Global| Aug 29 2019

Global| Aug 29 2019Corporate Profits--- Long Slide Has Preceded Recessions in Years Past

|in:Viewpoints

Summary

Corporate profits rebounded in Q2, rising 5.3%, reversing the near 5% decline of the prior two quarters based on the updated figures released by the Bureau of Economic Analysis. The up and down pattern in profits has become a [...]

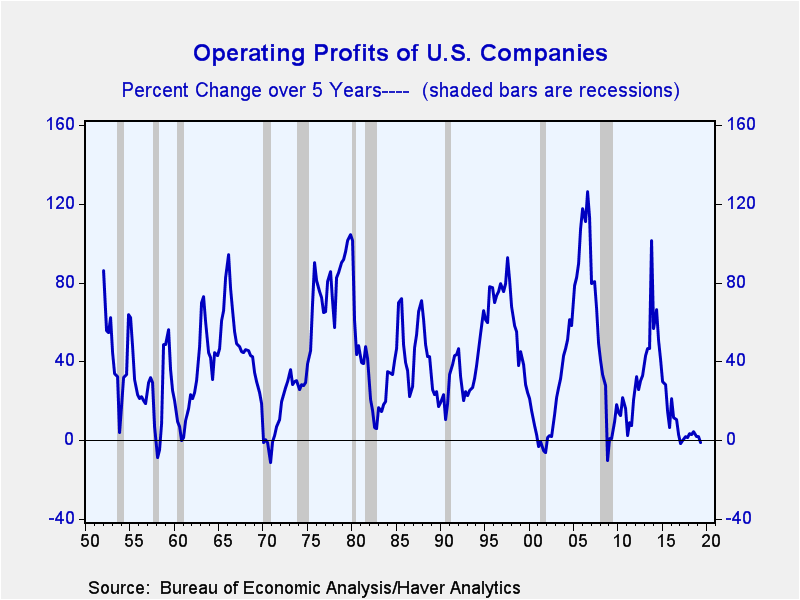

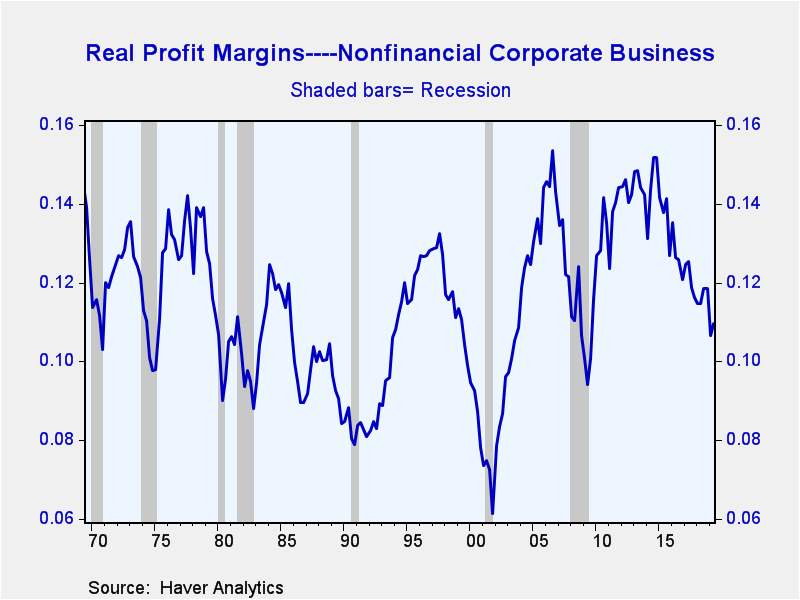

Corporate profits rebounded in Q2, rising 5.3%, reversing the near 5% decline of the prior two quarters based on the updated figures released by the Bureau of Economic Analysis. The up and down pattern in profits has become a persistent trend, as corporate profits have been flat to slightly negative now for the past 5 years, while profit margins have plunged to the lowest level since 2010. The flat trend in profits and the long slide in margins have important economic consequences as both have always preceded recessions in years past.

To be fair, the economy has not been, nor is it currently in recession, based on the GDP figures as well as the labor market data. Nonetheless, the profit and margins data shows how vulnerable the economy is at the present time, especially with business leverage at record highs.

In hindsight, the 2017 federal tax law change, which was signed into law on December 20th, probably helped a number of companies postpone making hard decision in their core operations. To be sure, profits on an after tax basis as well as cash flow was boosted by the substantial reduction in federal corporate tax rates. But the translation gain from a lower federal tax rate is a one-time benefit, and going forward operating earnings on the bottom line should track the top line.

The weak trend in operating profits could come as a big surprise to investors since S&P 500 earnings have been temporarily "spiced" (doubly) by the reduction in federal tax rates.

S&P 500 earnings are reported on an after-tax basis and are presented on a per share basis. Not only did the federal tax law provide a large boost to after-tax earnings, but also companies used the tax windfall to buy back stock---nearly $1.2 trillion since the new tax law went into effect.

According to various estimates the outstanding share count for the S&P 500 declined by over 5% in the past 12 months or so. The reduction in the share count made the year-on-year earnings per share gains paint a more optimistic picture than what was actually occurring. With the benefit of the tax reduction in the rear view mirror and corporate buybacks slowing S&P earnings will now be more aligned with the current state of the economy. That creates the potential for an increasing number of corporate earnings reports disappointing relative to market expectations.

A number of companies have already offered "cautious" guidance on 2H 2019 earnings. Yet, the sharp drop in profit margins increases the odds that the actual performance for a long list of firms, across a wide range of industries, will be much worse than companies guidance or analysts’ expectations.

Of all the real economy indicators pointing to the potential of recession the profit data are the most telling because businesses need earnings and cash flow to sustain existing operations (payrolls, rents, inventory etc.) and also to meet hefty debt obligations. Although interest rates are low the new tax law limits the deductibility on corporate debt—increasing the effective cost of interest payments. That is likely to put an additional strain on highly leveraged businesses.

A "true" earnings recession appears to be in train, with the potential to trigger cuts in investment, inventories, employment and then consumer spending. That’s the standard sequence of events following a downturn in corporate profits. The equity market has not re-priced to the dim outlook on corporate profits---as investors appear to betting that the economic slowdown in temporary, largely related to the trade dispute between the US and China and/or Fed will be forced to lower rates to sustain the cycle. The resilience of the equity market is typical as financial market corrections often follow economic slowdowns/recession and nowadays market corrections can occur as fast as "tweet-speed".

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Joseph G. Carson

AuthorMore in Author Profile »Joseph G. Carson, Former Director of Global Economic Research, Alliance Bernstein. Joseph G. Carson joined Alliance Bernstein in 2001. He oversaw the Economic Analysis team for Alliance Bernstein Fixed Income and has primary responsibility for the economic and interest-rate analysis of the US. Previously, Carson was chief economist of the Americas for UBS Warburg, where he was primarily responsible for forecasting the US economy and interest rates. From 1996 to 1999, he was chief US economist at Deutsche Bank. While there, Carson was named to the Institutional Investor All-Star Team for Fixed Income and ranked as one of Best Analysts and Economists by The Global Investor Fixed Income Survey. He began his professional career in 1977 as a staff economist for the chief economist’s office in the US Department of Commerce, where he was designated the department’s representative at the Council on Wage and Price Stability during President Carter’s voluntary wage and price guidelines program. In 1979, Carson joined General Motors as an analyst. He held a variety of roles at GM, including chief forecaster for North America and chief analyst in charge of production recommendations for the Truck Group. From 1981 to 1986, Carson served as vice president and senior economist for the Capital Markets Economics Group at Merrill Lynch. In 1986, he joined Chemical Bank; he later became its chief economist. From 1992 to 1996, Carson served as chief economist at Dean Witter, where he sat on the investment-policy and stock-selection committees. He received his BA and MA from Youngstown State University and did his PhD coursework at George Washington University. Honorary Doctorate Degree, Business Administration Youngstown State University 2016. Location: New York.