Global| Jan 17 2007

Global| Jan 17 2007Treasury TIC Data Show Sizable Foreign Investment in November, but Also Record US Investment Abroad

Summary

The US Treasury's monthly compilation of capital flows shows sizable foreign investment in US securities in November, amounting to $107.4 billion, purchases net of sales. This is modestly more than October's $104.2 billion and $107.0 [...]

The US Treasury's monthly compilation of capital flows shows sizable foreign investment in US securities in November, amounting to $107.4 billion, purchases net of sales. This is modestly more than October's $104.2 billion and $107.0 billion in November 2005.

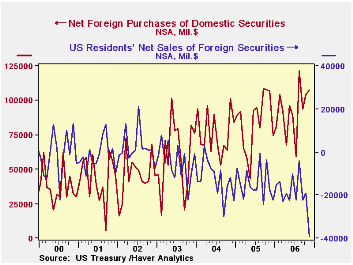

Press reports highlight another net figure, foreign investment in US securities less US residents' purchases of foreign securities. These were $39.1 billion in November, putting "net long term securities transactions" at $68.4 billion, down noticeably from October's $85.3 billion. Since, as we see, foreign purchases were nearly the same, the big difference in the month was the sharp increase in US investor purchases of foreign instruments, which had been $18.9 billion in October, less than half of the November amount. Even more interesting, the major part of that increase came in equities. US investors bought a significant $21.2 billion, $3.8 billion more than last November, which was the previous record amount. Net purchases of foreign bonds were $17.8 billion, which, while less than the equity purchases, was still the third largest month for that market segment.

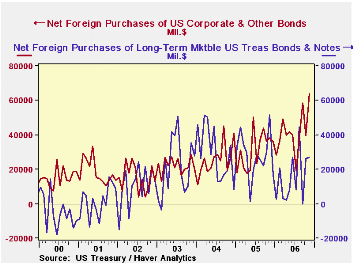

The foreign investments themselves took new paths. Usually months when Treasury refunding operations occur, as in November, contain outsized amounts of foreign purchases of that debt. This was moderately large, at $27 billion, but well down from the year-ago $51.8 billion.

The big difference this month was in corporate bonds. Foreign investors accumulated $63.9 billion in November. The previous record was $58.7 billion in September. The only other month above $50 billion is June 2005, at $50.5 billion. Investors in the UK seem to be the biggest net buyers, although the "clearinghouse" nature of the London markets means that the ultimate purchasers could be anywhere, not just in Britain.

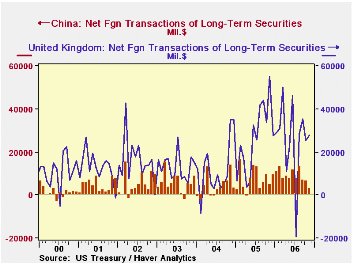

Speaking of countries, the ones show the biggest numbers this month are not who you think. While China has made sizable purchases all year long, they added only $3.1 billion in November, the smallest amount in 19 months. Japan has also not made outsized purchases lately, and some oil exporters [not much data on this sector is available] have actually been net sellers. The biggest gains recently have come from France and offshore Caribbean centers. UK investors have bought considerable volumes this year, but their purchases of US securities were much larger a year ago.

These variations and where they come from are another cautionary signal to us not to put much store in the notion that capital flows only serve to cover the trade deficit. If that were the case, the investments would match the trade partners and they would not likely be in equities or long-term bonds, but in trade financing vehicles, like loans. Global investors look for rate of return opportunities and those may be related to trade flows positively, negatively or not consistently at all.

| Net Foreign Purchases from US Residents, Bil $ | Nov 2006 | Oct 2006 | Nov 2005 | Monthly Averages||||

|---|---|---|---|---|---|---|---|

| Last 12 Months | 2005 | 2004 | 2003 | ||||

| 1. Domestic Securities | 107.4 | 104.2 | 107.0 | 92.4 | 84.3 | 76.4 | 60.0 |

| Treasuries | 27.1 | 26.3 | 51.8 | 15.5 | 28.2 | 29.3 | 22.0 |

| Agencies | 14.7 | 15.2 | 11.1 | 22.2 | 18.3 | 18.9 | 13.0 |

| Corporate Bonds | 63.9 | 39.5 | 38.3 | 40.8 | 31.0 | 25.8 | 22.1 |

| Equities | 1.8 | 23.2 | 5.7 | 12.3 | 6.8 | 2.4 | 2.9 |

| 2. Foreign Securities | -39.1 | -18.9 | -17.7 | -19.3 | -14.4 | -12.7 | -4.7 |

| 3. "Other Acquisition"* | -10.4 | -10.4 | -11.1 | -11.8 | -11.7 | -3.2 | -11.6 |

| 4. Net Foreign Acquisition (1+2+3) | 58.0 | 74.9 | 78.1 | 59.7 | 58.3 | 60.4 | 43.7 |

| 5. Short-Term Liabilities | 15.6 | 0.5 | 2.5 | 9.4 | -4.0 | 15.8 | 1.3 |

| 6. Total TIC Flows** | 74.9 | 60.4 | 88.5 | 70.3 | 55.7 | 81.6 | 59.8 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates