Global| Feb 12 2021

Global| Feb 12 2021Heading the Right Way

by:Andrew Cates

|in:Viewpoints

Summary

Some positive trends Amidst the daily barrage of bad news stories that pervade the international media, a number of positive trends have unfolded in recent weeks. For example: • At the global level there has been a sharp retreat in [...]

Some positive trends

Amidst the daily barrage of bad news stories that pervade the international media, a number of positive trends have unfolded in recent weeks. For example:

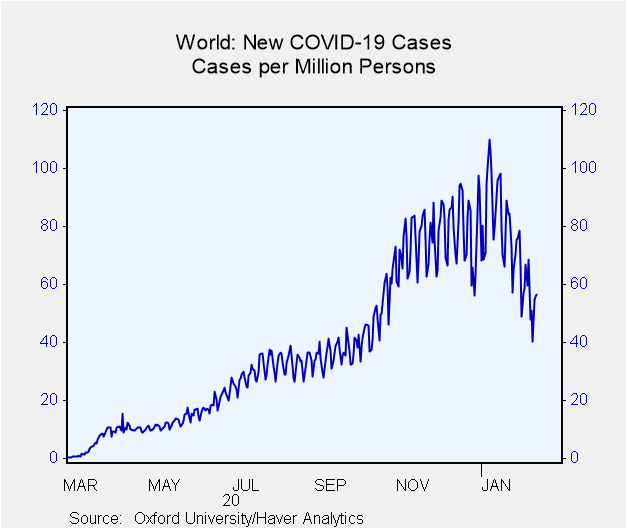

• At the global level there has been a sharp retreat in new COVID case numbers;

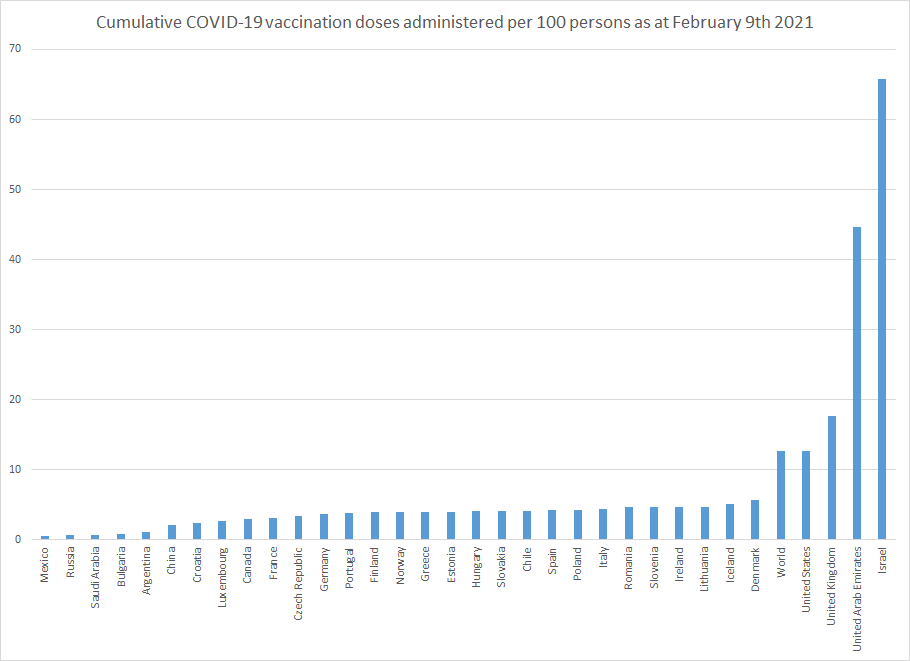

• Vaccination rates across a broadly based range of countries have been climbing at an impressive pace;

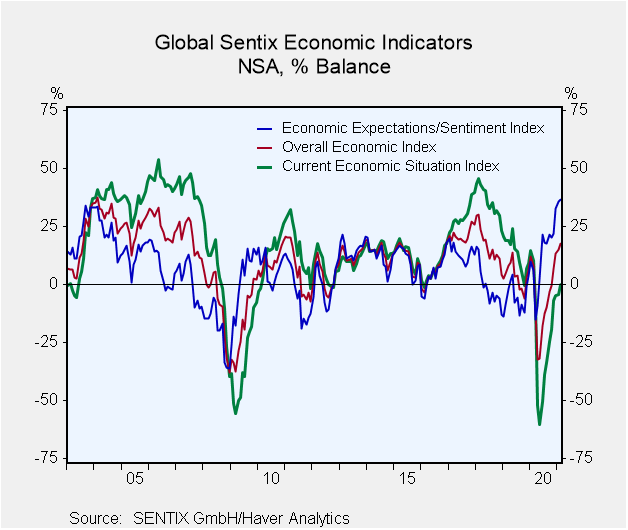

• Forward looking surveys of investor expectations suggest heightened optimism about the pace of global economic activity in coming months;

• And ECB indicators suggest reduced degrees of financial market stress, partly a consequence of exceptionally accommodative economic policies.

Insofar as the interplay between the virus, vaccination rates, confidence, policy and financial market conditions hold the key to how the world economy will evolve in the period ahead, this is naturally welcome.

In what follows we explore some of these trends in a little more detail.

Sharp decline in case numbers

Firstly, on the virus the latest news-flow has almost certainly turned more positive in recent weeks. Global weekly incidence levels have now declined for four consecutive weeks and now stand at their lowest levels since mid-October (see figure 1 below). Latest incidence levels moreover are down by over 38% from early January. This is a broadly-based trend with highly populous countries such as the US, India, Indonesia, Mexico, Russia as well as many European countries seeing much lower case numbers. With a lag, hospitalization and fatality rates can be expected to fall and this, in turn, should encourage a number of governments to ease the stringency of current lockdown restrictions.

Figure 1: New global COVID cases per million population

Vaccination rollout proceeding at pace

Next, on the vaccination front over 134 million vaccine doses were administered globally in the week to February 8th, a 31% increase compared to the same period a week ago. Johns Hopkins University notes that it is still unclear exactly how many individuals have received 1 or 2 doses of the vaccine, but of all countries, Israel is likely the closest to achieving coverage sufficient to make an impact on its epidemic (see figure 2 below). While Israel may not yet be at the point of making an impact on the national scale, the effects of high vaccination coverage among the earliest priority groups are starting to become evident. A report published in Nature indicates that COVID incidence among adults aged 60 years and older decreased 41% from January to February, including a 31% decrease in hospitalizations. For comparison, incidence and hospitalizations fell by only 12% and 5%, respectively, among younger adults over that time. This is obviously encouraging evidence for other countries that are actively rolling out their COVID vaccines.

Figure 2: Cumulative vaccination does per 100 persons – selected countries

Source: University of Oxford

Heightened optimism about the global economic outlookIndeed, vaccination news combined with falling case numbers are a couple of reasons why there is now heightened confidence in the global economic outlook. That at least is the message from the latest forward looking sentix index of investor expectations (see figure 3 below). The headline expectations balance from this survey climbed to 36.5 in February, its highest level in the survey's 18-year history.

Figure 3: Global sentix index of investor expectations

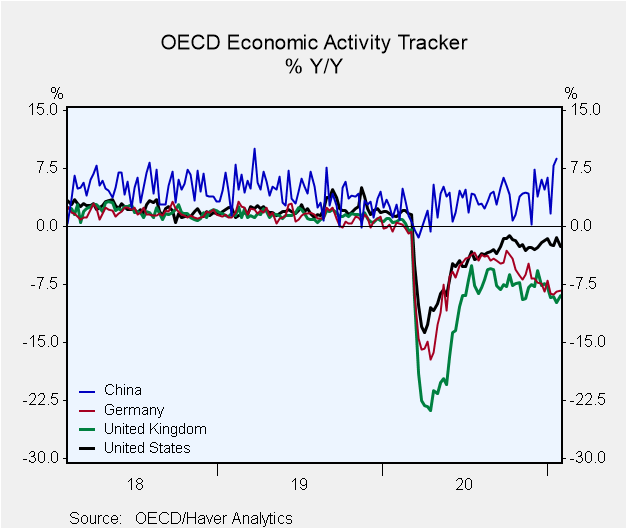

The underlying detail of this survey revealed a more mixed picture at the regional level. Europe is lagging a global trend but a decisive improvement (from a relatively weak base) has been registered in the US while Asia (including Japan) have chalked up impressive gains off the heels of an already vibrant trend in recent months. For the record, this regional dichotomy between a robust economic picture in Asia, an improving (though still subdued) picture in the US and a slowing picture in Europe is similarly evident in the OECD's new weekly economic trackers as well (as evidenced in figure 4 below).

Figure 4: OECD Weekly Economic Activity trackers

Upswing in ICT cycle

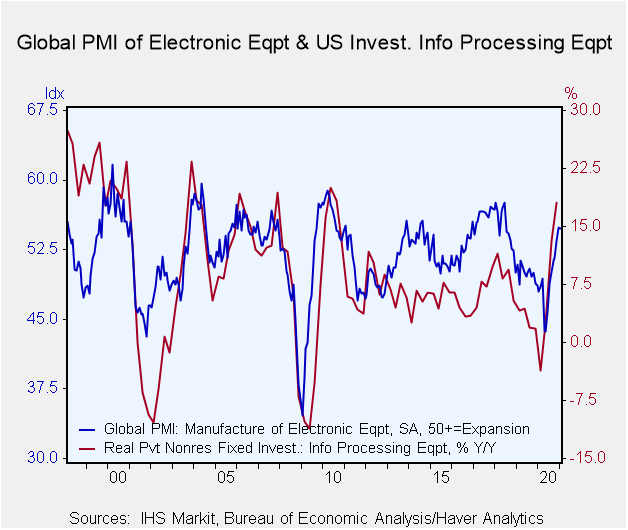

One of the key reasons why Asia is performing relatively well concerns its exposure to ICT (information and communications technology). As we explored in a recent post (see Positive Scarring) there is a great deal of positive cyclical momentum at present in the ICT sector. This can be seen in a rich array of economic data points including sector-specific Purchasing Managers indices for electronic equipment as well as in a recent take-off in the volume of US ICT investment (see figure 5 below). In that recent post we highlighted evidence from the World Economic Forum showing greater willingness from companies to invest in high tech-related innovation. Similar evidence from the UK has come to light as well. Specifically, a survey from the London School of Economics and the UK's CBIi reports large-scale adoption of new technologies and practices. Over 90% of adopting firms said they intend to continue their recent innovations and 75% consider that their investments will have a positive impact on productivity.

Figure 5: Global PMI of electronic equipment versus US investment in information processing equipment

Accommodative policy, accommodative financial markets

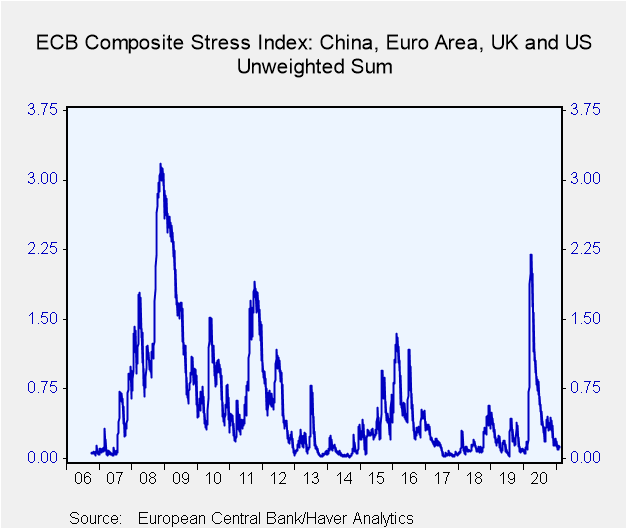

As also noted in recent posts, monetary policy settings have moved into an even more accommodative position in the past several weeks. And the thrust of fiscal policy in some countries (e.g. the US) may well loosen even more in the period ahead. This has helped drive financial market conditions into looser territory at the same time. The ECB's composite financial market stress index for most major countries, for example, is now at or close to its lowest levels (indicating low stress) since the COVID pandemic began last year.

In short then, COVID rates, vaccination rates, confidence, economic policy and financial market conditions have all been moving the right way in the past few weeks. Barring major setbacks from e.g. new COVID strains, the conditions are ripe for a material economic recovery. Policy toward lockdown infringement now holds one of the keys to unlocking that recovery.

Figure 6: ECB Composite Stress index for major countries

i See 'Innovation in the time of COVID-19', Capucine Riom and Anna Valero, Centrepiece, Autumn 2020.

Viewpoint commentaries are the opinions of the author and do not reflect the views of Haver Analytics.Andrew Cates

AuthorMore in Author Profile »Andy Cates joined Haver Analytics as a Senior Economist in 2020. Andy has more than 25 years of experience forecasting the global economic outlook and in assessing the implications for policy settings and financial markets. He has held various senior positions in London in a number of Investment Banks including as Head of Developed Markets Economics at Nomura and as Chief Eurozone Economist at RBS. These followed a spell of 21 years as Senior International Economist at UBS, 5 of which were spent in Singapore. Prior to his time in financial services Andy was a UK economist at HM Treasury in London holding positions in the domestic forecasting and macroeconomic modelling units. He has a BA in Economics from the University of York and an MSc in Economics and Econometrics from the University of Southampton.