Global| Jun 20 2012

Global| Jun 20 2012U.S. Existing Home Sales and Prices Were Strong in May

Summary

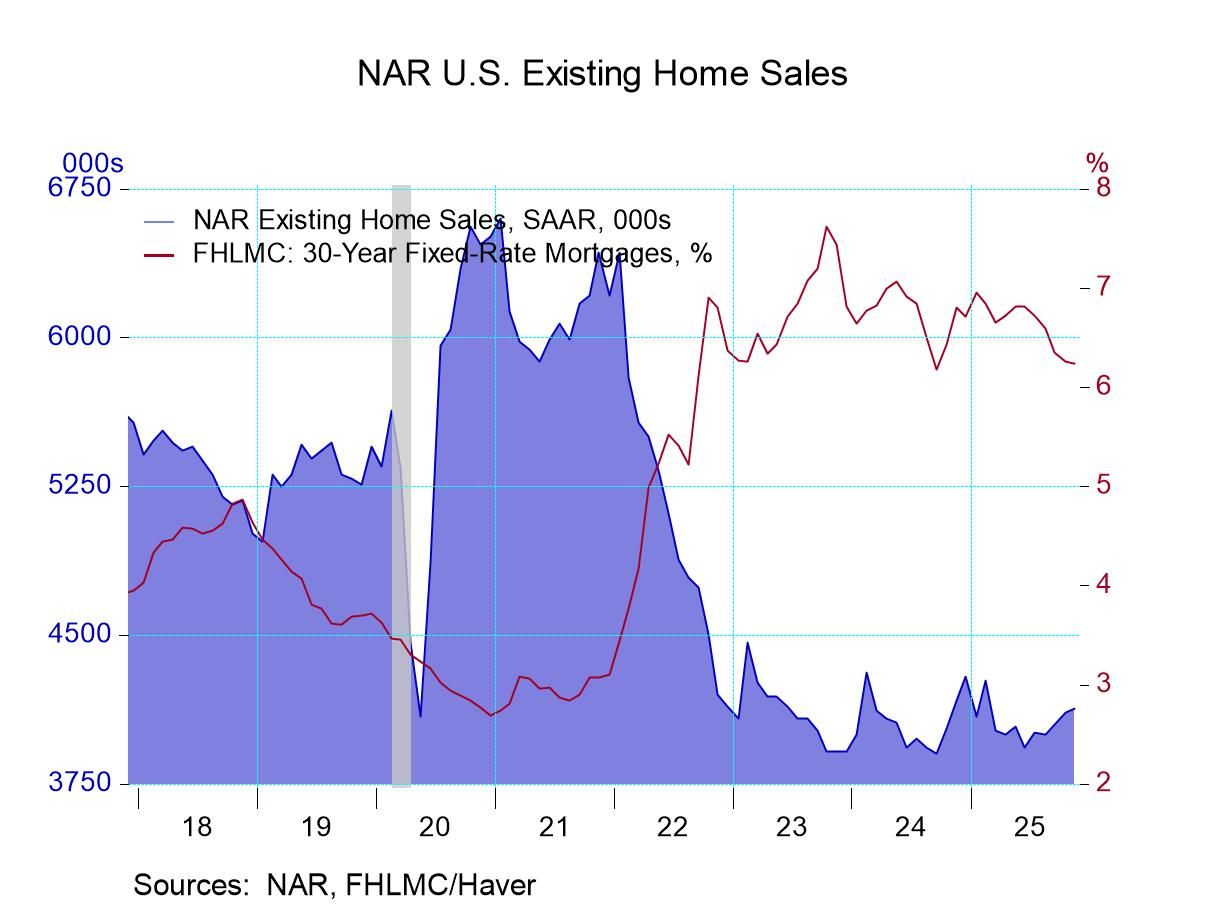

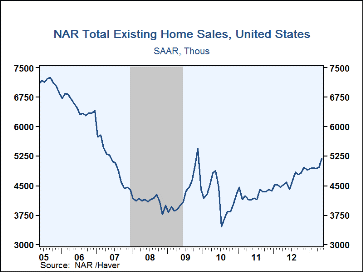

Existing home sales surged 4.2% in May, producing a substantial 12.9% gain y/y to a 5.180M annual rate, according to data compiled by the National Association of Realtors. This was the largest number of sales since the 5.440M of [...]

Existing home sales surged 4.2% in May, producing a substantial 12.9% gain y/y to a 5.180M annual rate, according to data compiled by the National Association of Realtors. This was the largest number of sales since the 5.440M of November 2009, which reflected a special temporary tax benefit. Consensus expectations had projected 5.000M. Sales of existing single-family homes alone came to 4.600M, up 5.0% m/m and 12.7% y/y. (These data have a longer history than the total sales series.) Sales of condos and co-ops actually decreased 1.7% m/m to 0.580M but were still 12.7% above the year earlier.

Existing home sales surged 4.2% in May, producing a substantial 12.9% gain y/y to a 5.180M annual rate, according to data compiled by the National Association of Realtors. This was the largest number of sales since the 5.440M of November 2009, which reflected a special temporary tax benefit. Consensus expectations had projected 5.000M. Sales of existing single-family homes alone came to 4.600M, up 5.0% m/m and 12.7% y/y. (These data have a longer history than the total sales series.) Sales of condos and co-ops actually decreased 1.7% m/m to 0.580M but were still 12.7% above the year earlier.

Sales rose in all four regions of the country. The Midwest had the largest monthly gain, 8.0%, to 1.210M (+16.3% y/y). Sales rose 4.0% in the South to 2.090M, up 16.1% y/y. Those in the West were up 2.5% to 1.230M (+7.0% y/y) and those in the Northeast increased 1.6% to 0.650M, 8.3% ahead of May 2012. (All amounts are seasonally adjusted annual rates).

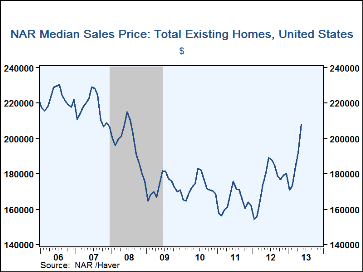

The median price of an existing home was up 8.4% in May to $208,000, a substantial 15.4% from May 2012. This is once again the highest price reading since August 2008 and the first time since then above $200,000. The peak was $230,300 in July 2006.

With the gain in sales, the supply of homes on the market edged down in May to 5.1 months from 5.2 months at the end of April. The number of homes for sale did rise, by 3.7% to 2.220M from 2.150M for April, but the increase was smaller than the gain in sales, pushing down on the months' supply measure. The number of homes for sale was 10.1% below a year ago. For single-family homes alone, the supply was unchanged at 5.2 months of sales. The number was 1.980M compared to 1.910M at the end of April and 9.2% below May 2012. .

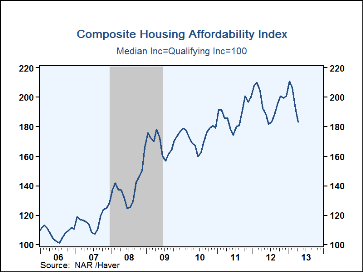

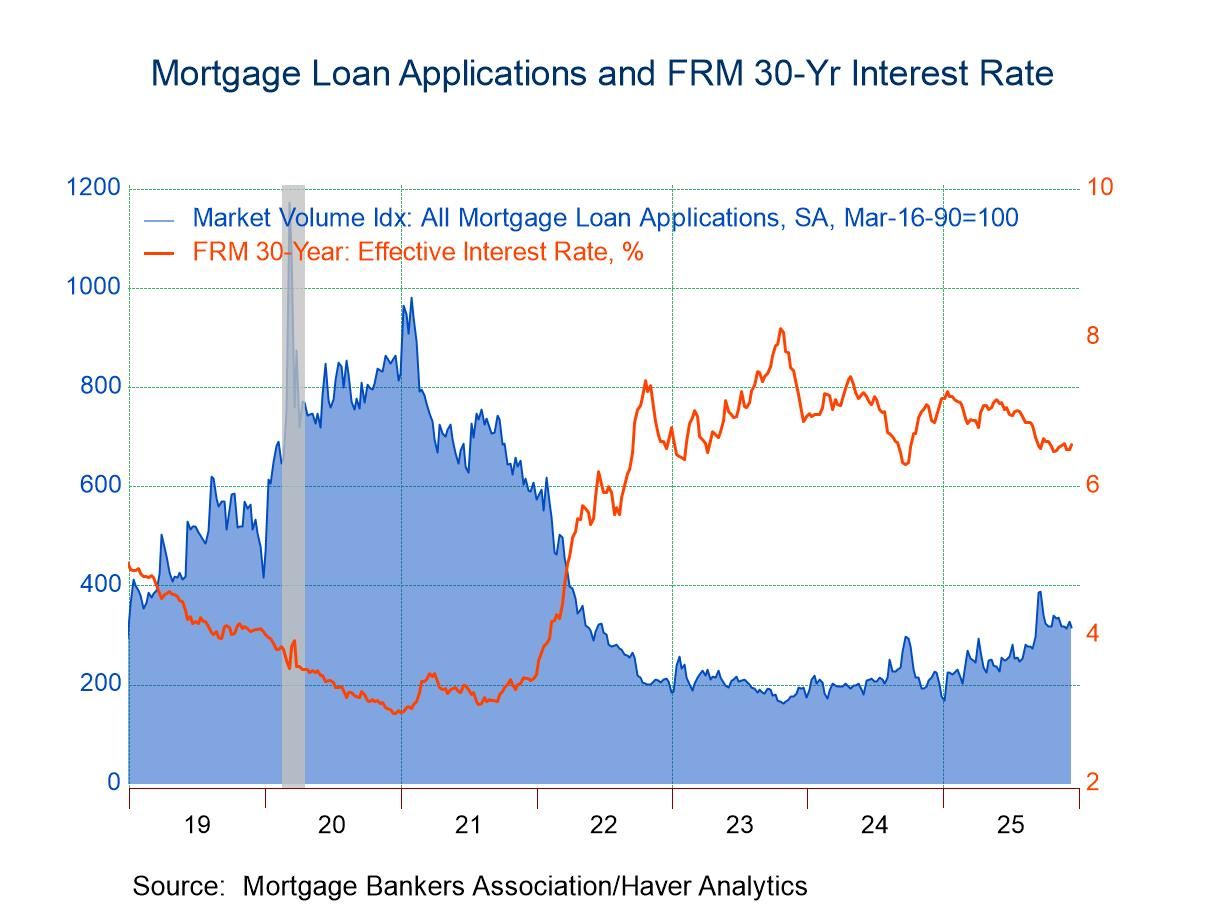

Reported earlier this month, the composite index of home price affordability for April fell 4.8% m/m, which was also the size of the decline from a year ago. The lower affordability number is to be expected as interest rates and home prices both rise; the mortgage rate edged up to 3.69% in April from 3.66% in March, and the monthly payment rose from 13.0% of income in March to 13.7% in April.

The data on existing home sales, prices and affordability can be found in Haver's USECON database. The regional price, affordability and inventory data are available in the REALTOR database. The expectations figure is from the Action Economics survey, reported in the AS1REPNA database.

| Existing Home Sales (Thous, SAAR) | |||||||

|---|---|---|---|---|---|---|---|

| May | Apr | Mar | Y/Y% | 2012 | 2011 | 2010 | |

| Total | 5,180 | 4,970 | 4,940 | 12.9 | 4,661 | 4,278 | 4,183 |

| Northeast | 650 | 640 | 630 | 8.3 | 596 | 543 | 563 |

| Midwest | 1,210 | 1,120 | 1,160 | 16.3 | 1067 | 918 | 909 |

| South | 2,090 | 2,010 | 1,970 | 16.1 | 1,833 | 1,683 | 1,626 |

| West | 1,230 | 1,200 | 1,180 | 7.0 | 1,165 | 1,133 | 1,084 |

| Single-Family Sales | 4,600 | 4,380 | 4,330 | 12.7 | 4,130 | 3,793 | 3,705 |

| Median Price Total ($, NSA) | 208,000 | 191,800 | 183,900 | 15.4 | 175,442 | 164,542 | 172,442 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.