Global| Feb 02 2007

Global| Feb 02 2007U.S. Vehicle Sales Steady in January

Summary

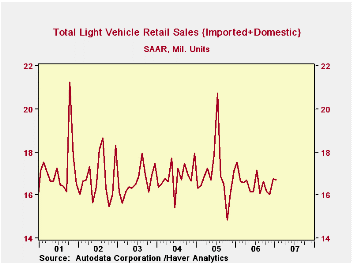

In January, U.S. sales of light vehicles eased 0.1% from the prior month to 16.73M units, according to the Autodata Corporation. This was 4.6% below January 2006. There were offsetting moves in trucks and cars. Total truck sales came [...]

In January, U.S. sales of light vehicles eased 0.1% from the prior month to 16.73M units, according to the Autodata Corporation. This was 4.6% below January 2006.

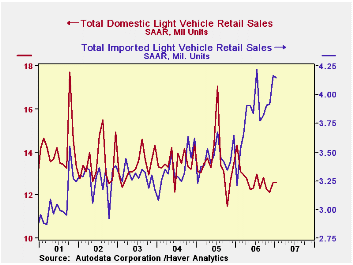

There were offsetting moves in trucks and cars. Total truck sales came to 9.04 million, up 4.5% from December and the largest volume of truck sales since 9.11 million last March. Domestic and import trucks gained in about equal proportion.

Car sales, in almost mirror fashion, fell 5.0% in the month and 9.0% from a year ago. Domestic car sales, at 5.12 million lost much of their December increase, down 5.8%; they were down 21.5% from January 2006, but that was an unusually high month. Sales of imported autos were 2.57 million, down 3.4% from December, but up 33.5% from a weak year-ago figure.

Vehicle sales have been firmer in the last two months and we'd surmise that lower gasoline prices have something to do with that. At the same time, the increase does not carry these sales much above earlier months of 2006, suggesting that consumers remain skittish about prospects for gas prices as 2007 progresses. The fact that import brands tend to be better at fuel-efficient vehicles is seen in the escalating share of imports in the total. Note too that among "domestics", import brands produced in North America also have better sales. In Haver's INDUSTRY database, we tabulate these sales by manufacturer, and market shares of specific companies can be assessed using those data.

| Light Vehicle Sales (SAAR, Mil. Units) | January | December | Y/Y | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| Total | 16.73 | 16.74 | -4.6% | 16.55 | 16.96 | 16.87 |

| Autos | 7.69 | 8.09 | -9.0% | 7.77 | 7.65 | 7.49 |

| Trucks | 9.04 | 8.65 | -0.5% | 8.78 | 9.32 | 9.37 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates