Global| Mar 25 2008

Global| Mar 25 2008Iceland Raises Its Official Discount Rate to 15%

Summary

Iceland unexpectedly raised its official discount rate today to 15% from 13.75%. According to the Board of Governors of the Bank of Iceland, inflation has been higher than forecast and its currency, the kroner, has depreciated [...]

Iceland unexpectedly raised its official discount rate

today to 15% from 13.75%. According to the Board of Governors of the

Bank of Iceland, inflation has been higher than forecast and its

currency, the kroner, has depreciated sharply. The kroner fell 14%

during the week ending March 19 as seen in the first chart. Demand is

down and it is becoming more difficult to finance its current account

deficit.

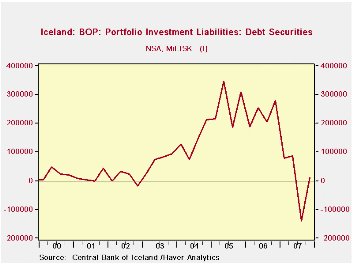

Iceland's action is in stark contrast to that of the majority of developed nations who are lowering rates to combat the spreading effects of the sub prime crisis. Iceland's problems appear to have little to do with the financial turmoil resulting from the sub prime crisis, rather its problems appear to be more the result of its role in the "Carry Trade." (Investors borrow money in low interest countries, say in Japan, and invest the proceeds in high interest countries, say in Iceland. Providing that exchange rates are relatively stable, the trade is profitable. When exchange rates go against the borrower, the trade becomes unprofitable.) Iceland with its relatively high interest rates was a favorite recipient of funds in the "Carry Trade". With relative stability in exchange rates in the period from 2002 to 2006, the Carry Trade was, for the most part, very profitable. When exchange rates began rising in the low interest countries in 2007 and falling in the high interest countries, the Carry Trade lost much of its appeal. Inflows were reduced and, in some cases, reversed. The ups and downs in the carry trade in Iceland are shown in the second chart which shows the dramatic rise in the inflow of foreign investment in debt securities. These flows rose dramatically beginning in 2003, holding at high levels through 2006, plummeting in most of 2007 and recovering slightly in the last quarter.

The Carry Trade inflows are more like "hot money" flows than more long term oriented inflows. As such they tend to cause disruptions in an economy. Among other things, they result in bigger current account deficits and, unless they are sterilized, they tend to add to inflationary pressures.

| ICELAND | Q4 08 | Q3 07 | Q1 07 | Q/Q Chg | Y/Y Chg | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Inflows of Foreign Invest in Debt Securities (Mil Korona) | 11,212 | -138,609 | 278,074 | 149,981 | -266,862 | 37,891 | 925,191 | 1,057,402 |