Global| Feb 03 2021

Global| Feb 03 2021Economic Performance Has Been OK Despite Difficult Headlines

by:Andrew Cates

|in:Viewpoints

Summary

January was riddled with some troublesome headlines. Political instability engulfed a number of countries including the US, Italy, the Netherlands – and via vaccine concerns – the European Commission. Worries about COVID mutations in [...]

January was riddled with some troublesome headlines. Political instability engulfed a number of countries including the US, Italy, the Netherlands – and via vaccine concerns – the European Commission. Worries about COVID mutations in the meantime also mounted which encouraged many governments, particularly in Europe, to enforce more stringent lockdowns. And financial markets became more unsettled by an unusual deployment of leverage and derivatives by some retail investors.

In the background to all these 'difficult' headlines, however, the dataflow that concern both the evolution of the world economy and the COVID pandemic has been more encouraging. In what follows we highlight some of the more noteworthy trends.

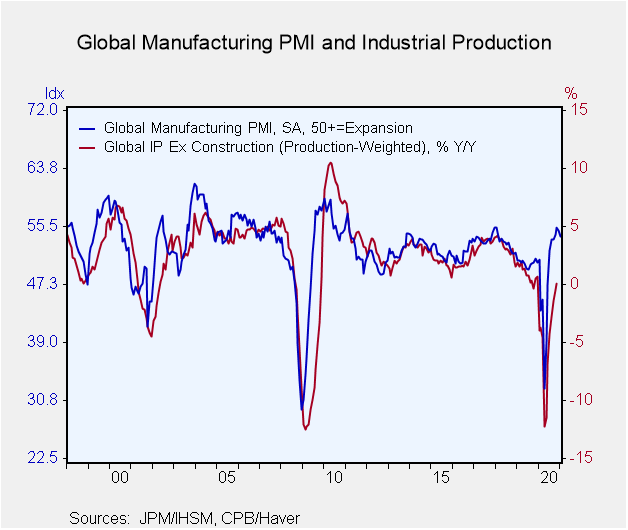

The first concerns the forward looking PMI survey data and the highly respectable growth in the manufacturing sector that this survey suggests. Notwithstanding more stringent lockdown enforcement, the global manufacturing PMI was 54.0 in January, only 0.9 point lower than in December, and a level that would ordinarily be consistent with annual growth in global industrial production of nearly 5% (see figure 1 below).

Figure 1: Global manufacturing PMI versus global industrial production growth

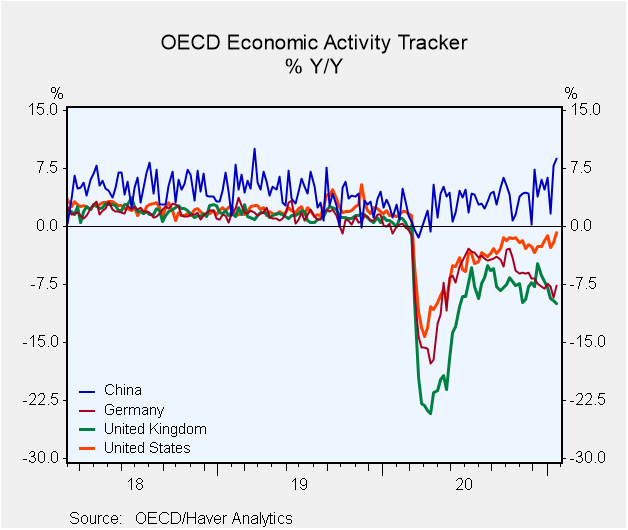

Unsurprisingly perhaps given the underlying vigor in the global manufacturing space, China too appears to be performing more strongly than expected. Recently launched weekly economic activity trackers from the OECD (and available in our OECDMEI database) suggest a marked pick-up in activity in mid-January and to levels that would ordinarily be consistent with GDP growth of nearly 9% (see figure 2). Following some slippage in late November and early December, the US also appears to have recovered some poise in recent weeks although the OECD tracker is nevertheless still consistent with a year-on-year GDP retreat of 1.2% in the week to January 17th. European economies in contrast have experienced a material deceleration in growth, consistent with their more severe lockdown policies and the impact this has had on economic mobility. For the record the flash reports for the Euro area showing that GDP fell 0.7% q/q in 2020 Q4 following a 12.4% rebound in Q3 are consistent with this messaging.

Figure 2: OECD Economic Activity Trackers – China, Germany, the UK and the US

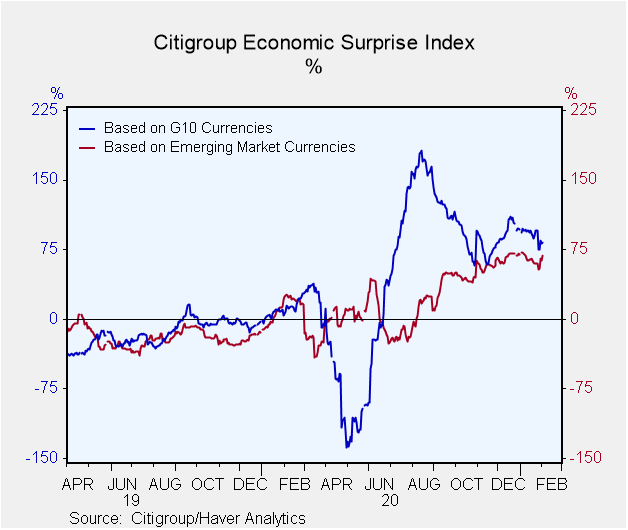

A further noteworthy feature of the economic dataflow, however, concerns a trend toward positive surprises. The economic data surprise index from Citigroup (available in INTDAILY and INTWKLY), for example, shows that incoming data from both advanced and emerging economies have tended to surprise economic forecasters on the upside more frequently than on the downside for a good 6 to 7 months (see figure 3 below). This possibly speaks to some of the underlying adjustments to spending and working habits that have been made as a result of the pandemic. Notwithstanding inevitable and difficult disruption in some sectors (e.g. hospitality, travel and tourism), other sectors of the world economy have staged a marked turnaround in recent months which has invariably surprised forecasters on the upside. That some Central Banks and multilateral organizations such as the IMF have also been lifting their GDP forecasts for 2021 in recent weeks speaks to this positive trend as well.

Figure 3: Citigroup economic surprise indices for G10 and emerging market countries

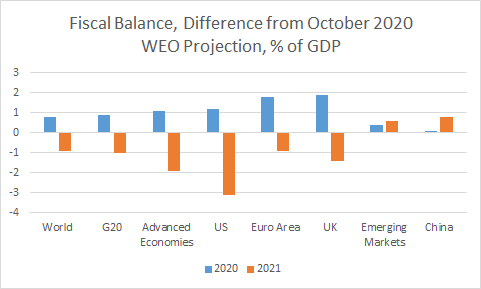

One of the additional reasons though for the unexpected vigour in economic activity could relate to policy settings. The latest update of the IMF's Fiscal Monitor reveals that around $14 trillion of global fiscal support was provided by various governments over the past few months, $7.8 trillion of which was additional spending while $6 trillion was made up of equity injections, loans, and guarantees. Compared with the IMF's analysis in its Fiscal Monitor last October this support has increased by an additional $2.2 trillion. This is the result of new fiscal actions or extensions of previous temporary measures (from Australia, Canada, France, Germany, India, Indonesia, Japan, Spain, the UK and the US).

Figure 4: Difference in forecasts for fiscal balances from latest IMF fiscal monitor and October

Source: IMF

The tentative conclusion that we would draw from this recent news on the economy and on policy settings is an upbeat one. Incoming global economic data have continued to post positive surprises, particularly in the manufacturing space and in China. Policy settings in the meantime remain highly accommodative and in the fiscal space somewhat more accommodative than had been anticipated as well. What matters now of course for the sustainability of this position revolves around the pandemic.

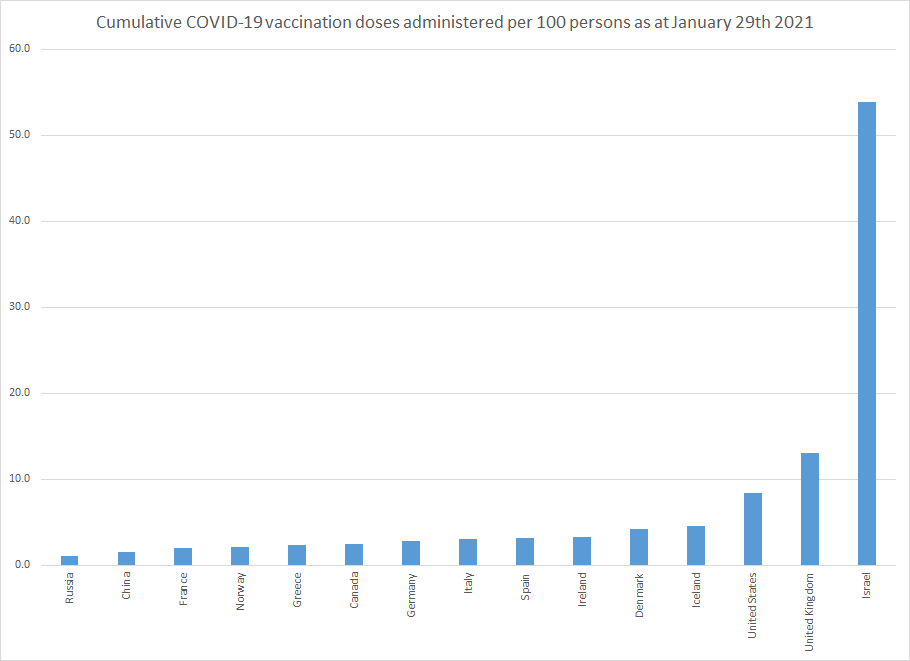

But on this front the news-flow has tended to be positive in recent weeks as well. Three global trends in particular stand out. The first concerns the roll-out of vaccines. While still in its early stages and admittedly somewhat uneven in some countries relative to others, positive progress nevertheless is being made (see figure 5 below). The Our World in Data from Oxford University (available in our GLSECTOR database) specifically suggests that 101.3 million vaccine does have now been administered at the global level, a 48% increase from last week.

Figure 5: Cumulative vaccination doses in various countries up to January x

Source: University of Oxford

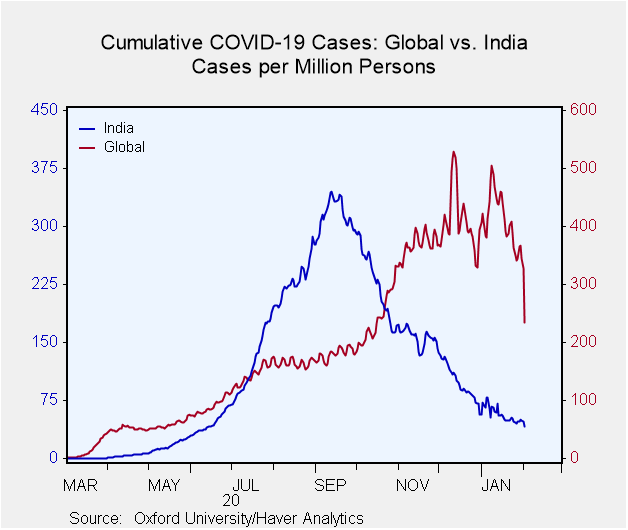

The second noteworthy trend concerns global incidence levels of COVID-19 which have declined now for three consecutive weeks. Overall numbers declined by nearly 15% in the week to February 2nd compared with the previous week and now stand at their lowest levels since late October. Weekly global mortality has also been on a declining trend. That India – obviously a highly populated country – has been experiencing declining incidence levels for several months now, albeit from very high levels, is also a noteworthy feature of recent global trends as well (see figure 6 below).

Figure 6: Cumulative global COVID case numbers versus Indian case numbers

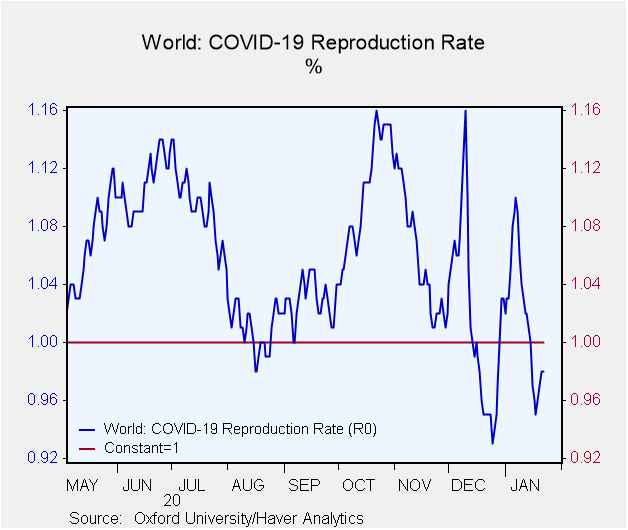

The final trend that's noteworthy on the virus front concerns the Reproduction rate (the so-called R-rate). According to the estimates provided again by Oxford University (and also available in GLSECTOR) at the global level the R rate has lately fallen below 1. That's significant of course for how virus incidence levels will evolve at the global level in the period ahead. For if that estimate is accurate the pandemic will continue to ease. Admittedly it's early days and as figure 7 below suggests that global estimate for R was also below 1 in late December before it shot back up again in the first two weeks of January. Still, combined with the more broadly-based roll-out of vaccines and the evidence that shows global incidence levels are presently on the wane this is encouraging. Indeed when combined as well with the reassuring evidence that we have illustrated on the economic front above it ought to offer some comfort for those with an optimistic take on the world economy in the months ahead.

Figure 7: Global COVID-19 Reproduction Rate

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.