Global| Oct 19 2007

Global| Oct 19 2007UK GDP Maintains 0.8% Growth in Q3; Industry Sectors Rotate Leadership

Summary

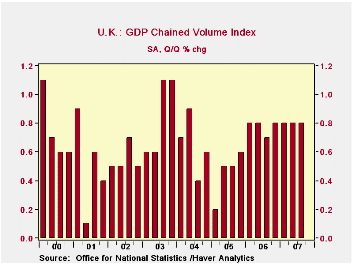

Overall Q3 GDP growth in the UK appears to make for boring reading, at 0.8% Qtr/Qtr for a fourth consecutive time and a sixth time out of the last seven quarters. But with the upheaval in world financial markets coming to a head right [...]

Overall Q3 GDP growth in the UK appears to make for boring reading, at 0.8% Qtr/Qtr for a fourth consecutive time and a sixth time out of the last seven quarters. But with the upheaval in world financial markets coming to a head right in the middle of Q3, we'll be grateful for a steady growth rate. At the same time, a quick look at the table indicates that it is only the total that is steady. Almost every major industrial sector altered its recent trends noticeably during the period to bring offsetting gains and losses.

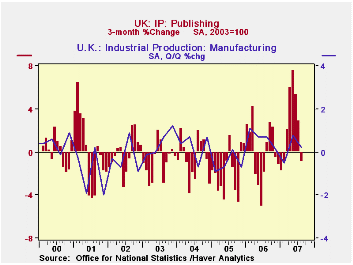

Manufacturing slowed to a 0.2% rise in Q3 from 0.8% in Q2. As with the economy as a whole, segments of manufacturing experienced a mixed performance, according to industrial production data through August, reported about 10 days ago. Food, some metals and transportation equipment appear to have declined in Q3; textiles, chemicals and electrical equipment are flattish, while wood products, furniture and machinery have all been expanding. We noted here three months ago in our discussion of Q2 data that the publishing industry was showing great strength then. That was borne out by later, more complete information showing 6.9% Qtr/Qtr growth in Q2; now, in Q3, that is fading, with output actually down noticeably in August.

Another source of strength in Q2 was mining. Output in that sector has apparently fallen in Q3, but only by 0.3%, according to today's ONS estimates. That is still a far cry from the 8% and 9% declines during 2005 and 2006 and reflects the continuing benefits of the new Buzzard oil field.

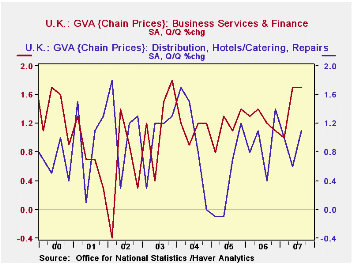

As for the service sectors, Robert Brusca highlighted yesterday the strengthening in retail sales, and that contributed to an estimated 1.1% advance in the distribution industries in Q3, nearly double Q2's 0.6%. Transport and communication also saw a pickup in growth, to 1.1% from 0.8% in Q2. Business services, an area of strong growth in many parts of the world, kept up its already high 1.7% Q2 gain through Q3 as well. The separate construction sector repeated its 0.8% growth in Q1 and Q2 through Q3.

| UK GDP, SA % Chg | Qtr/Qtr Year/Year2006 | 2005 | 2004 | ||||

|---|---|---|---|---|---|---|---|

| 3Q 2007 | 2Q 2007 | 3Q 2007 | 2Q 2007 | ||||

| Total | 0.8 | 0.8 | 3.3 | 3.1 | 2.8 | 1.9 | 3.2 |

| Mining* | -0.3 | 1.3 | -1.8 | -1.3 | -8.2 | -9.2 | -7.2 |

| Manufacturing | 0.2 | 0.8 | 0.6 | 1.1 | 1.3 | -1.2 | 2.0 |

| Services | 1.0 | 0.9 | 4.0 | 3.7 | 3.7 | 2.9 | 3.7 |

| Distribution, Hotels, Restaurants | 1.1 | 0.6 | 4.1 | 3.4 | 3.5 | 1.2 | 5.2 |

| Transportation & Communication | 1.1 | 0.8 | 5.8 | 5.4 | 3.8 | 4.3 | 2.5 |

| Business Services & Finance | 1.7 | 1.7 | 5.6 | 5.1 | 5.3 | 4.5 | 5.0 |

| *Includes oil & gas extraction | |||||||

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates