Global| Nov 15 2006

Global| Nov 15 2006UK Labor Market Stalls; Unemployment Rate Highest since Spring 2000

Summary

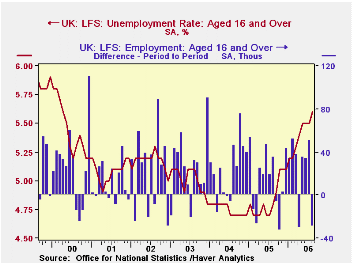

Employment in the UK fell 29,000 in the August period, reversing more than half of July's 51,000 increase. This move accompanied a 0.1% uptick in the unemployment rate to 5.6% from 5.5%. Both figures are three-month centered moving [...]

Employment in the UK fell 29,000 in the August period, reversing more than half of July's 51,000 increase. This move accompanied a 0.1% uptick in the unemployment rate to 5.6% from 5.5%. Both figures are three-month centered moving averages, so they cover July, August and September. Compared with three months before, the style of comparison that the UK's Office of National Statistics (ONS) generally emphasizes, the August number was up 56,000 from May, which in turn had been up 43,000 from February. So their longer horizon still highlights gains in the late spring/early summer.

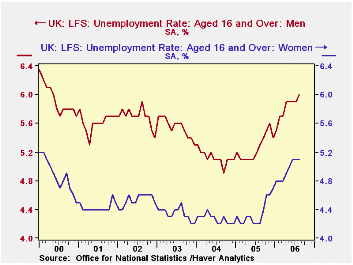

By demographic category, employment among men continued to increase modestly, while women's employment fell 39,000 from the July period to August. Interestingly, the increase in the unemployment rate occurred among men, from 5.9% to 6.0%, while the rate for women remained steady at 5.1%. A sizable rise in the number of women deciding to leave the labor force -- becoming "economically inactive" in the ONS terminology -- to maintain their homes kept their unemployment rate from going up. Even so, the overall 5.6% unemployment rate is the highest since the April period in 2000.

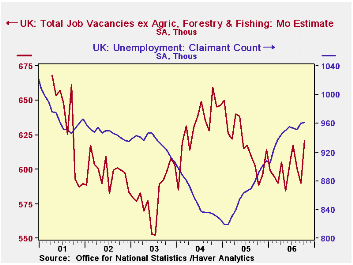

Another sign of softness in the UK labor situation came in the average earnings index, or AEI. This is an index of average earnings over the last three months relative to the same period a year ago. It slowed to 3.9% in the latest three-month period from 4.2% the period before. This effectively closed off a firming trend that had been running since February. This measure is seen in the UK as a major determinant of inflation pressure, and it is watched closely by financial markets and the Bank of England. Indeed, press reports highlighted the slowdown this morning. Additionally, the so-called claimant count rose in the month of October, reaching 961,300, up almost 10,000 from just two months ago and 70,000 from a year ago (7.9%). Two months ago here, we took note of politicians' pleasure in a "welcome fall" in claimants for unemployment benefits, but the mild reduction back in the summer has been more than counterbalanced. In contrast, a more favorable labor market development is a gain of 30,000 in the number of reported job vacancies, which reached 620,600, the highest in 17 months.

| UK Labor Force Survey & Related Labor Data | Oct 2006 | Sept 2006 | Aug 2006 | July 2006 | Year Ago | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|

| Employment (3Mo Avg, SA, Thous) |

-- | -- | 28,986 | 29,015 | 28,794 | 28,730 | 28,465 | 28,183 |

| Chg from 1 & 3 Months Ago | -- | -- | -29/56 | 51/120 | +16(MoAvg) | 0.9% | 1.0% | 1.0% |

| Unemployment Rate (3Mo Avg, SA, %) |

-- | -- | 5.6% | 5.5% | 4.8% | 4.8% | 4.8% | 5.0% |

| Claimant Count (Monthly, Thous) |

963.1 | 960.1 | 951.8 | 954.0 | 891.2 | 874.4 | 866.1 | 945.9 |

| Vacancies (Monthly, Thous) | 620.6 | 590.0 | 600.7 | 617.6 | 588.4 | 619.0 | 631.9 | 582.0 |

| Average Earnings Index inc Bonus (Headline Rate*) | -- | 3.9% | 4.2% | 4.4% | 4.2% | 4.0% | 4.5% | 3.4% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates