Global| Dec 13 2006

Global| Dec 13 2006Japan Current Account Hits Record ¥2.02 Trillion in October; Trade, Services & Income All Contribute

Summary

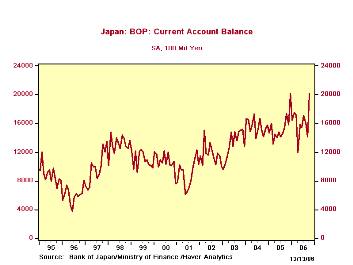

Japan's current account surplus rose ¥611.4 billion in October, according to data reported December 13 by the Ministry of Finance, reaching a record ¥2,020.1 billion (seasonally adjusted).The previous record was ¥2,015.1 billion in [...]

Japan's current account surplus rose ¥611.4 billion in October, according to data reported December 13 by the Ministry of Finance, reaching a record ¥2,020.1 billion (seasonally adjusted).The previous record was ¥2,015.1 billion in December 2005.

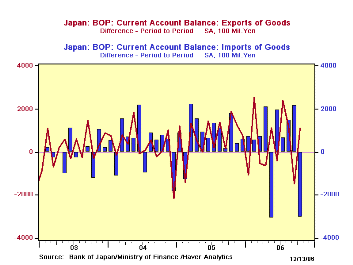

The month-to-month increase in the surplus included favorable moves in every segment of the current account.The goods balance increased to ¥852.7 billion from ¥437.2 billion, more than reversing September's shrinkage.Exports rose ¥113.0 billion or 1.9% and imports fell ¥302.5 billion or 5.4%.The merchandise trade data reported earlier indicate that just under half of the fall in imports was in "mineral fuels", including petroleum and natural gas products.Among exports, the strongest items appear to be motor vehicles and metals, as suggested by year/year gains in not-seasonally-adjusted data.

There is a deficit in services, but it shrank markedly in October, to ¥122.8 billion from ¥208.5 billion in September.It is erratic on a monthly basis, but the October reading compares favorably with an average for all of last year of ¥219.4 billion and with ¥308.3 billion in 2004.

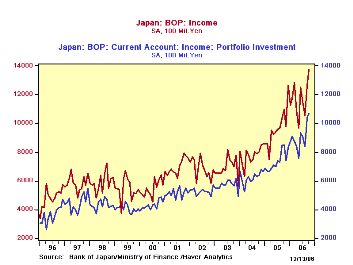

The balance on income flows grew as well in October, as gains in assets held abroad are bringing in increased portfolio income. The monthly change in October portfolio income was small, just to ¥1,071.0 billion from ¥1,038.4 billion in September, but these are both up from ¥852.4 billion in October a year ago and ¥737.6 billion for all of 2005.Total income includes interest on bank loans, profits from direct investments, and wage income; the October total was ¥1,374.9 billion.

All together in Japan's current account performance for October, the balance of trade in goods showed the largest improvement, but the largest net surplus is in income.As world capital markets become more and more integrated and direct investment becomes more diversified around the world, swings in both goods and income balances are likely to be wider and more frequent.

| JAPAN: SA, Bil.¥ | Oct 2006 | Sept 2006 | Aug 2006 | Year-Ago | Monthly Averages|||

|---|---|---|---|---|---|---|---|

| 2005 | 2004 | 2003 | |||||

| Current Account Balance | 2020.1 | 1408.7 | 1605.0 | 1739.6 | 1537.7 | 1557.4 | 1316.9 |

| Goods Exports | 6134.1 | 6021.1 | 6170.0 | 5510.8 | 5212.5 | 4841.6 | 4303.3 |

| Goods Imports | -122.8 | -208.5 | -169.8 | -54.1 | -219.4 | -308.3 | -300.8 |

| Balance on Services | 1374.9 | 1266.0 | 105.73 | 1099.3 | 966.2 | 776.9 | 692.4 |

| Balance on Income | 1374.9 | 1266.0 | 1057.3 | 1099.3 | 966.2 | 776.9 | 692.4 |

| Portfolio Income | 1071.0 | 1038.4 | 838.2 | 852.4 | 737.6 | 622.8 | 569.9 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.