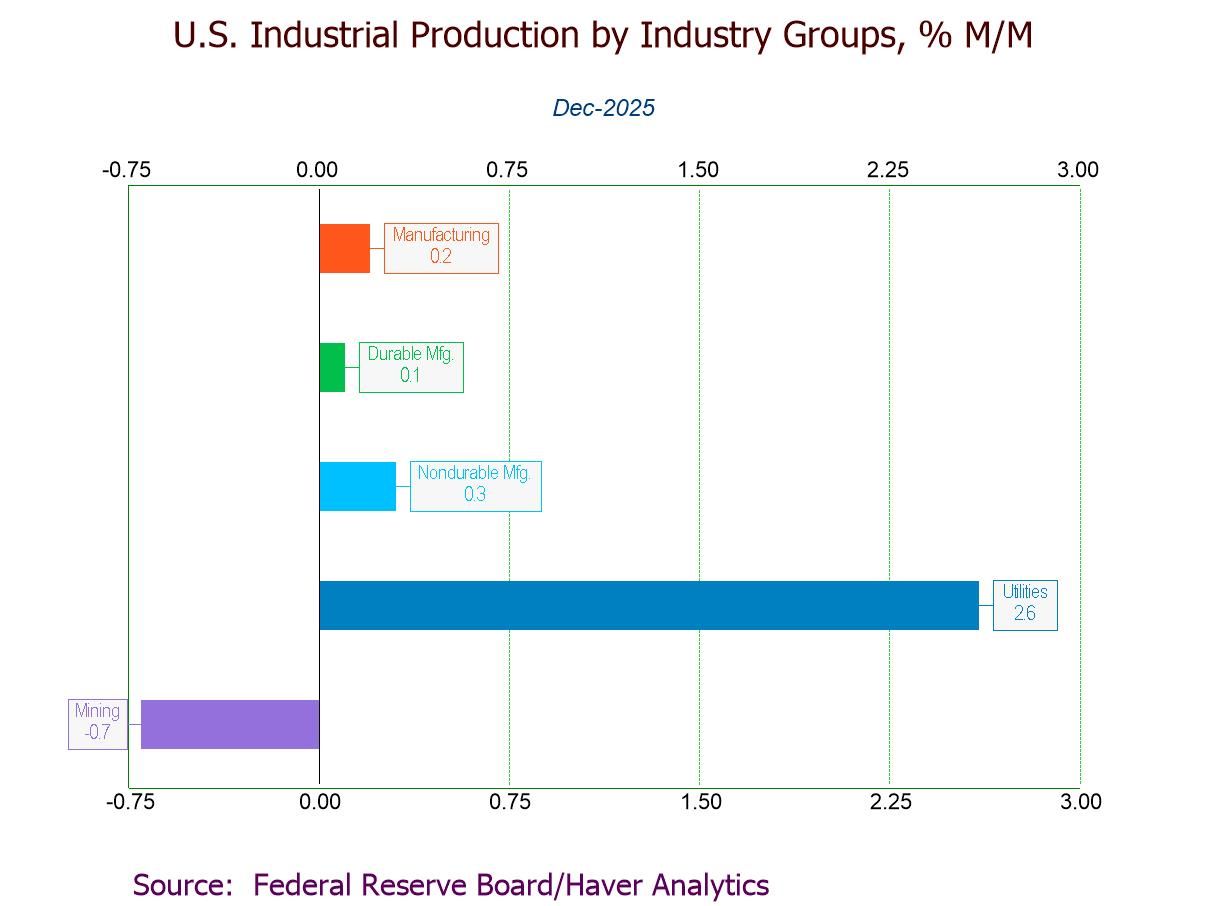

- December IP +0.4% (+2.0% y/y), third m/m rise in four months, led by a 2.6% gain in utilities.

- Manufacturing +0.2% (+2.0% y/y), w/ durables +0.1% and nondurables +0.3%.

- Selected high-tech +0.7%, third consecutive m/m rise; motor vehicles -1.1%, fourth straight m/m fall.

- Mining -0.7%, third m/m decline in four months.

- Key categories in market groups mostly increase.

- Capacity utilization at a five-month-high 76.3%; mfg. capacity utilization steady at 75.6%.

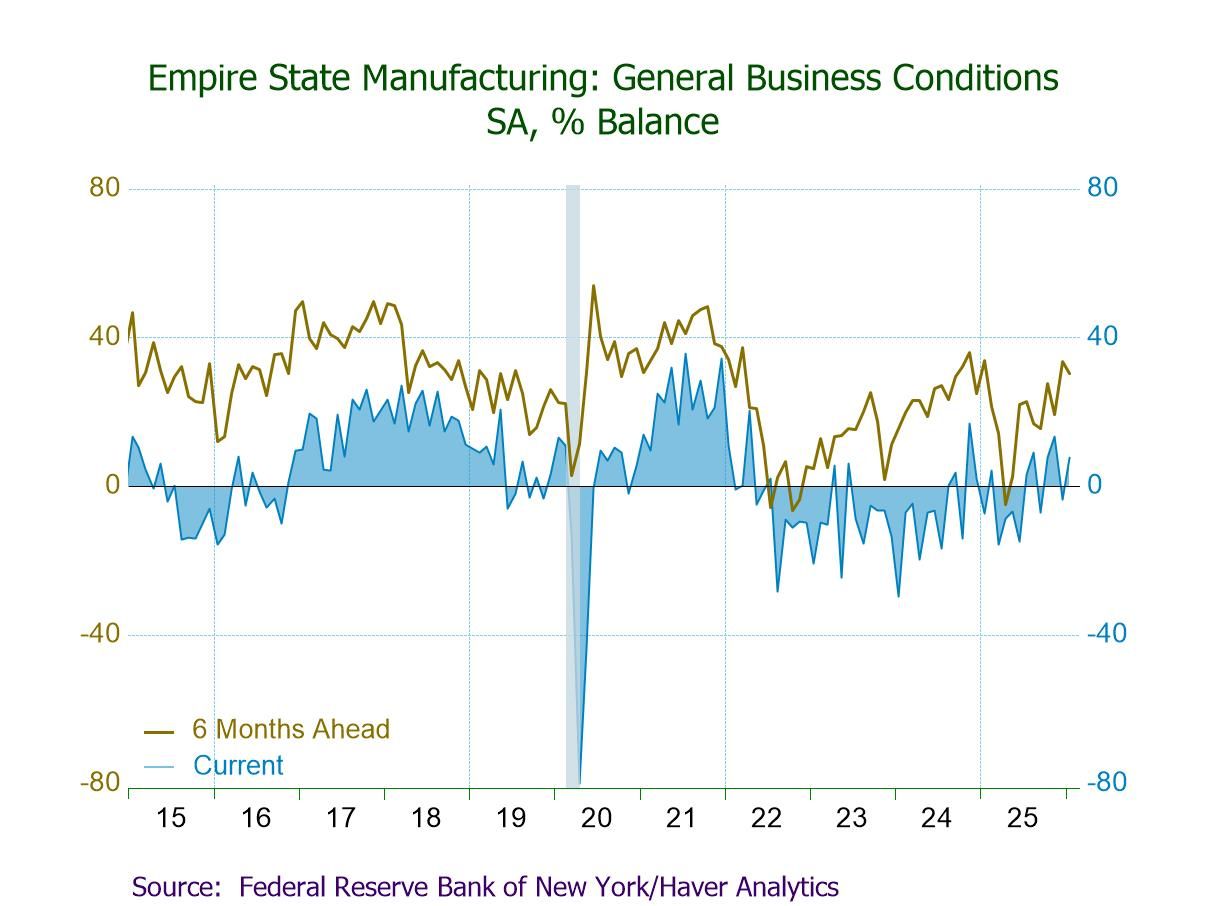

- General Business Conditions Index up 11.4 pts. to 7.7 in January.

- Positive: Shipments (16.3, highest since Nov. ’24) and new orders (6.6).

- Negative: Employment (-9.0, lowest since Jan. ’24), unfilled orders (-8.2), and inventories (-2.1, a four-month low).

- Prices paid at a 10-month-low 42.8 and prices received at a one-year-low 14.4.

- Firms fairly optimistic: Future Business Conditions Index down to a still-positive 30.3; future prices paid at a one-year-low 52.6.

- USA| Jan 14 2026

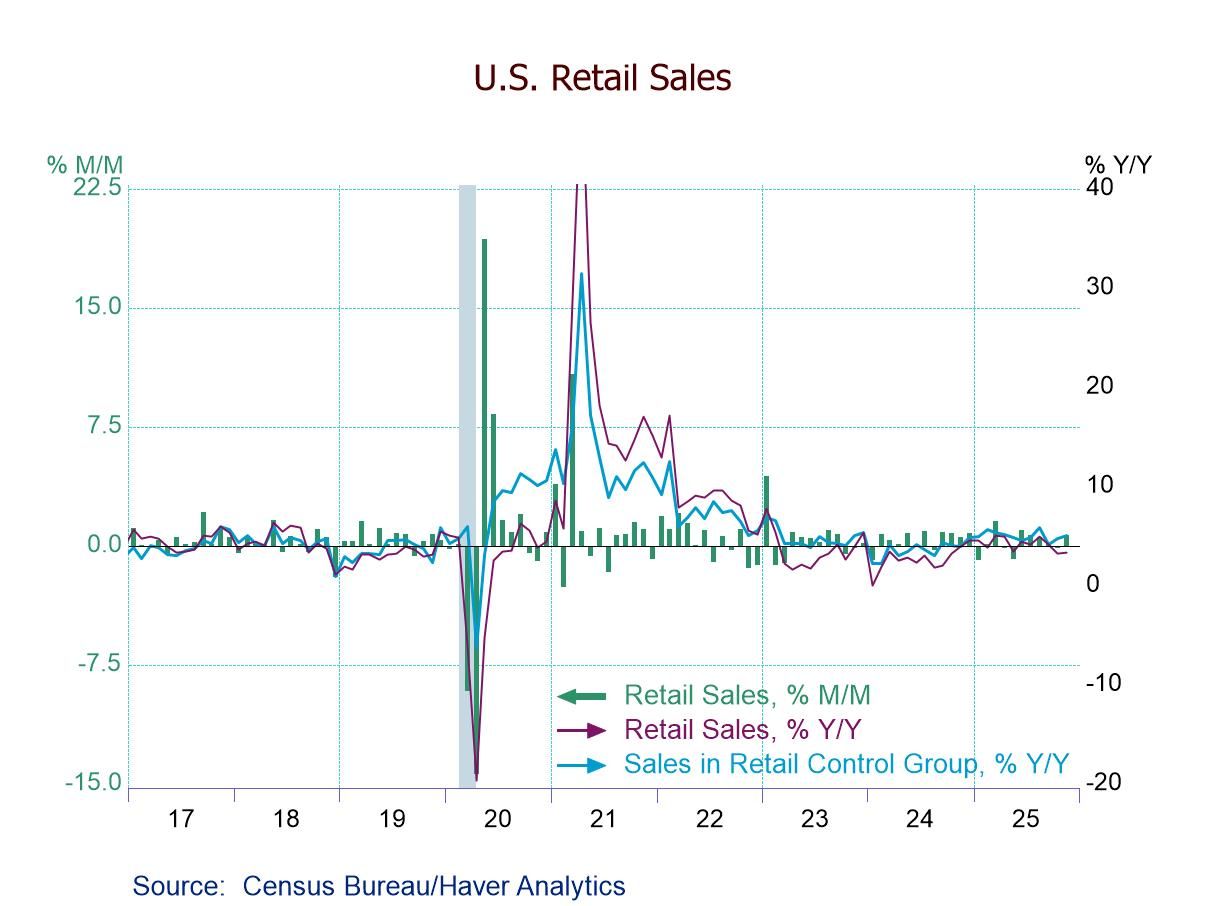

U.S. Retail Sales Rise More Than Expected in November

- November total retail sales +0.6% (+3.3% y/y); fifth m/m gain in six months.

- Ex-auto sales +0.5% (+4.3% y/y); auto sales +1.0% (-0.7% y/y).

- Gains m/m: sporting goods (+1.9%), misc. stores (+1.7%), gasoline stations (+1.4%), and bldg. materials (+1.3%).

- Declines m/m: department stores (-2.9%) and furniture stores (-0.1%).

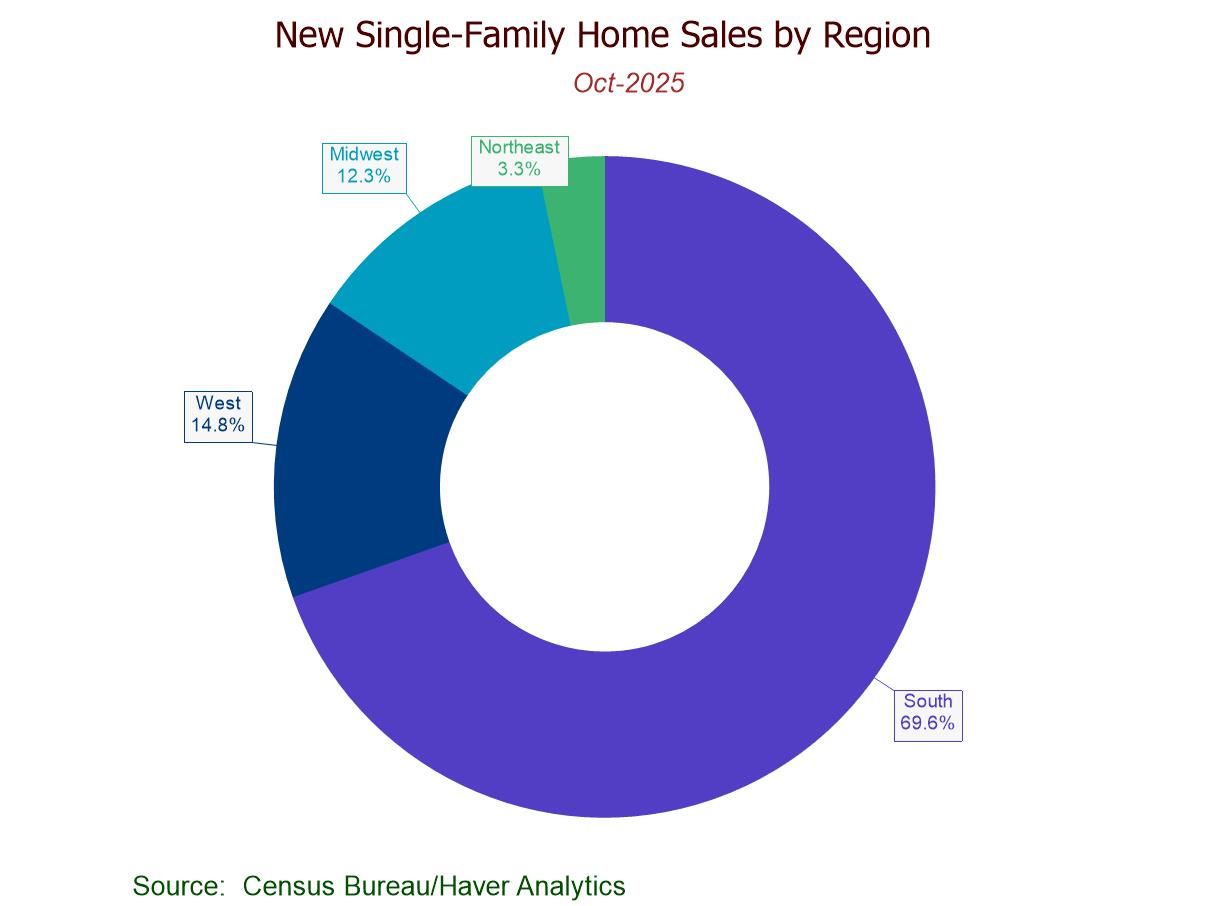

- October sales -0.1% (+18.7% y/y) to 737,000; still 42.0% above the July ’22 low.

- Sales fall m/m in all major regions except the South (+16.9%).

- Median sales price down to $392,300, lowest since July ’21; avg. price up to $498,000.

- Months' supply of new homes for sale holds steady at 7.9 mths., lowest since Sept. '24.

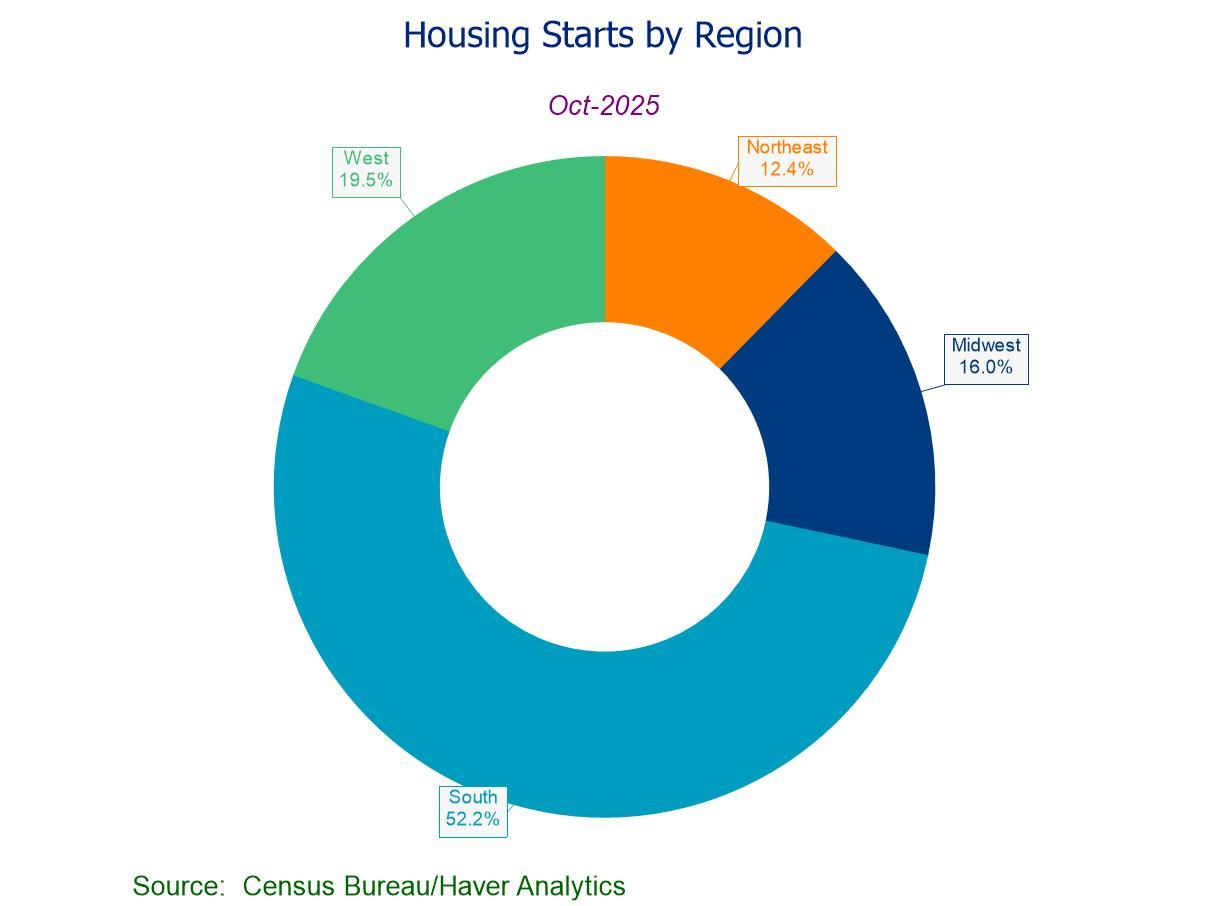

- Housing starts -4.6% (-7.8% y/y) to 1.246 mil. in Oct.; second m/m fall in three months.

- Single-family starts up to a three-month high; multi-family starts down to a five-month low.

- Housing starts m/m down the West and Northeast but up in the South and Midwest.

- Building permits fall for the sixth time in seven months, led by a drop in single-family permits.

- of28Go to 1 page