Global| Dec 22 2006

Global| Dec 22 2006U.S. Personal Income Again Light, Core Prices Ease

by:Tom Moeller

|in:Economy in Brief

Summary

November personal income again rose a bit less than expectations with a 0.3% increase after a downwardly revised 0.3% increase in October. The PCE chain price index was unchanged after an unrevised 0.2% decline in October. Prices less [...]

November personal income again rose a bit less than expectations with a 0.3% increase after a downwardly revised 0.3% increase in October.

The PCE chain price index was unchanged after an unrevised 0.2% decline in October. Prices less food & energy also were unchanged for the first time since 2002. The three month change in core prices fell to 1.8% (AR) and the six month change fell to 2.1%, its lowest this year.

Disappointment in income continued as rental income fell 2.8% (-7.9% y/y) after a downwardly revised 4.7% skid in October. Proprietors' income also rose just 0.1% (2.9% y/y) but October's increase was revised up to 0.6%.

Wage & salary disbursements increased 0.3% (6.3% y/y) although the October increase was lessened a bit to 0.5%. Factory sector wages slipped marginally (+3.9% y/y) following a downwardly revised 0.4% gain while wages in the private service-producing industries rose a moderate 0.4% (6.8% y/y).

Interest income rose 0.4% (6.3% y/y) for the second month and dividend income surged 1.1% (11.7% y/y) for the third month.

Disposable personal income increased 0.3% (5.1% y/y) after a downwardly revised 0.2% October. Personal taxes increased 0.5% (11.8% y/y) after the 1.1% October jump.

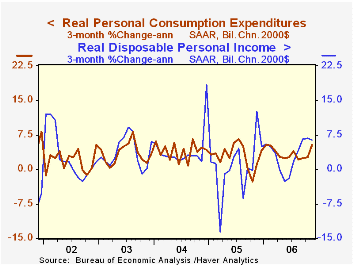

Real disposable personal income rose 0.3% (3.2% y/y) last month and the three month growth in real income was 6.4% (AR). Real disposable income per capita rose 0.2% (2.2% y/y) and three month growth was 5.4% (AR).Personal consumption surged 0.5% after the upwardly revised 0.3% gain during October. Expectations had been for a 0.6% increase. Real consumer spending rose 0.5%, the same as in October.

The personal savings rate was a more negative -1.0% last month and so far in 2006 has averaged -0.9%. Should the Decline in the Personal Saving Rate Be a Cause for Concern? from the Federal Reserve Bank of Kansas City is available here.

| Disposition of Personal Income | November | October | Y/Y | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|

| Personal Income | 0.3% | 0.3% | 5.9% | 5.2% | 6.2% | 3.2% |

| Personal Consumption | 0.5% | 0.3% | 5.7% | 6.5% | 6.6% | 4.8% |

| Savings Rate | -1.0% | -0.7% | -0.3% (Nov. '05) | -0.4% | 2.0% | 2.1% |

| PCE Chain Price Index | 0.0% | -0.2% | 1.9% | 2.9% | 2.6% | 2.0% |

| Less food & energy | 0.0% | 0.2% | 2.2% | 2.1% | 2.0% | 1.4% |

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.