Global| Jun 27 2019

Global| Jun 27 2019U.S. GDP Growth Is Unrevised; Corporate Profits Weaken

by:Tom Moeller

|in:Economy in Brief

Summary

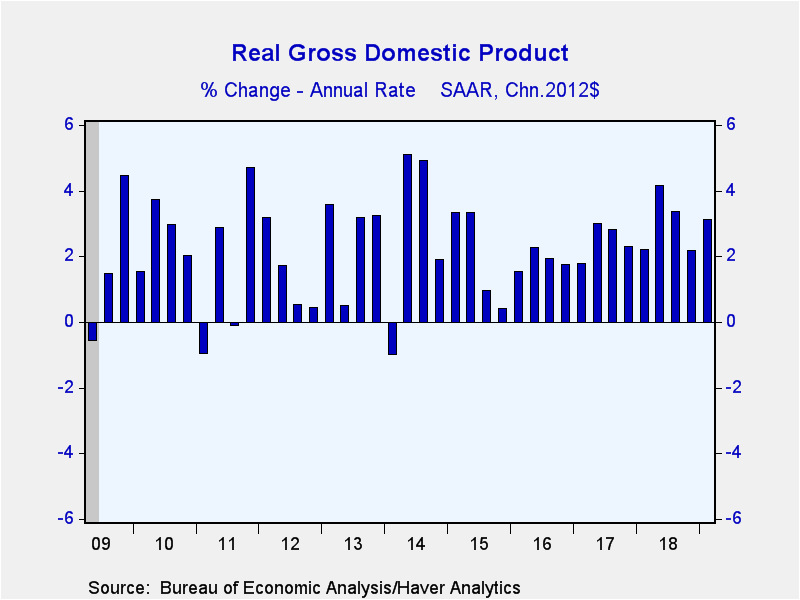

Economic growth maintained a moderate pace early this year. Gross domestic product, adjusted for price inflation, increased an unrevised 3.1% during Q1'19. The 3.2% y/y growth rate remained the strongest increase since Q2'15. The rise [...]

Economic growth maintained a moderate pace early this year. Gross domestic product, adjusted for price inflation, increased an unrevised 3.1% during Q1'19. The 3.2% y/y growth rate remained the strongest increase since Q2'15. The rise matched expectations in the Action Economics Forecast Survey. Personal spending growth was reduced but business fixed investment was strengthened.

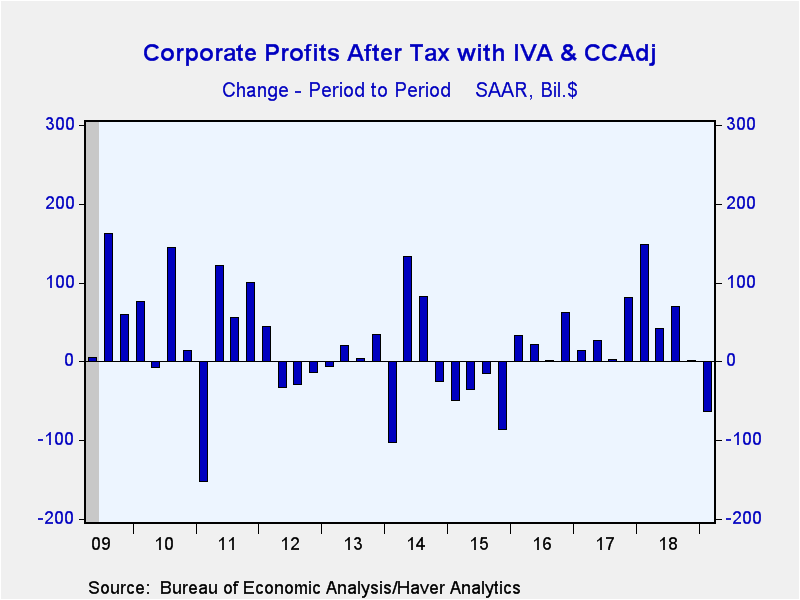

After-tax corporate profits with inventory and capital consumption adjustments declined a lessened $63.9 billion (+2.3% y/y), the first decline since Q3'16. Before-tax profits with IVA & CCA fell $59.3 billion (+3.4% y/y). Domestic nonfinancial profits fell $68.1 billion (+6.5% y/y), the first decline since Q3'17. Profits earned abroad rose $7.4 billion (1.2% y/y), and earnings in the domestic financial sector gained $1.4 billion (-13.4% y/y).

The contribution to growth in real GDP from inventory investment was unchanged at 0.6 percentage points following a 0.1 percentage point addition in Q4'18. Improvement in the foreign trade deficit added a lessened 0.9 percentage points to growth following two quarters of subtraction. Export growth of 5.2% (2.8% y/y) was the largest gain since Q2'18. Imports fell 1.9% (+2.1% y/y) and reversed the Q4 rise.

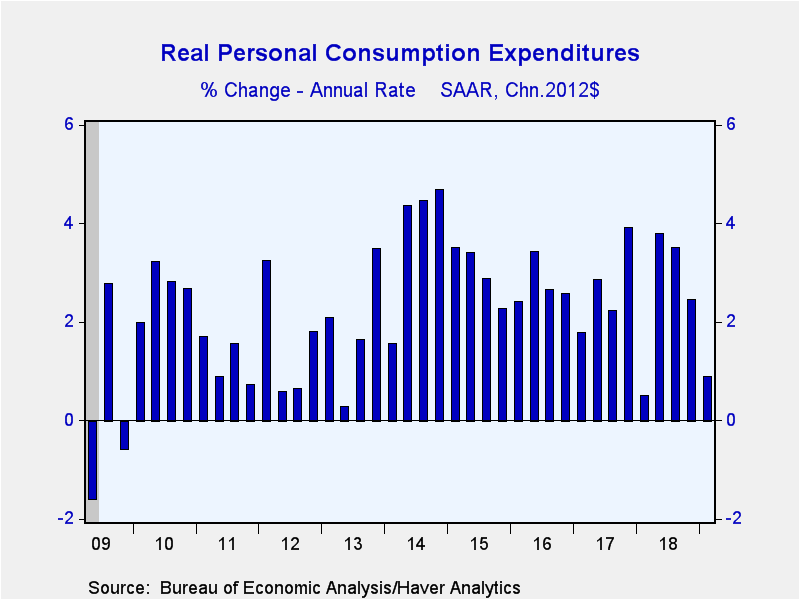

Growth in final sales to domestic purchasers of 1.6% (2.7% y/y), revised from 1.5%, remained the weakest rate of growth since Q4'15. Consumer spending rose a lessened 0.9% (2.7% y/y), remaining the weakest rise in a year. A 2.4% decline (+3.3% y/y) in durable goods demand was led by a 17.2% shortfall (-1.6% y/y) in motor vehicle & parts sales. Demand for home furnishings & household equipment rose 1.1% (2.1% y/y) which compared to the earlier estimate of a modest decline. Sales of recreational goods & vehicles rose an improved 12.7% (8.3% y/y). Nondurable product sales increased 2.3% (3.2% y/y). The rise continued to center in the "other" category, as apparel & shoes demand fell 4.0% (+4.2% y/y). Food & restaurant sales declined 3.3% (+0.9% y/y) and demand for gasoline & oil eased 1.0% (+0.7% y/y). Demand for services rose a downwardly revised 1.0% (2.4% y/y), the weakest growth in a year. Transportation sales rose a downwardly revised 2.4% (0.5% y/y) and demand for financial services & insurance improved 1.6% (1.5% y/y). Health care services demand rose a strong 5.6% (3.2% y/y) and housing & utilities purchases increased 1.0% (1.5% y/y). Offsetting these increases was a little changed 1.9% decline (+0.6% y/y) in the demand for recreation services, the second decline in three quarters.

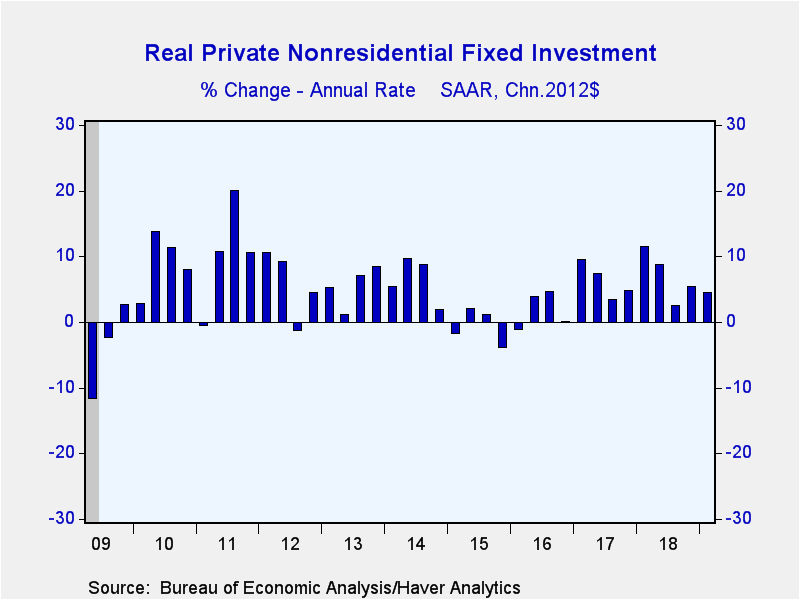

Business fixed investment grew a strengthened 4.4% (5.3% y/y) after a 5.4% Q4'18 rise. Investment in structures was increased to 4.4% (2.6% y/y) following two quarters of decline. Equipment demand fell an unchanged 1.0% (+3.4% y/y) as an 8.1% decline (+2.4% y/y) in "other" equipment offset a 6.2% rise (5.0% y/y) in transportation equipment. Investment in intellectual property products surged an upwardly revised 12.0% (9.7% y/y). Industrial equipment sales declined 2.9% (+2.1% y/y) and demand for information processing equipment held steady (3.6% y/y).

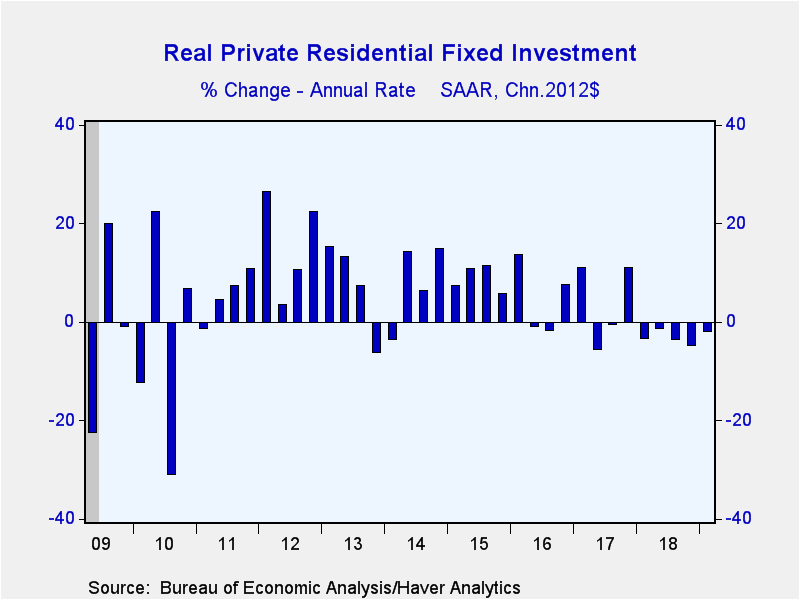

The 2.0% decline (-2.9% y/y) in residential investment was less than estimated last month, but it remained 3.8% below the peak in Q4'17.

Government expenditures grew at an improved 2.8% rate (1.9% y/y). State & local government spending growth of 4.6% (1.8% y/y) was accompanied by a 0.1% easing (+2.0% y/y) in federal government expenditures. A 4.0% jump (5.3% y/y) in defense spending offset a 5.8% decline (-2.5% y/y) in nondefense outlays.

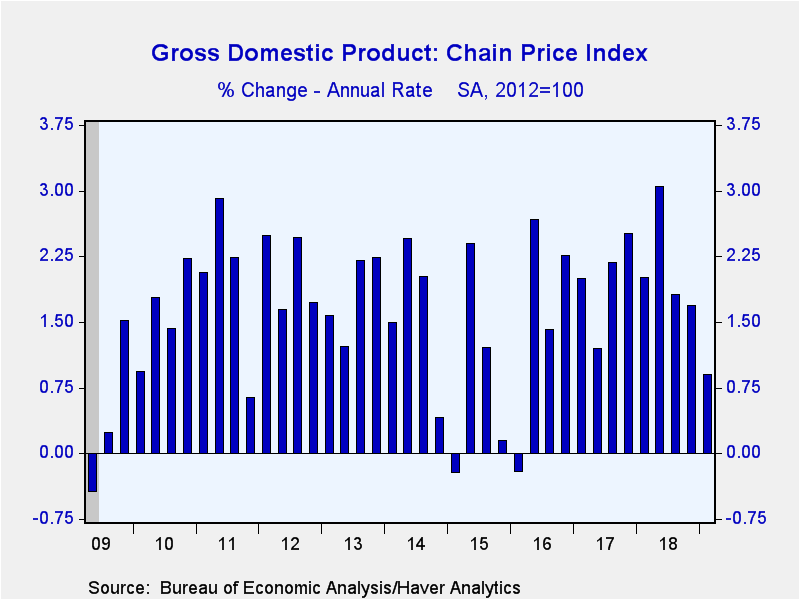

The GDP chain price index increased an unrevised and expected 0.9% (AR, 1.9% y/y), the weakest y/y rise in three years. A 0.8% rise had been expected. The PCE chain price index increase of 0.5% (1.4% y/y) was bolstered by a 1.2% rise (1.7% y/y) in the index excluding food & energy. The business fixed investment price price index rose 1.5% both q/q and y/y, and the residential price index gained 2.5% (4.0% y/y). The government spending price index increased 1.1% (2.3% y/y).

The GDP figures can be found in Haver's USECON and USNA database. USNA contains virtually all of the Bureau of Economic Analysis' detail in the national accounts. Both databases include tables of the newly published not seasonally adjusted data. The Action Economics consensus estimates can be found in AS1REPNA.

| Chained 2012 $ (%, AR) | Q1'19 (Third Estimate) | Q1'19 (Second Estimate) | Q1'19 (Advance Estimate) | Q4'18 | Q3'18 | Q1'19 Y/Y | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|---|

| Gross Domestic Product | 3.1 | 3.1 | 3.2 | 2.2 | 3.4 | 3.2 | 2.9 | 2.2 | 1.6 |

| Inventory Effect (%-point) | 0.6 | 0.6 | 0.7 | 0.1 | 2.3 | 0.5 | 0.1 | 0.0 | -0.5 |

| Final Sales | 2.6 | 2.5 | 2.5 | 2.1 | 1.0 | 2.7 | 2.7 | 2.2 | 2.1 |

| Foreign Trade Effect (%-point) | 0.9 | 1.0 | 1.0 | -0.1 | -2.0 | 0.1 | -0.2 | -0.3 | -0.3 |

| Domestic Final Sales | 1.6 | 1.5 | 1.4 | 2.1 | 2.9 | 2.7 | 2.9 | 2.5 | 2.3 |

| Personal Consumption Expenditure | 0.9 | 1.3 | 1.2 | 2.5 | 3.5 | 2.7 | 2.6 | 2.5 | 2.7 |

| Nonresidential Fixed Investment | 4.4 | 2.3 | 2.7 | 5.4 | 2.5 | 5.3 | 6.9 | 5.3 | 0.5 |

| Residential Investment | -2.0 | -3.5 | -2.8 | -4.7 | -3.5 | -2.9 | -0.3 | 3.3 | 6.5 |

| Government Spending | 2.8 | 2.5 | 2.4 | -0.4 | 2.6 | 1.9 | 1.5 | -0.1 | 1.4 |

| Chain-Type Price Index | |||||||||

| GDP | 0.9 | 0.8 | 0.9 | 1.7 | 1.8 | 1.9 | 2.2 | 1.9 | 1.1 |

| Personal Consumption Expenditure | 0.5 | 0.4 | 0.6 | 1.5 | 1.6 | 1.4 | 2.0 | 1.8 | 1.1 |

| Less Food & Energy | 1.2 | 1.0 | 1.0 | 1.8 | 1.6 | 1.7 | 1.9 | 1.6 | 1.7 |

| Nonresidential Investment | 1.5 | 1.5 | 1.3 | 1.1 | 1.6 | 1.5 | 1.2 | 0.7 | -0.8 |

| Residential Investment | 2.5 | 2.5 | 1.8 | 2.6 | 3.6 | 4.0 | 5.6 | 4.5 | 3.6 |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.