Global| Jul 06 2007

Global| Jul 06 2007Who Says Manufacturing Growth Is All in Asia? German Factory Orders Up Markedly in May

Summary

Sometimes it's easy to dismiss manufacturing activity in the West. Asian producers have come on so strong in the last several years that one might think European and North American manufacturing is fading away. But this is not so. [...]

Sometimes it's easy to dismiss manufacturing activity in the West. Asian producers have come on so strong in the last several years that one might think European and North American manufacturing is fading away. But this is not so. Activity in the US has slowed the last several months, but new orders are still maintaining better than 5% annual growth over the past five years in nominal terms. In Europe, a volume measure published by Eurostat is rising at a similar pace.

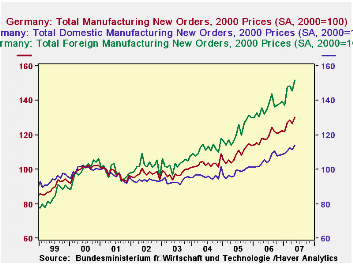

The most recent evidence of continued industrial vitality in the West comes from Germany, where new factory orders surged in May by 3.2%. This more than reversed a dip in April of 1.6%. These orders stand 7.5% ahead of a year ago, on top of last year's overall growth of 9.0%. Foreign customers are increasing their demand for German products, particularly those outside the Euro-Zone. Total foreign orders were up 4.4% in May, with gains among Euro partners of 3.6% and 5.1% elsewhere. Domestic orders were up 2.2% in the latest month.

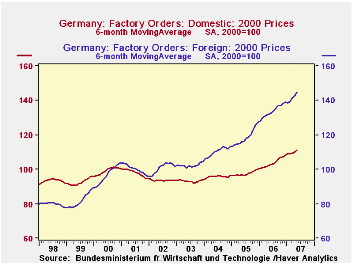

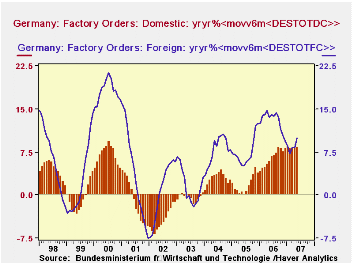

Year-ago co mparisons suggest that growth in foreign orders is far outstripping that in domestic orders. The latter are up just 3.8% from May 2006, while orders from Euro-Zone customers are up 9.6% and from non-Euro-Zone, 12.4%. But what these figures really show is volatility. To smooth some of this out, we can examine the performance of moving averages. With the new, oncoming DLXVG3, we can perform nested-function calculations, so we can take a moving average and then do a percent change on the smoothed series. We illustrate that in the second and third graphs, with, first the 6-month moving averages and then the 12-month growth in those moving averages. We see that domestic orders have accelerated to over 8% on this basis, catching up to growth in foreign orders. The last time domestic orders were this strong was in 2000, just at the peak of the tech boom.

mparisons suggest that growth in foreign orders is far outstripping that in domestic orders. The latter are up just 3.8% from May 2006, while orders from Euro-Zone customers are up 9.6% and from non-Euro-Zone, 12.4%. But what these figures really show is volatility. To smooth some of this out, we can examine the performance of moving averages. With the new, oncoming DLXVG3, we can perform nested-function calculations, so we can take a moving average and then do a percent change on the smoothed series. We illustrate that in the second and third graphs, with, first the 6-month moving averages and then the 12-month growth in those moving averages. We see that domestic orders have accelerated to over 8% on this basis, catching up to growth in foreign orders. The last time domestic orders were this strong was in 2000, just at the peak of the tech boom.

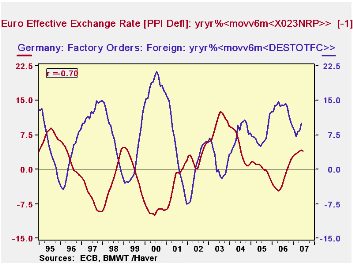

At the same time, the continuing strength in foreign orders, particularly those outside the Euro-Zone, seems surprising in view of the recent strengthening of the euro. So we looked at this relationship too, with the same year-to-year % change in the 6-month moving average. We find a rather nice, negative relationship with the effective euro exchange rate for the so-called "narrow" group of countries, deflated by the PPIs, which we assume would be a relevant price index for judging the competitiveness of manufacturers. The correlation ratio is -68%. We can improve that slightly, to -70%, by leading the exchange rate variable by 1 month, so that as customers examine their situation, the current exchange rate may have a modest impact on action they take the following month. We see here that the recent experience of orders gains is not really out of line with the exchange rate: as our exchange rate growth variable has started to flatten, orders growth has started to pick up, maintaining the negative reaction. The relationship is in the growth rates, not just the levels.

At the same time, the continuing strength in foreign orders, particularly those outside the Euro-Zone, seems surprising in view of the recent strengthening of the euro. So we looked at this relationship too, with the same year-to-year % change in the 6-month moving average. We find a rather nice, negative relationship with the effective euro exchange rate for the so-called "narrow" group of countries, deflated by the PPIs, which we assume would be a relevant price index for judging the competitiveness of manufacturers. The correlation ratio is -68%. We can improve that slightly, to -70%, by leading the exchange rate variable by 1 month, so that as customers examine their situation, the current exchange rate may have a modest impact on action they take the following month. We see here that the recent experience of orders gains is not really out of line with the exchange rate: as our exchange rate growth variable has started to flatten, orders growth has started to pick up, maintaining the negative reaction. The relationship is in the growth rates, not just the levels.

The German orders data are contained in the main country-source database GERMANY and also in Haver's own G10. US orders data were referenced from USECON and the European totals and exchange rate are from EUROSTAT.

| GERMANY: Manufacturers' New Orders |

May 2007* | Apr 2007* | Mar 2007* | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Total (2000=100) | 130.6 | 126.5 | 128.5 | 117.4* | 119.0 | 109.1 | 104.1 |

| % Change | 3.2 | -1.6 | 1.1 | 7.5 | 9.0 | 4.9 | 6.8 |

| Domestic | 2.2 | -1.2 | 1.9 | 3.8 | 7.0 | 1.6 | 4.3 |

| Euro-Zone | 3.6 | -1.5 | -1.0 | 9.6 | 7.7 | 8.0 | 9.2 |

| Non-Euro-Zone | 5.1 | -2.3 | 1.4 | 12.4 | 13.8 | 8.7 | 9.8 |

| Intermediate Goods | 2.4 | -1.8 | 2.5 | 4.7 | 10.5 | 2.3 | 6.5 |

| Capital Goods | 3.8 | -2.0 | 0.2 | 10.3 | 8.6 | 6.9 | 8.2 |

| Consumer Goods | 4.0 | 1.6 | 0.2 | 4.6 | 4.8 | 4.3 | 1.4 |

| Memo: Euro** | 0.2 | 1.0 | 0.5 | 3.2 | 0.4 | -1.6 | 2.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates