Global| Apr 17 2002

Global| Apr 17 2002Trade Deficit Deepened With Improved US Economy

by:Tom Moeller

|in:Economy in Brief

Summary

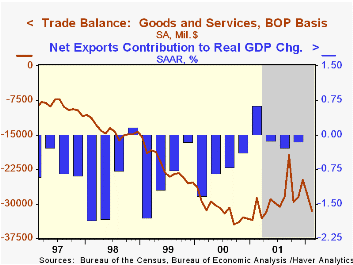

The US foreign trade deficit rose more than expected in February. January's deficit was revised slightly shallower, due to raised exports, from $28.5B reported last month . The trade deficit in 1Q so far averaged $29.9B versus $27.6B [...]

The US foreign trade deficit rose more than expected in February. January's deficit was revised slightly shallower, due to raised exports, from $28.5B reported last month .

The trade deficit in 1Q so far averaged $29.9B versus $27.6B in 4Q. That degree of deterioration would sap one quarter of a percentage point from 1Q GDP growth if sustained.

Imports of nonauto capital goods were strong for the second consecutive month as were imports of nonauto consumer goods. Imports of auto products rose 10.5% to the highest level since November 2000.

Imports of industrial supplies and materials fell 4.4% as the value of petroleum imports fell 17%. The price per barrel of crude oil rose 1.5% to $16.56 but the per day quantity of crude oil consumed fell 10.4% (-3.3% y/y).

Exports rose meaningfully for the first month since October due to strong gains in autos and food. Exports of capital goods fell for the second month in three and exports of nonauto consumer goods rose a modest 0.5% after a 5.2% January drop.

The Web site below contains new research from the Federal Reserve suggesting that US net international debt is smaller than official figures suggest.http://www.federalreserve.gov/pubs/ifdp/2002/722/ifdp722.pdf

| Foreign Trade | Feb | Jan | Y/Y | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|

| Trade Deficit | $31.5B | $28.2B | $28.8B(2/01) | $347.5B | $375.7B | $261.8B |

| Exports - Goods & Services | 1.2% | 0.3% | -12.2% | -5.7% | 11.3% | 2.6% |

| Imports - Goods & Services | 4.0% | 3.6% | -7.0% | -6.2% | 18.2% | 10.9% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates