Inflation and a 10% Tariff

by:Joel Prakken

|in:Viewpoints

As the Trump Administration moves forward with tariffs on a range of imported goods, it is useful to establish a benchmark for the potential inflationary effects of tariffs. To do so I modeled the impact on the price index for domestic demand plus exports of a 10% tariff on all imported goods, one proposal of then-candidate Trump.

First, some historical context. Chart 1 shows the average tariff rate on goods since 1929 and, for 2025, the rate implied by a new 10% tariff on all imported goods. Under the proposal, the rate jumps from 2.5% to 12.5%, a level not seen since the Great Depression, reminiscent of the infamous Smoot-Hawley tariff of 1930, and undoing decades of negotiations to reduce international barriers to trade.

I built a model including five channels of impact. First, the accounting effect. This is how much the price index rises if the tariff is passed fully forward with no offsets. It is determined by the proportion of purchases subject to the tariff. Second, a partially offsetting decline in the price of imports. This represents the squeeze in the profit margins of foreign suppliers and is governed by the elasticities of supply and demand for imports. Third, the potential for importers to absorb the cost of the tariff in their margins, determined by those same elasticities. Fourth, the potential for domestic producers of import-competing goods to raise prices under the protective umbrella of the tariff. This is determined by the ease of substitution between imported and domestically produced goods. And fifth, any mix effect on the aggregate price level as purchasers shift from imports towards domestic product.

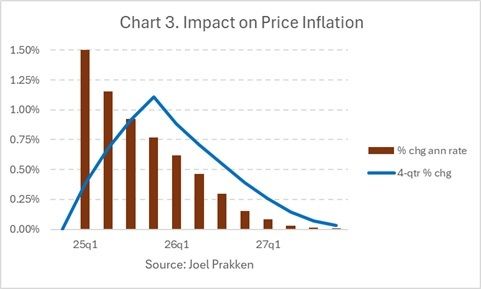

I simulated the model assuming the new 10% tariff is imposed in the first quarter of 2025. Results for the price level are shown in Chart 2 along with the contributions to the increase from the accounting effect, from the net expansion of the domestic markup, and from the decline in the price of imports. Over the first year, the price level rises by 1.2%, and over two years rises by 1.5%. Chart 3 re-casts the aggregate results in terms of the inflation rate. The initial impact (percent change annualized rate) is 1.5% percentage points, fading to zero by early 2027. The impact on the 4-quarter change peaks at 1.1% in 2025Q4. The persistence of the inflation effect arises as an initial decline in the price of imports is reversed and as domestic producers raise prices.

Economic growth would slow in response to a 10% tariff. Hence, these sizable “direct” effects on inflation pose a dilemma for the Fed as it attempts to achieve high employment and low inflation, objectives that in the short run are competing. Furthermore, these results abstract from the potential “indirect” effects on inflation of a potential wage-price spiral or increase in inflation expectations that would be of even more concern for the Central Bank. Implications? In the face of higher tariffs, the Fed is likely to approach further cuts in its policy rate very cautiously.

A longer version of this commentary is available here.

Joel Prakken

AuthorMore in Author Profile »Joel Prakken is past Chief US Economist of S&P Global and IHS Markit, co-founder of Macroeconomic Advisers, and past president and director of the National Association for Business Economics. He has served as an outside advisor to the Congressional Budget Office, on the Advisory Panel of the Bureau of Economic Analysis, and as a consultant to the Joint Committe on Taxation. He holds a bachelor's degree in economics from Princeton University and a PhD in economics from Washington University in Saint Louis.

Global

Global