Global| Mar 29 2019

Global| Mar 29 2019German Sales Rebound in the Context of a Slowing Trend and Global Malaise

Summary

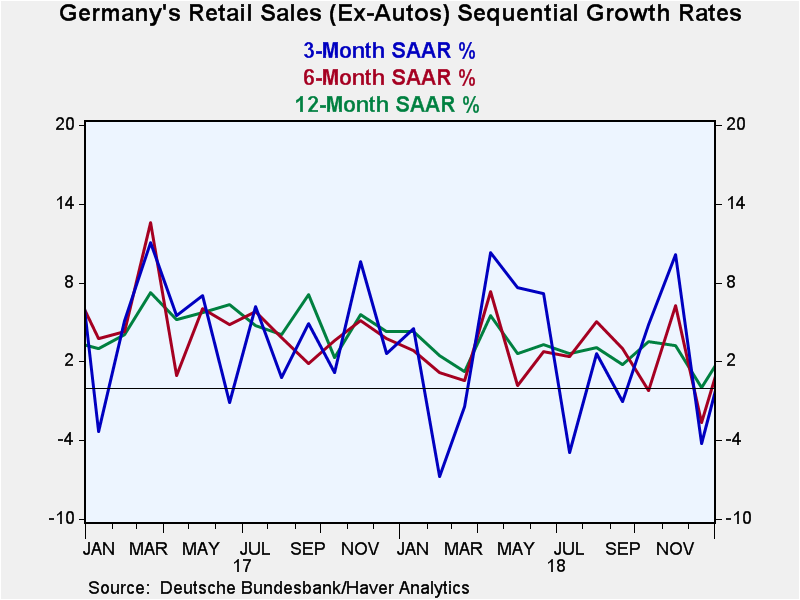

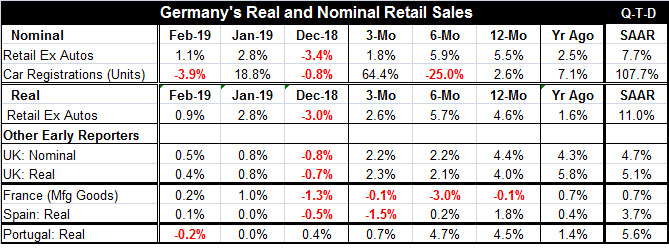

Germany's retail sales unexpectedly rose sharply in February after a solid rebound in January. Year-over-year retail sales rise by 5.5% and they are rising at a 7.7% annual rate in the quarter-to-date. Real retail sales also have a [...]

Germany's retail sales unexpectedly rose sharply in February after a solid rebound in January. Year-over-year retail sales rise by 5.5% and they are rising at a 7.7% annual rate in the quarter-to-date. Real retail sales also have a strong gain in February after a solid rebound in January. Real sales in the quarter-to-date are up at an unexpected 11% annual rate. In addition, auto registrations, always volatile, are exploding at a 107.7% annual growth rate on a quarter-to-date basis.

Germany's retail sales unexpectedly rose sharply in February after a solid rebound in January. Year-over-year retail sales rise by 5.5% and they are rising at a 7.7% annual rate in the quarter-to-date. Real retail sales also have a strong gain in February after a solid rebound in January. Real sales in the quarter-to-date are up at an unexpected 11% annual rate. In addition, auto registrations, always volatile, are exploding at a 107.7% annual growth rate on a quarter-to-date basis.

Some European strength beyond Germany

However, German explosive spending and auto results contrast with a smaller-than-expected drop in German unemployment in March. While France shows a gain in spending on manufactured goods, French household consumption fell in February by 0.4%. But Spain and the U.K. show sales gains in February. The U.K., Portugal and Germany show firm sales trends.

Sad case of the U.K.

The U.K. continues to plow ahead even as no U.K. official or political body can advance the case of Brexit and major uncertainty prevails. Today Theresa May's plan failed for the third time (3 strikes and you're out? Oh, that's not cricket, is it?). This time it failed by just 58 votes, but it did fail. While Parliament continues to think it can carve out a new agreement, in fact it can't come up with a scheme that a majority of members will support and even if it did the EU has made it clear that it is done negotiating. So it is vexing to wonder where this possibility could go and exactly what the U.K. politicians are maneuvering for. Logically it seems that only two things make sense. One is that there may be no agreement and hard Brexit will result. The other is that a new referendum vote might be required and that could either lead to the Brexit vote being over turned or to some renewed energy to leave and possibly followed by new national elections to put the people in Parliament who would vote do it.

Pick up, but...

While retail sales spending for now seems solid across most of Europe, this is after some relatively severe weakness in December. So it is unclear how much this recent rebound simply is a make-up or if it is a true revival. Moreover, the industrial data clearly point to ongoing weakness.

Asia runs hot and cold on today's new

Data from Asia today show a decline in industrial output in South Korea balanced by a sharp gain in IP in Japan. Japan's unemployment rate fell, but retail sales only edged higher there. Japan's inflation rate continues to be stable and low, stuck well below the target set by the central bank.

Some good news...but globally conditions are mixed-to-weak

The strengthening in spending in Europe is contrasted to weak consumer spending in the U.S. and quite moderate income growth as well, both announced just today. Globally, the industrial data look weakest. In Europe the construction sector is still strong while it has been slowing in the United States. Services point to growth everywhere, but generally the services sector shows signs of slowing globally although the U.S. still seems to be the exception to that, depending on job growth bouncing back in the services sector after that weak February result.

No one seems to grasp the nature of the yield curve inversion signal

The inverted U.S. yield curve and global bond market rally muddy the waters on where the global economy is headed. I hear a lot of people saying that the yield curve is not inverted enough yet to matter. But the clear message from the yield as told by history is that once the inversion starts it almost always progresses and a recession follows. The fact that it has already inverted is the point; the fact that the inversion is only incipient is beside the point- and misleading. The one exception to this is in the mid-1960s. The exception occurred because, unlike now, the Fed saw the inversion as sign of weakness and potential recession and swerved policy cutting the fed funds rate by a cumulative 200 bp to turn the inversion signal off and to truncate the path to recession. But the signal was a correct signal about a coming recession. Unexpected Fed action simply drew-out the process. And the Fed move only took inversion out of the market temporarily. In fact, the curve quickly inverted again and a recession did follow. To me, the recession signal has already been generated as it was in the mid-1960s. The view that the signal is not loud enough ignores what we know about how the yield curve inversion process works. In the mid-1960s, the Fed's attempt to avoid recession failed because inflation was rising too. The Fed's swerve did take the inversion out of the market, but inflation continued to rise and the Fed was forced to tighten again. That re-established the inversion-to-recession cycle. Currently, inflation is low, below target and possibly even falling. Today the Fed has latitude to cut rates, unlike in the mid-1960s. But today the Fed has no appetite to do it and instead is making excuses to ignore the yield curve inversion- even though the flattening has been in gear for quite some time. So with inflation globally low and weakness in train, central bankers are still much more obsessed with holding to their interest rate levels rather that to take any action to support growth despite having flexibility and a multitude of signs that growth may be under assault.

When policy is run by the one-trick ponies

All I can add on this topic is how old habits die hard. There is in these circumstances no argument against stimulus to try to prevent weakness from cascading. There is no credible case for the need to hold rates at current levels or to show restraint against further stimulus. But this is all that central banks seem to know or to be able to bring themselves to consider. And let me point out that most places (China as an exception) any fiscal action is also out of the question. It seems likely that central bankers are going to wait until the yield curve is inverted enough and the economic data are weak enough that the kind of pathetic policy responses that central banks can bring to the table in this environment will prove insufficient to revive the economy and restore growth. Once bankers see the light (or the end of the light), it will be too late. The low levels of rates globally should argue for a quicker response by central bankers to assure that stimulus is effective. And if that runs afoul of inflation- so much the better! Inflation is undershooting! In other words, the current overall traditional cautious tilt of global monetary policy makes no sense here and now. It might seem ‘responsible' under old rules in the old economy, but by no means is it ‘responsible' in this environment.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates