Global| May 04 2020

Global| May 04 2020ISM April's New Order & Production Crash

|in:Viewpoints

Summary

The Institute of Supply Management (ISM) composite index for manufacturing fell 7.6 points to 41.5 in April, the lowest level since the Great Financial Recession. As bad as the headline numbers appear at first glance the "internals" [...]

The Institute of Supply Management (ISM) composite index for manufacturing fell 7.6 points to 41.5 in April, the lowest level since the Great Financial Recession. As bad as the headline numbers appear at first glance the "internals" of the monthly survey are

even more alarming. In April, the new orders index fell 15 points to 27.1, while the production index fell 20 points to 27.5. In the history of the ISM index, which goes back to 1948, there are only two readings in May 1980 (government-imposed credit controls)

and December 2008 (fallout from Great Financial Recession) that recorded combined lower readings on new orders and production indexes.

The Institute of Supply Management (ISM) composite index for manufacturing fell 7.6 points to 41.5 in April, the lowest level since the Great Financial Recession. As bad as the headline numbers appear at first glance the "internals" of the monthly survey are

even more alarming. In April, the new orders index fell 15 points to 27.1, while the production index fell 20 points to 27.5. In the history of the ISM index, which goes back to 1948, there are only two readings in May 1980 (government-imposed credit controls)

and December 2008 (fallout from Great Financial Recession) that recorded combined lower readings on new orders and production indexes.

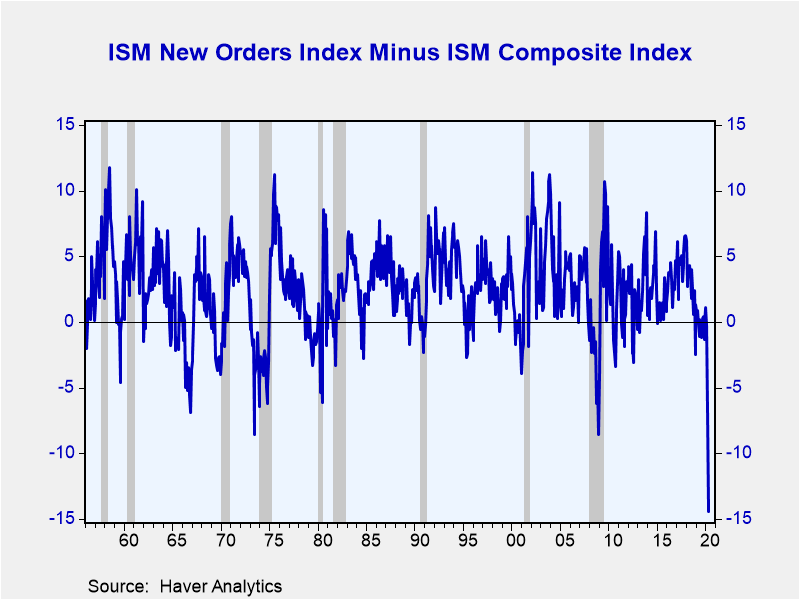

The ISM manufacturing index was initially created in the early 1980s by Mr. Ted Torda, a colleague of mine at that time at the Office of the Chief Economist at the Department of Commerce. The initial launch of the ISM manufacturing index awarded new orders and production components the largest weights (30% each). Using the original weights the April 2020 composite index would have dropped to 36.6. (Note: nowadays these two subcomponents along with employment, supplier deliveries, and inventories are given equal weights of 20%). The initial research showed that the up and down movements in new orders and production offered the most accurate assessment of the current state of manufacturing. The April readings on new orders and production indicate that the current state of the manufacturing sector is far worse than what is implied in the overall composite index. And as bad as business conditions are today, firms are saying conditions are not likely to improve in a major way anytime soon. One of the most accurate forward-looking indicators of the ISM survey is to compare the levels of new orders index to the overall composite index. The rule is that when new orders run below the composite index the near term direction of manufacturing is lower/bleaker, whereas when the new order index runs above the composite index the near-term outlook is higher/brighter. In April, the new orders index had a minus -14.4 reading relative to the overall composite. That's the most negative reading in the 70-year plus history of the ISM survey. That record low reading is a way companies saying "current conditions are bad and we have no visibility when conditions will improve."

Joseph G. Carson

AuthorMore in Author Profile »Joseph G. Carson, Former Director of Global Economic Research, Alliance Bernstein. Joseph G. Carson joined Alliance Bernstein in 2001. He oversaw the Economic Analysis team for Alliance Bernstein Fixed Income and has primary responsibility for the economic and interest-rate analysis of the US. Previously, Carson was chief economist of the Americas for UBS Warburg, where he was primarily responsible for forecasting the US economy and interest rates. From 1996 to 1999, he was chief US economist at Deutsche Bank. While there, Carson was named to the Institutional Investor All-Star Team for Fixed Income and ranked as one of Best Analysts and Economists by The Global Investor Fixed Income Survey. He began his professional career in 1977 as a staff economist for the chief economist’s office in the US Department of Commerce, where he was designated the department’s representative at the Council on Wage and Price Stability during President Carter’s voluntary wage and price guidelines program. In 1979, Carson joined General Motors as an analyst. He held a variety of roles at GM, including chief forecaster for North America and chief analyst in charge of production recommendations for the Truck Group. From 1981 to 1986, Carson served as vice president and senior economist for the Capital Markets Economics Group at Merrill Lynch. In 1986, he joined Chemical Bank; he later became its chief economist. From 1992 to 1996, Carson served as chief economist at Dean Witter, where he sat on the investment-policy and stock-selection committees. He received his BA and MA from Youngstown State University and did his PhD coursework at George Washington University. Honorary Doctorate Degree, Business Administration Youngstown State University 2016. Location: New York.