- New claims jumped 22,000 to 231,000, the highest level since December 6.

- Continuing claims rose to 1.844 million from 1.819 million.

Introducing

Sandy Batten

in:Our Authors

Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

Publications by Sandy Batten

- USA| Feb 05 2026

U.S. Initial Unemployment Claims Surged in Latest Week

by:Sandy Batten

|in:Economy in Brief

- USA| Feb 04 2026

U.S. ADP Private Employment Edged Up in January

- Total private employment rose a less-than-expected 22,000 in January.

- Goods-producing industries added only 1,000 jobs while service-producing industries produced 21,000 jobs.

- A 74,000 surge in education and health services jobs more than accounted for the overall January gain.

- Manufacturing lost 8,000 jobs. Manufacturing has lost jobs in every month since March 2024.

by:Sandy Batten

|in:Economy in Brief

- USA| Jan 29 2026

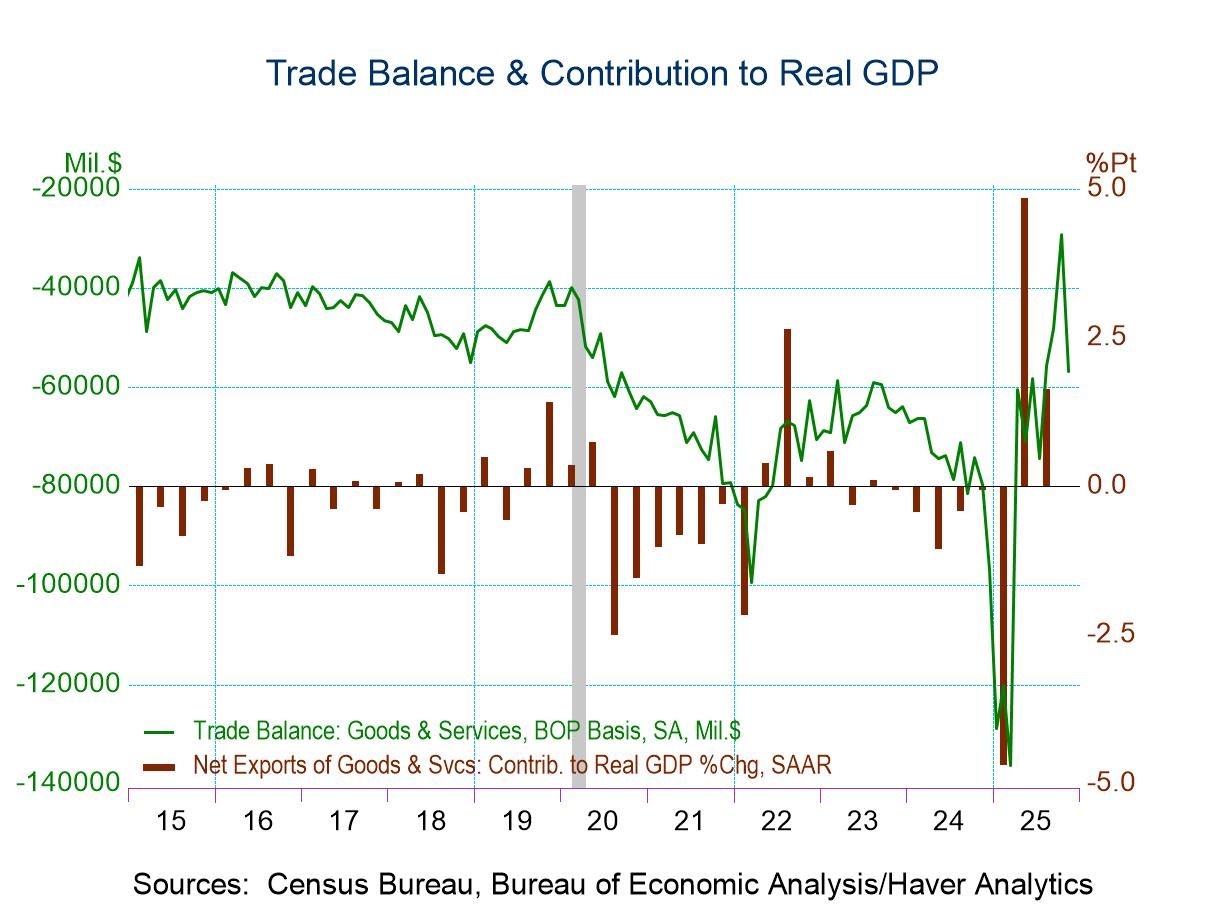

U.S. Trade Deficit Widened in November

- The overall deficit widened to $56.8 billion in November from $29.2 billion in October.

- The goods deficit widened markedly to $86.9 billion from $59.0 in October.

- The services surplus widened modestly to $30.1 billion from $29.8 billion in October.

- Exports fell 3.6% m/m, the first monthly decline in six months, while imports rebounded 5.0% m/m.

by:Sandy Batten

|in:Economy in Brief

- USA| Jan 22 2026

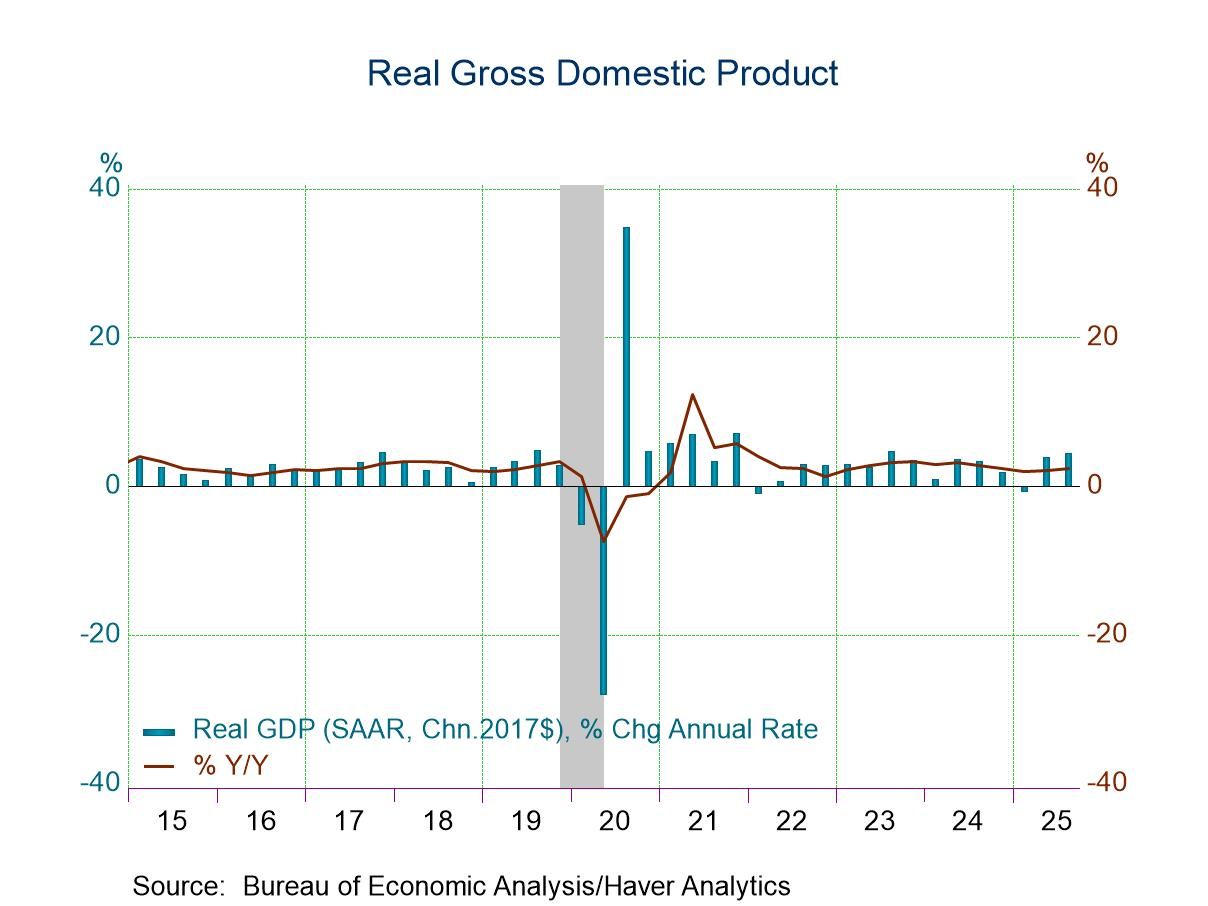

U.S. Q3 GDP Growth Revised Slightly Faster

- Real GDP grew 4.4% q/q saar in Q3 2025, up slightly from 4.3% previously reported.

- The modest upward revision was due mostly to slightly stronger nonresidential fixed investment, a larger increase in exports and a smaller decrease in inventories.

- Growth of domestic demand remained solid in Q3 but was revised down 0.1%-point.

- GDP and PCE inflation were unrevised at 3.8% and 2.8%, respectively. Both are meaningful accelerations from Q2.

by:Sandy Batten

|in:Economy in Brief

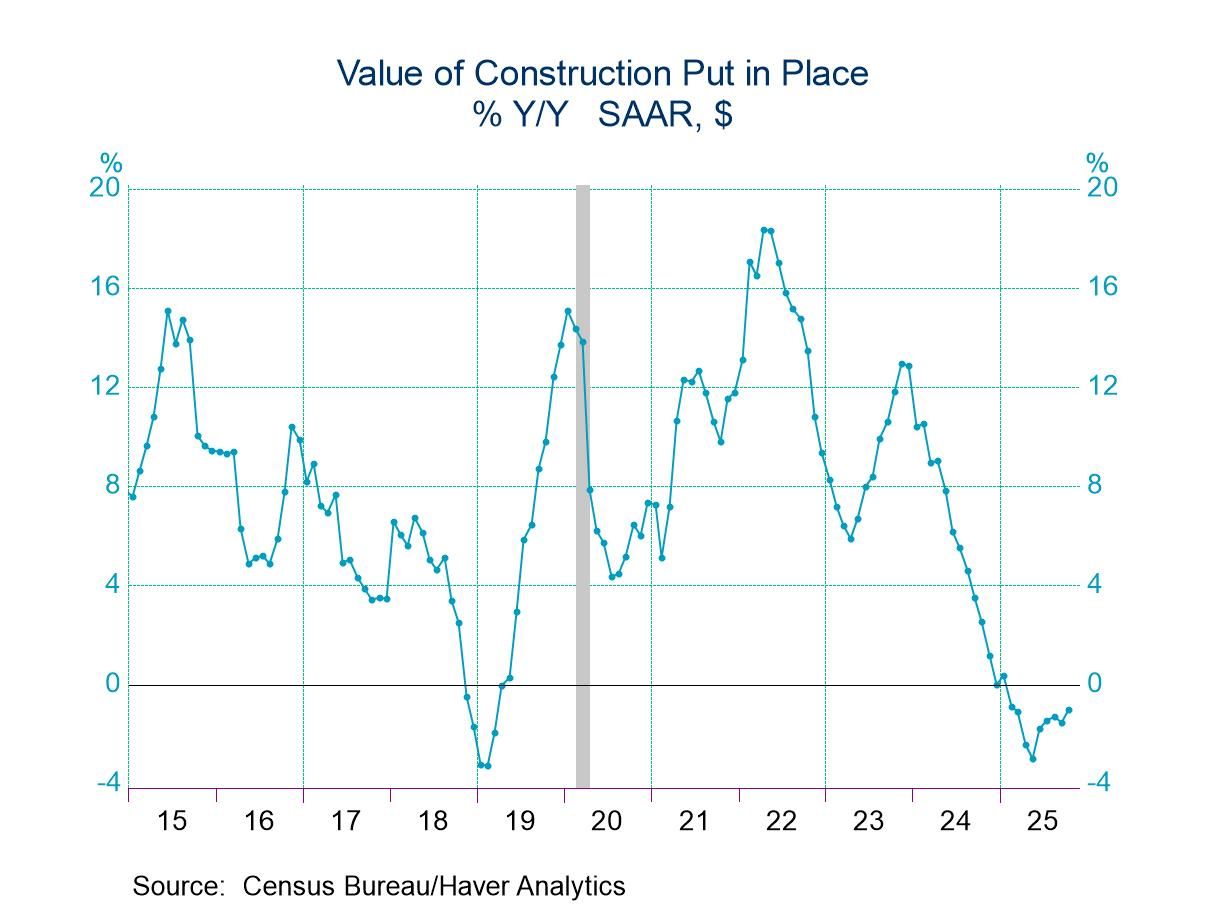

- Total construction spending fell 0.6% m/m in September but rebounded 0.5% m/m in October.

- Private construction spending slumped 0.9% m/m in September but rose 0.6% m/m in October.

- Private nonresidential construction fell for the fourth consecutive month while private residential construction posted a 1.3% m/m gain.

by:Sandy Batten

|in:Economy in Brief

- USA| Jan 15 2026

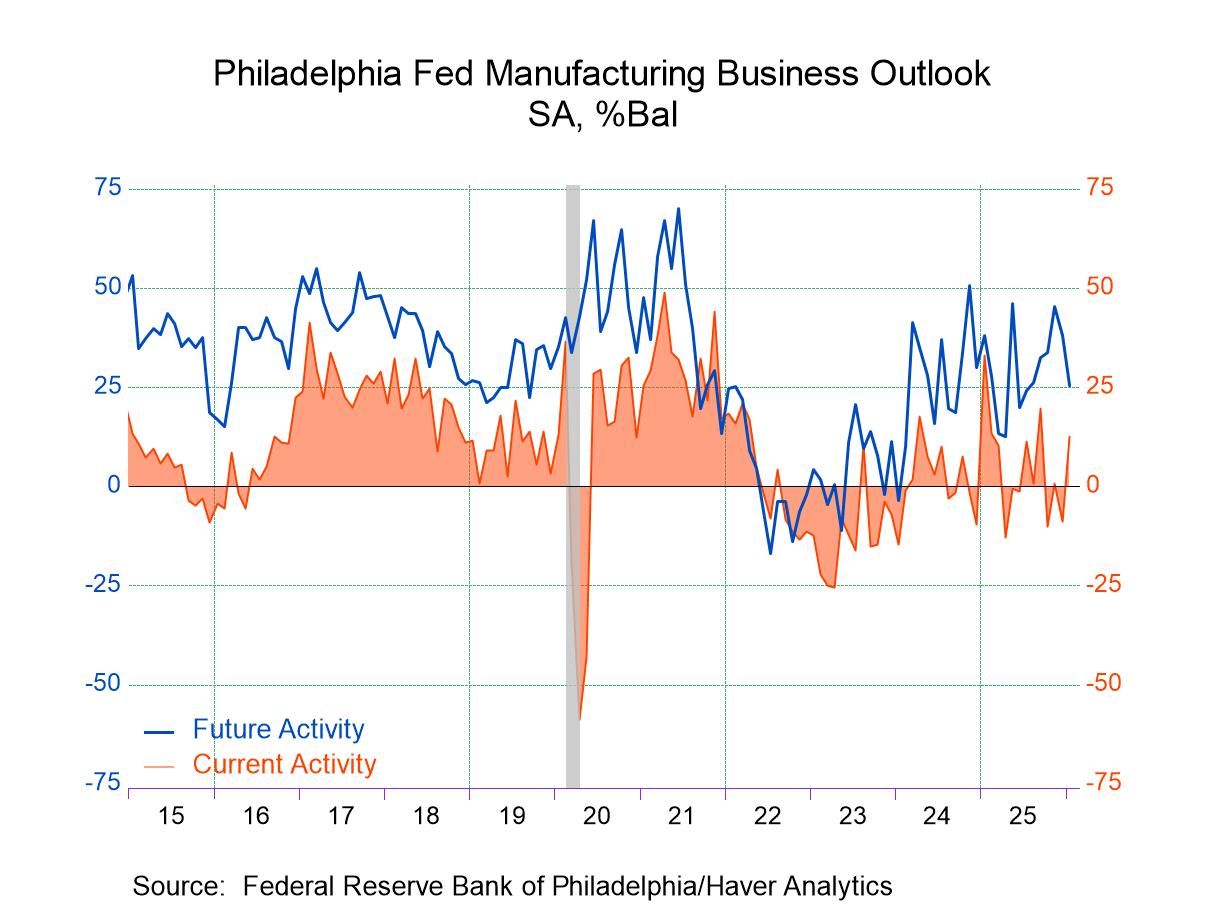

Philly Fed Manufacturing Activity Rebounds in January

- The headline index increased to 12.6 in January, the highest reading since September, from -8.8 in December.

- Both new orders and shipments increased in January.

- Delivery times lengthened while the pace of input price increases slowed.

- Employment decreased but remained in positive territory, indicating further gains in employment though at a slower pace.

by:Sandy Batten

|in:Economy in Brief

- USA| Jan 14 2026

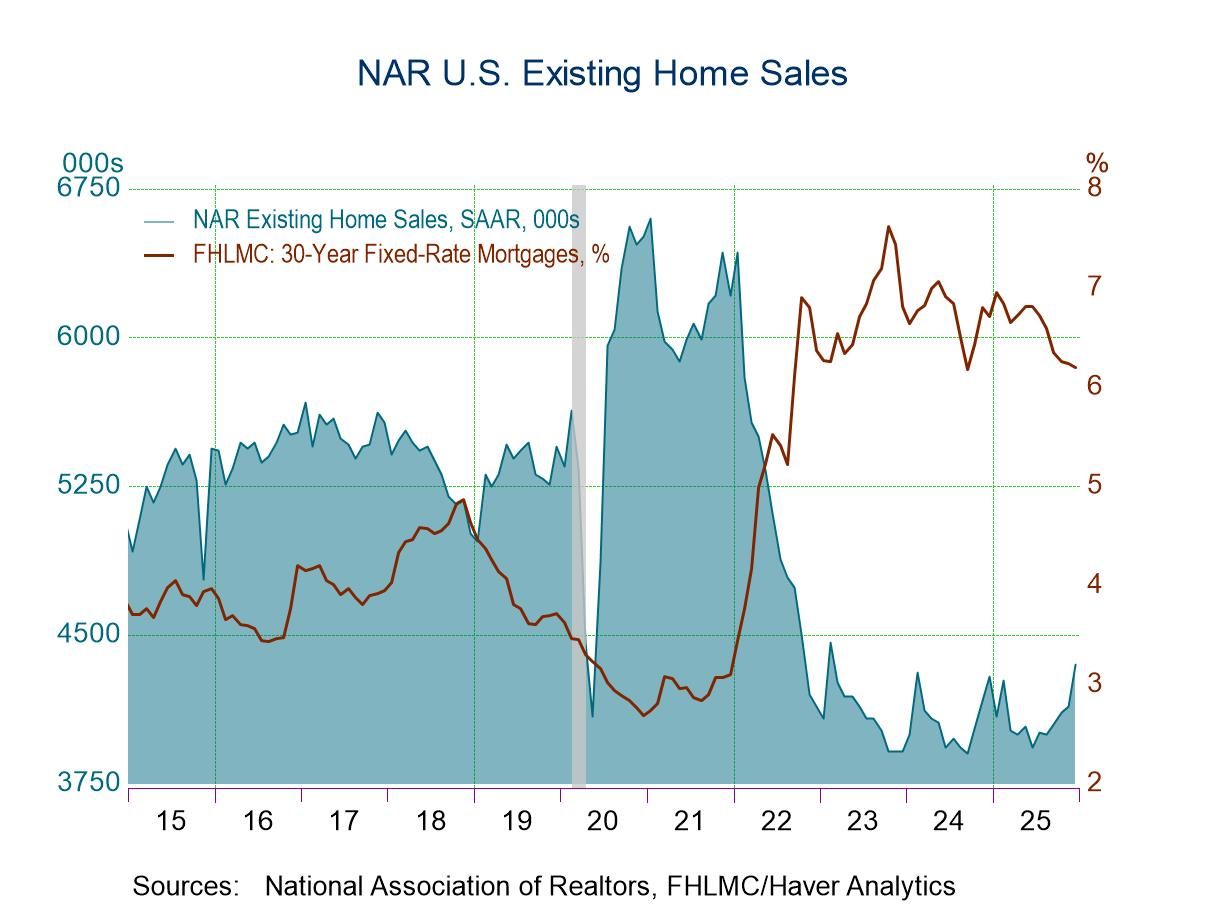

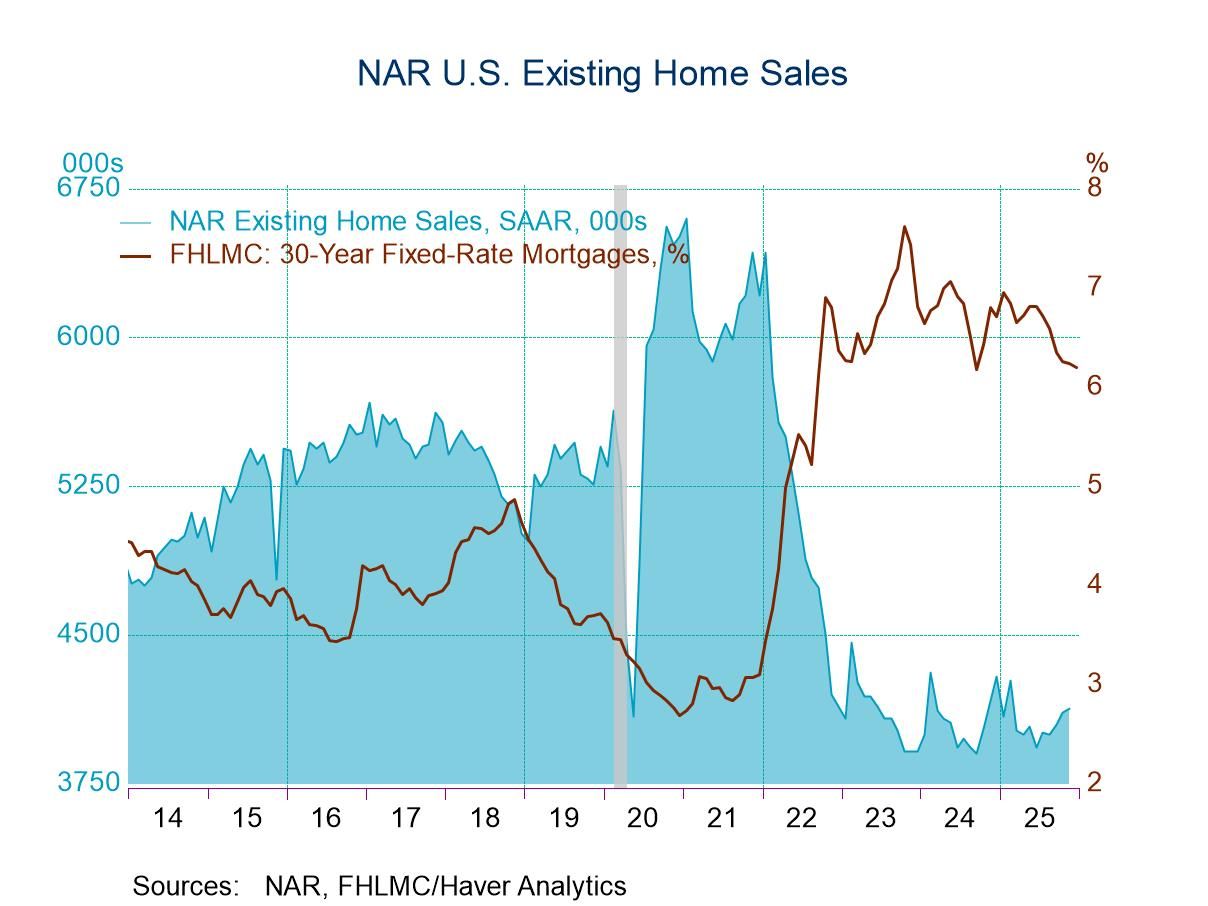

U.S. Existing Home Sales Jumped 5.1% in December

- Existing home sales jumped a much larger-than-expected 5.1% m/m in December, the fourth consecutive monthly gain.

- Month-over-month sales increased in each of the four major areas.

- But year-over-year sales rose only in the South.

- For all of 2025, sales totaled 4.084 million, up slightly from 4.067 million in 2024.

by:Sandy Batten

|in:Economy in Brief

- USA| Jan 08 2026

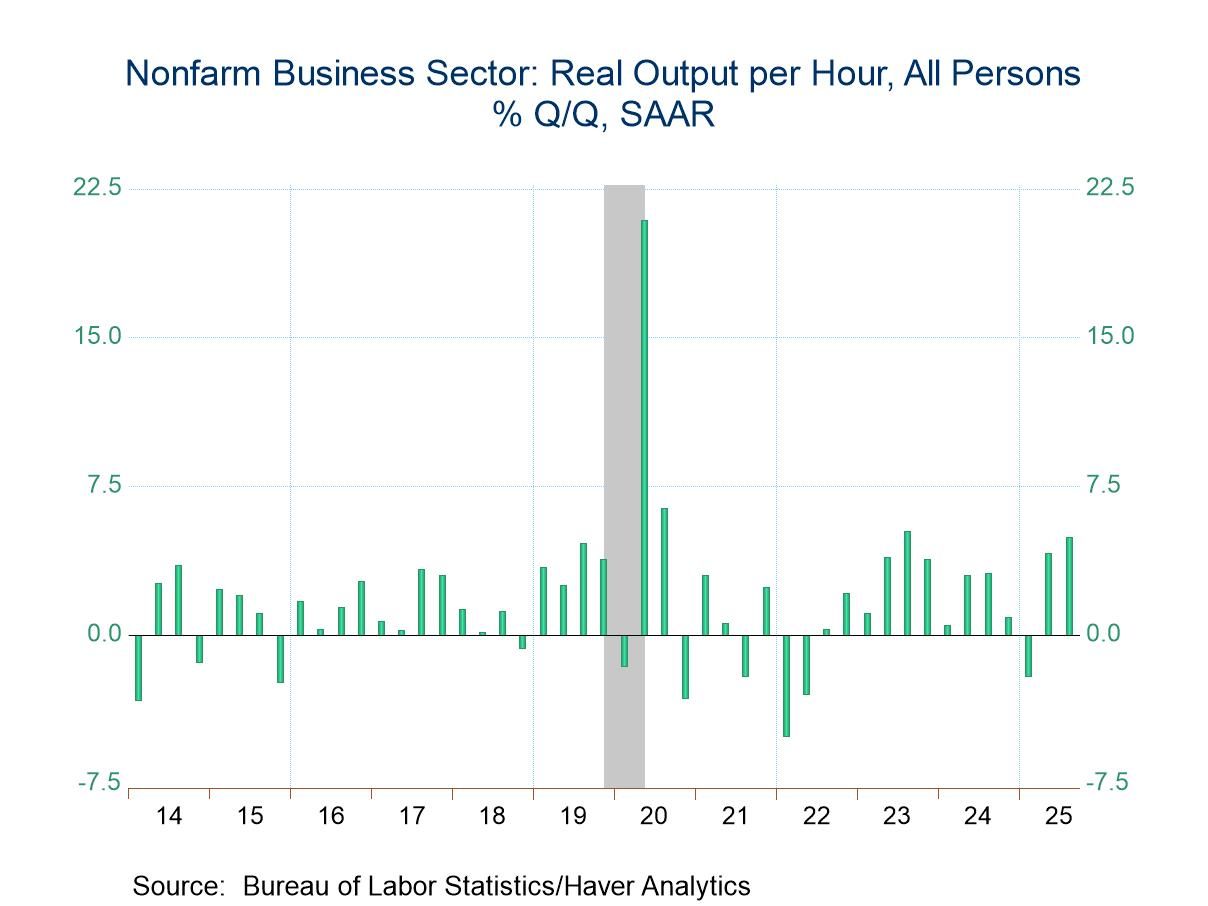

U.S. Productivity Jumped in Q3; Unit Labor Costs Fell

- Nonfarm business output per hour rose 4.9% q/q SAAR in Q3 on top of an upward revision to Q2.

- Compensation increased 2.9% in Q3 resulting in a 1.9% quarterly decline in unit labor costs.

by:Sandy Batten

|in:Economy in Brief

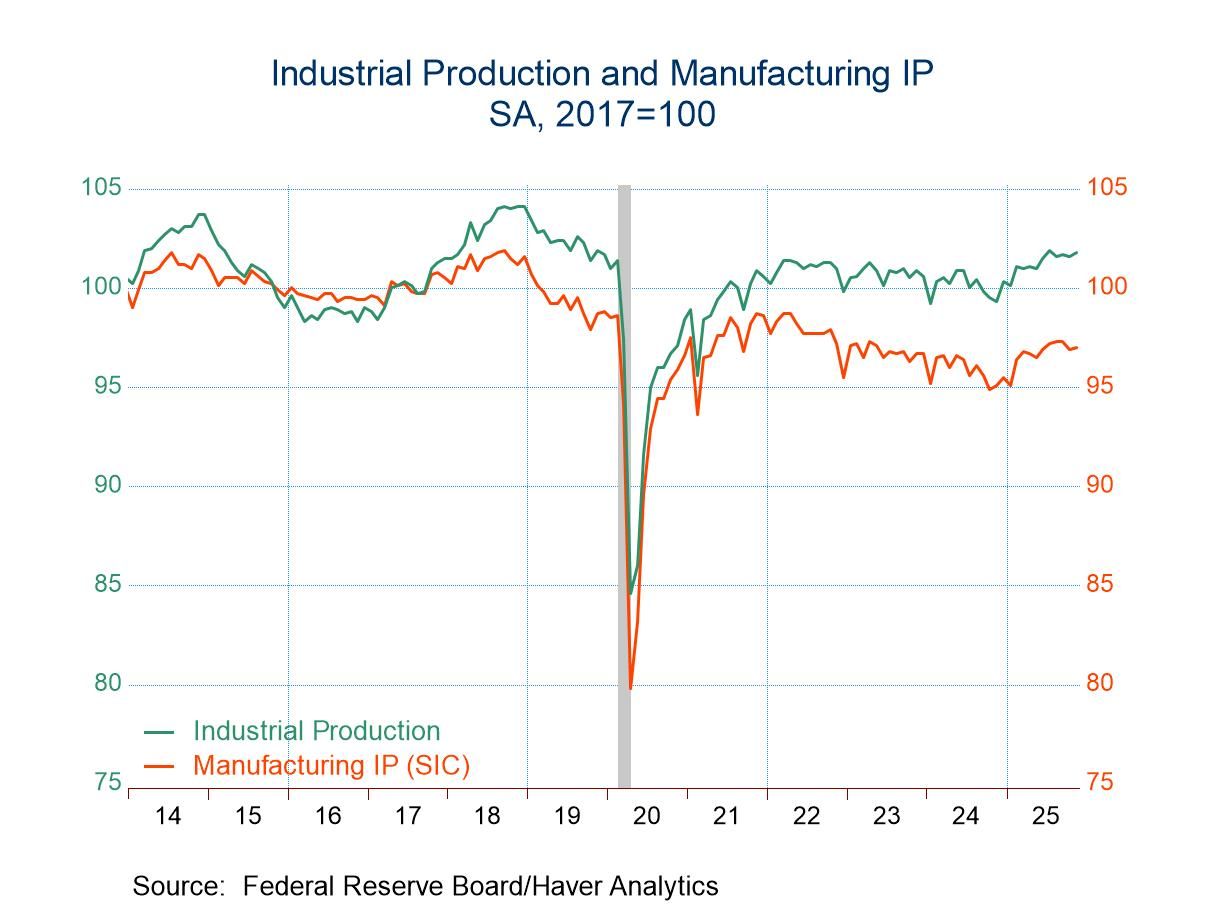

- Today’s release contained figures for both October and November that had been delayed by the federal government shutdown.

- IP fell in October but recovered in November.

- Manufacturing output was tepid, falling in October and unchanged in November.

- A surge in utilities output in October prevented a larger decline in total production.

- A jump in mining output in November accounted for all of the increase in total production.

by:Sandy Batten

|in:Economy in Brief

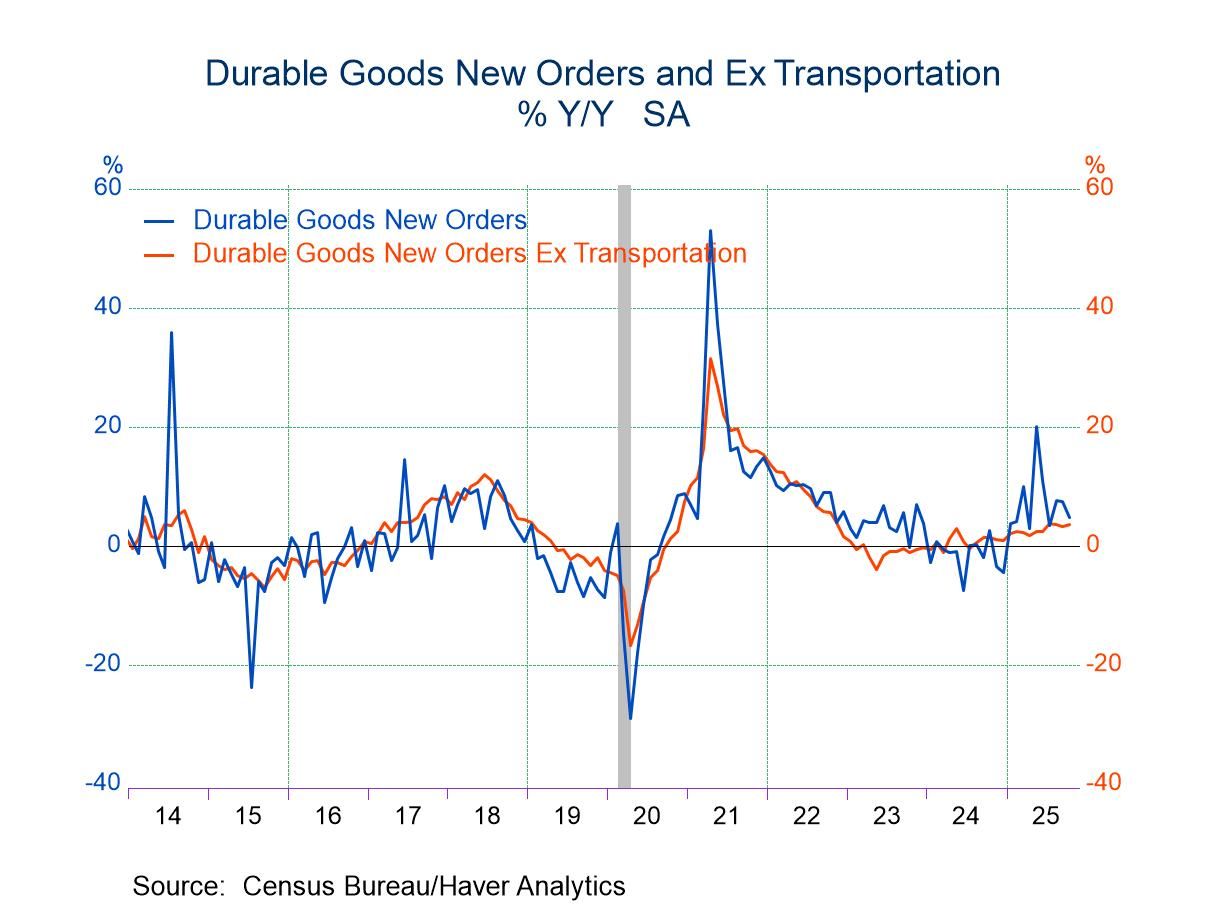

- New orders for durable goods slumped 2.2% m/m in October following increases in both August and September

- A 24% monthly drop in aircraft orders drove the overall decline

- Orders excluding aircraft rose 0.2% m/m in October

- Core capital goods shipments and orders continued to rise in October with small upward revisions to September

by:Sandy Batten

|in:Economy in Brief

- USA| Dec 19 2025

U.S. Existing Home Sales Edged Up in November

- Existing home sales increased 0.5% m/m in November, the third consecutive monthly gain.

- Month-over-month sales increased in the Northeast and South, were unchanged in the West, and fell in the Midwest.

- Year-over-year sales were unchanged in the Northeast and South and decreased in the Midwest and West.

by:Sandy Batten

|in:Economy in Brief

- USA| Dec 16 2025

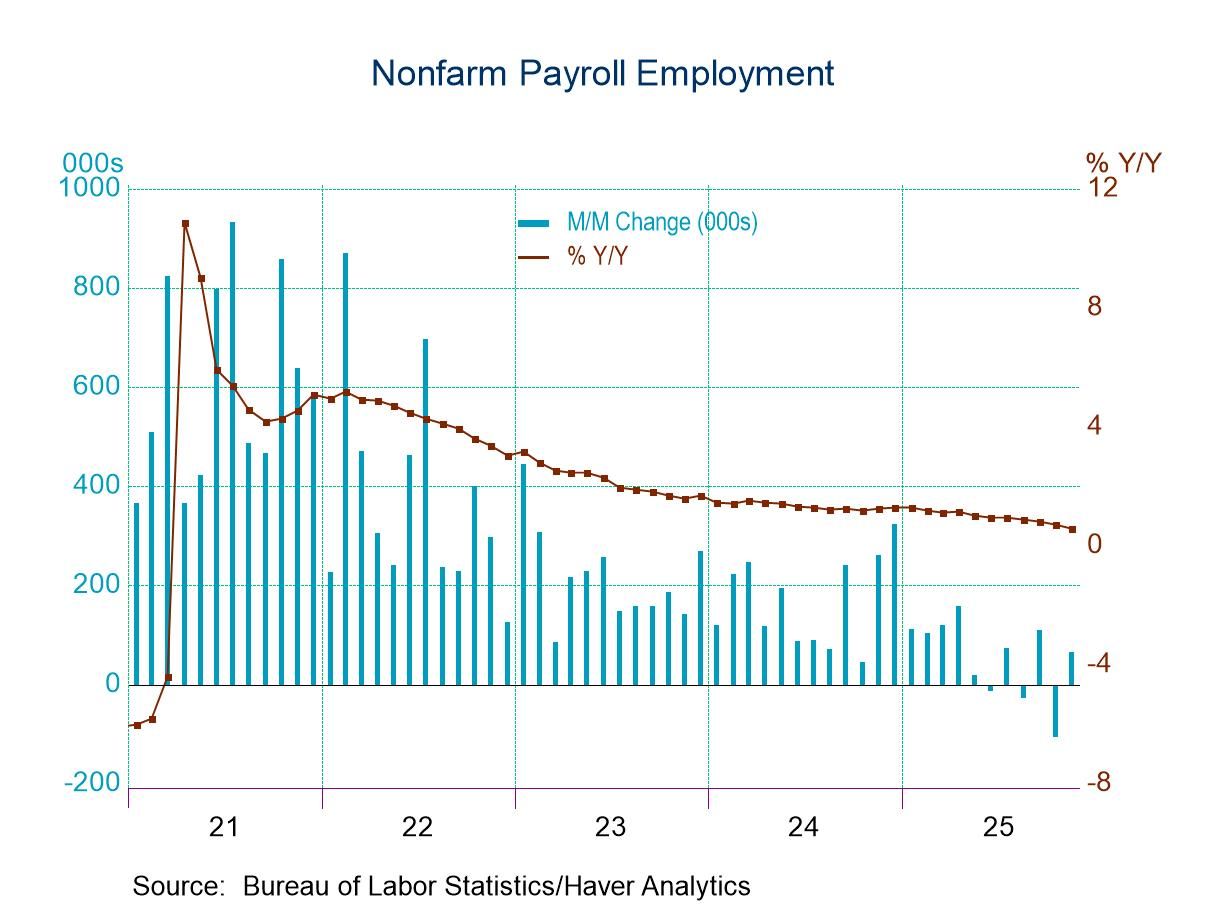

U.S. Employment and the Unemployment Rate Rose in November

- Total payrolls rose 64k in November but fell 105k in October

- The October decline was more than accounted for by a 157k decline in government employment

- The unemployment rate jumped to 4.6% in November from 4.4% in September.

- There were no household survey data collected for October.

by:Sandy Batten

|in:Economy in Brief

- of57Go to 1 page