Global| Dec 20 2006

Global| Dec 20 2006UK Institutional Investors Invest Record Amount in Q3

Summary

UK institutional investors added a record amount to their asset portfolios in Q3, according to the "First Release" of the widely followed "MQ5" report, which was issued this morning by the Office of National Statistics. Insurance [...]

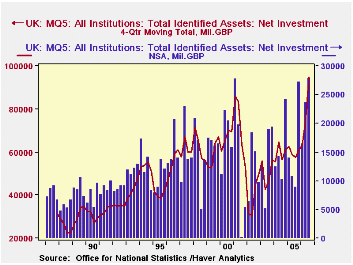

UK institutional investors added a record amount to their asset portfolios in Q3, according to the "First Release" of the widely followed "MQ5" report, which was issued this morning by the Office of National Statistics. Insurance companies, pension funds and trusts (mutual funds) acquired a net of £27.8 billion in UK and overseas securities, cash, and real estate and other assets, compared with £23.6 billion in Q2 and a previous record of £27.7 billion in Q1 2001. Further, the sum of the first three quarters of 2006 is £67.7 billion, just £1.8 billion shy of the largest investment amount in any previous YEAR, which was £69.5 billion in 2000.

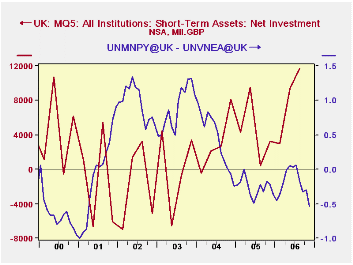

Investment patterns have been quite interesting this year as well. In both Q2 and Q3 the firms have concentrated on additions to short-term holdings. See in the table below that such "cash and equivalents" are a large proportion of net investment, indeed, about 42% in Q3. In Q2 they were 40% of the total. This looks at a glance to reflect the negative yield curve in the UK -- and elsewhere, for that matter. In the second graph, we show net investment in short-term assets against the yield curve, measured as the spread between the 10-year nominal par yield on gilts and the 1-month sterling inter-bank rate. There appears to be a rough negative relationship, and indeed, why would investors put their money out long when short instruments pay more?

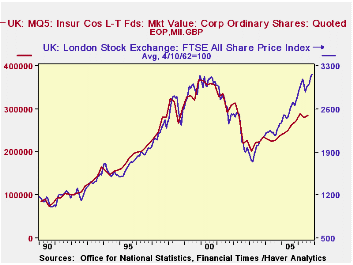

A second development of interest is the net liquidations of company shares, which are evident in our table. These groups of institutions have been net sellers of shares continuously since the spring of 2003, and off-and-on since 1999. It is important to notice here that these figures are the net of acquisitions and what in the UK are known as "realisations". They are NOT net changes in market value. In fact, the latter have been positive, as seen in the third graph, which also shows the trend in stock prices. The market value of stock holdings has continued to rise, even as this important UK investor group has been selling. It's an intriguing situation.

| UK: MQ5 Net Investment, £ Millions |

Q3 2006 | Q2 2006 | Q3 2005 | Quarterly Averages|||

|---|---|---|---|---|---|---|

| 2005 | 2004 | 2003 | ||||

| Total Identified Assets | 27,776 | 23,552 | 8,898 | 15,183 | 15,250 | 14,048 |

| Short-Term | 11,699 | 9,395 | 439 | 4,357 | 3,103 | 157 |

| British Govt Securities | 6,035 | 4,804 | 3,042 | 2,450 | 4,150 | 4,974 |

| UK Company Shares | -8,203 | -8,460 | -6,044 | -5,507 | -5,209 | -1,293 |

| Other UK Company Securities | 3,178 | 5,517 | 3,111 | 3,545 | 5,126 | 6,445 |

| Overseas Company Shares | 3,021 | -1,832 | 3,253 | 3,289 | 3,594 | 924 |

| Other Overseas Company Securities | 5,530 | 6,671 | -495 | 1,891 | 2,435 | 1,742 |

| Overseas Govt Securities | 2,266 | 2,219 | -596 | 89 | -1,011 | -859 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates