Global| Sep 07 2007

Global| Sep 07 2007Payrolls Fall 4,000 in August; Revisions Take Away 81,000 More

Summary

Oh, well. Nonfarm payrolls declined 4,000 in August, the first monthly decrease since August 2003. Needless to say, forecasters and market participants are surprised at this outcome; the consensus expected a pickup to a 113,000 gain [...]

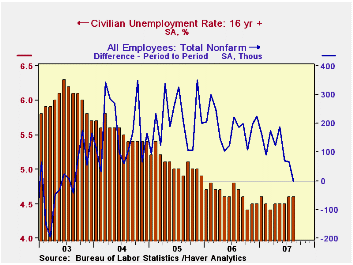

Oh, well. Nonfarm payrolls declined 4,000 in August, the first monthly decrease since August 2003. Needless to say, forecasters and market participants are surprised at this outcome; the consensus expected a pickup to a 113,000 gain following July's originally reported 92,000. Instead, July and June were both revised downward, as noted in the table below; the two-month reduction was 81,000.

The three-month change in payrolls thus slowed to just 44,0000 on average, also the weakest since the summer of 2003 and much less than the 109,000 average for this year to date.

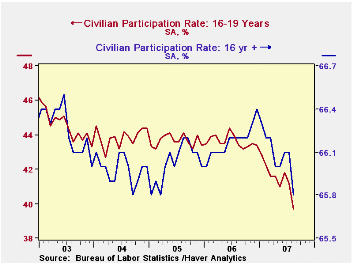

The unemployment rate held at 4.6% in August. Household employment fell 316,000 (-0.2% or +0.8% y/y) following a 30,000 cut during July. The labor force, though, declined more, by 340,000 (also 0.8% y/y) so despite the decline in this employment measure, the number unemployed also declined, by 24,000. The labor force participation rate dipped to 65.8%, the lowest since March 2005. BLS commentary points out that much of this decline occurred among teenagers, who accounted for almost three-quarters of the drop in the labor force, as they were apparently returning to school.

From the establishment survey, private service sector jobs posted a relatively modest 88,000 (1.9%) gain after a 130,000 July rise which was revised very slightly downward. So far this year, these industries have added an average of 124,000 per month; last year’s average monthly gain was 159,000. Retail employment improved, adding 13,000 jobs (+0.7% y/y) during August, lifting the average increase this year to almost 10,000 per month after an outright decline of 2,700 per month during 2006. In the financial sector, the number of jobs was unchanged from July, which was revised a bit lower to a 24,000 increase from 27,000 reported a month ago. The average gain this year has been 6,000 versus 16,000 last year. Professional & business services employment rose just 6,000 after July's 25,000 increase. The average gain this year has been 16,000 per month, off from last year's average of 42,000.

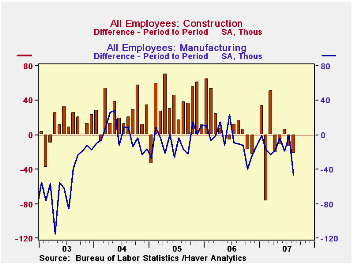

Factory sector payrolls fell 46,000 (-1.5 y/y) and jobs have fallen in every month beginning in July 2006. Construction employment declined again in August, by 22,000 after July's 14,000 decrease; the latest was more than accounted for among residential builders and specialty trades contractors. Construction jobs have fallen 7,000 per month this year versus an average 11,000 increase per month during 2006.

Government payrolls fell again by 28,000 (+0.6% y/y) in August, while July's original 28,000 decline was revised to 52,000. So far in 2007, this sector has added a mere 5,000 monthly, compared with the per month average last year of 20,000.

Average hourly earnings increased 0.3%, the same as in July. Factory sector earnings rose 0.1% (2.7% y/y) and private service producing earnings rose 0.3% (4.1% y/y). The monthly average increase in overall average hourly earnings this year has been 0.3% versus 0.4% per month last year.

| Employment : 000s | August | July | June | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Payroll Employment | -4 | 68 | 69 | 1.2% | 1.9% | 1.7% | 1.1% |

| Previous | -- | 92 | 126 | -- | -- | -- | -- |

| Manufacturing | -46 | -1 | -19 | -1.5% | -0.2% | -0.6% | -1.3% |

| Construction | -22 | -14 | 6 | -1.2 | 4.8% | 5.2% | 3.6% |

| Average Weekly Hours | 33.8 | 33.8 | 33.9 | 33.8 (Aug '06) | 33.8 | 33.8 | 33.7 |

| Average Hourly Earnings | 0.3% | 0.3% | 0.5% | 3.9% | 3.9% | 2.8% | 2.1% |

| Unemployment Rate | 4.6% | 4.6% | 4.5% | 4.7% (Aug '06) | 4.6% | 5.1% | 5.5% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.