Global| Aug 13 2010

Global| Aug 13 2010U.S. Business Inventories Pick Up Slightly in June

Summary

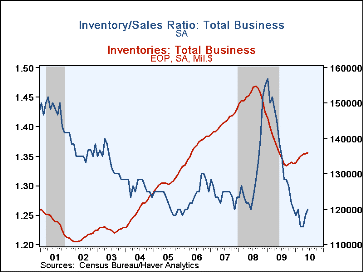

Business inventories continued a halting recovery in June. All together, they rose 0.3%, and May's increase was revised from 0.1% to 0.2%. As visible in the first graph, this hardly constitutes a "recovery" from their total decline [...]

Business inventories continued a halting recovery in June. All together, they rose 0.3%, and May's increase was revised from 0.1% to 0.2%. As visible in the first graph, this hardly constitutes a "recovery" from their total decline during the recession, but it remains a constructive move, nonetheless. Similarly, the inventory/sales ratio picked up to 1.26 in June after an upwardly revised 1.25 in May, coming up a bit from the recent all-time low of 1.23.

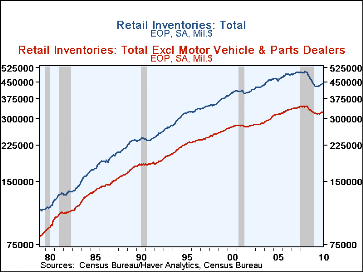

Retail stocks, the new information in today's report, were up 0.8% following May's upwardly revised 0.5% (originally 0.3%). However, the gain was all at motor vehicle dealers, where sales were weak in both May and June. July's sales pick-up there, described elsewhere here by Tom Moeller, likely cut into stocks. So the inventory rise in June was not really a sign of renewed confidence by merchants. By store category, furniture stores and clothing stores each saw June inventories rise 0.3%, but other store groups cut their stocks.

In our graph of the retail sector, we have used the log scale option in Haver's DLXVG3 software to put recent movements in historical perspective. Even as the log scale diminishes the appearance of the larger numbers in the later years, the recent plunge still looks dramatic compared to other periods of inventory adjustment since the late 1970s.

The business sales and inventory data are available in Haver's USECON database.

| Business Inventories (%) | June | May | April | June Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|

| Total | 0.3 | 0.2 | 0.4 | 0.2 | -9.8 | 0.8 | 4.0 |

| Retail | 0.8 | 0.5 | 0.2 | 0.2 | -10.4 | -3.3 | 2.5 |

| Retail ex Motor Vehicles | 0.0 | 0.3 | 0.5 | -0.1 | -4.9 | -1.9 | 2.7 |

| Wholesale | 0.1 | 0.5 | 0.2 | -0.3 | -10.8 | 3.7 | 6.4 |

| Manufacturing | -0.1 | -0.4 | 0.6 | 0.5 | -8.8 | -0.8 | 7.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.