Global| Jan 18 2007

Global| Jan 18 2007Total Housing Starts Rise, But Single-Family Units Fall Anew

Summary

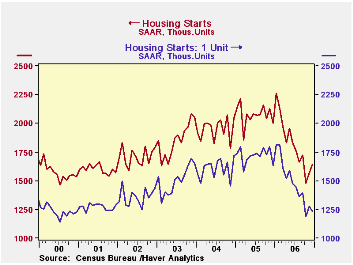

December housing starts appeared to gain some forward momentum, with a 4.5% advance. The resulting 1.642M was considerably better than Consensus expectations for renewed decline to 1.563M starts. For all of 2006 starts of 1.819M was [...]

December housing starts appeared to gain some forward momentum, with a 4.5% advance. The resulting 1.642M was considerably better than Consensus expectations for renewed decline to 1.563M starts.

For all of 2006 starts of 1.819M was 12.3% below the 2005 total.

However, the December increase was all in multi-family structures. These jumped 42.1% in the month to 412,000, the largest since January. Multi-family building starts have been running just below 350,000 yearly for about the last ten years.

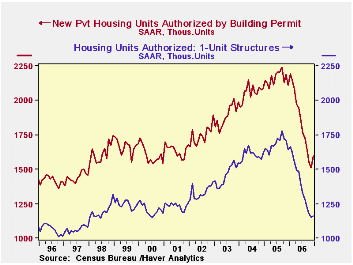

Disappointingly, single-family starts in December turned back down again, losing 4.1% to 1.23M. For the year as a whole, they totaled 1.478M, actually an annual rate not seen since June. This is 14.0% below 2005's total; as seen in the table below, the month of December was almost 25% below December 2005..

By region, single-family housing starts in the South lost 5.7% in December (-26.3% y/y); at 642,000, this is 8.6% above October's low. Single-family starts in the Northeast were off 3.5% (-14.0% y/y). Starts in the Midwest fell 4.7% (-26.4% y/y) and out West, they managed to hold steady at 293,000 for a third consecutive month, down 23.5% December/December.

Building permits gained 5.5% in the month, but here too, the increase was mainly in the volatile multi-family sector. These permits rose 69,000 to 432,000, the best volume since August. Permits to start single-family homes edged up 1.2%, their first increase since January. For the year as a whole, these permits totaled 1.38M, down 18.0% from 2005. Total building permits for the 1.834M, down 15.1% from 2005.

New Federal Reserve Board Governor Frederic Mishkin gave his first speech as a Board Member yesterday in New York. It is titled, appropriately enough, The Role of House Prices in Formulating Monetary Policy and can be found here. Chairman Bernanke testified this morning before the Senate Budget Committee; his prepared statement, Long-term fiscal challenges facing the United States, can be found here.

| Housing Starts (000s, AR) | December | November | October | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total | 1,642 | 1,572 | 1,478 | -18.0% | 1,819 | 2,073 | 1,950 |

| Single-family | 1,230 | 1,282 | 1,187 | -24.7% | 1,478 | 1,719 | 1,604 |

| Multi-family | 412 | 290 | 291 | 11.7% | 341 | 354 | 345 |

| Building Permits | 1,596 | 1,513 | 1,553 | -24.3% | 1,834 | 2,159 | 2,058 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.