Global| Jan 19 2007

Global| Jan 19 2007Michigan Consumer Sentiment Gauge Rebounds Sharply on Optimistic View of Business Conditions & Personal Finances

Summary

The University of Michigan's preliminary reading of consumer sentiment this month jumped from December's 91.7 to 98.0 (Q1 1966 = 100). This contrasted sharply with forecast expectations for only a modest rise to 92.0-92.5. Both [...]

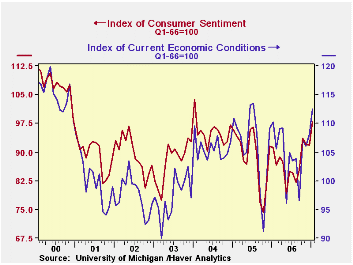

The University of Michigan's preliminary reading of consumer sentiment this month jumped from December's 91.7 to 98.0 (Q1 1966 = 100). This contrasted sharply with forecast expectations for only a modest rise to 92.0-92.5.

Both current conditions and expectations contributed to the rise in overall sentiment. Current conditions increased to 112.5 from December's 108.1 and expectations to 88.7 from 81.2.

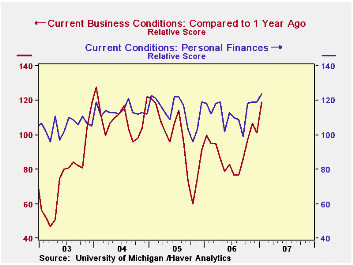

Among various sectors in the survey, the most dramatic increase occurred in respondents' assessment of "current business conditions". This reading rose from 101 in December to 119 this month. The proportion perceiving "better" conditions gained 9 points while those perceiving "worse" conditions fell by a like amount. People generally believe this will continue as the reading on "expected business conditions" rose to 106 from 101.

Personal financial conditions also look better. "Current personal finances" went up from 119 to 124 as more people feel "better off". The proportion feeling "worse off" declined a bit. Notably, neither of these changes is due to a corresponding assessment of income. The same number as in December reported higher incomes and the number with falling incomes actually increased by 1 point. Fewer people did report that they are experiencing rising prices, which sounds like a good explanation, except that the expected inflation rate ticked higher. Over the next year, people look for a mean inflation rate of 3.6% versus 3.5% reported last month and a median of 3.0% versus 2.9%. Over the longer five- to 10-year span, people look for 3.5% inflation on average, up from 3.4% in December, with the median pace steady at 3.0%.

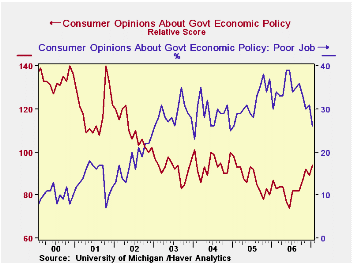

Assessment of government policy and performance rose after December's decline. The opinion of government was 94 against December's 89. The number of respondents believing government is doing a good job was unchanged at 20, but the number expressing the view of a poor job fell from 31 to 26.

The University of Michigan survey is not seasonally adjusted.This mid-month survey was based on telephone interviews with about 340 households nationwide on personal finances and business and buying conditions. The survey is expanded to a total of 500 interviews at month-end.

| University of Michigan | January (Prelim.) | December | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Consumer Sentiment | 98.0 | 91.7 | 7.5% | 87.3 | 88.6 | 95.2 |

| Current Conditions | 112.5 | 108.1 | 2.0% | 105.1 | 105.9 | 105.6 |

| Expectations | 88.7 | 81.2 | 12.4% | 75.9 | 77.4 | 88.5 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.